Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | VEMO surges 44.7% overnight as earnings top forecasts, fueling optimism for growth and finances

Vimeo, Inc. - Common Stock VMEO | 7.85 7.85 | Delist 0.00% Pre |

Astera Labs ALAB | 144.94 149.46 | +0.89% +3.12% Pre |

Gogo Inc. GOGO | 4.70 4.96 | -4.28% +5.53% Pre |

Semler Scientific, Inc. SMLR | 17.40 17.96 | +8.55% +3.24% Pre |

Aris Water Solutions, Inc. ARIS | 23.69 23.69 | Delist 0.00% Pre |

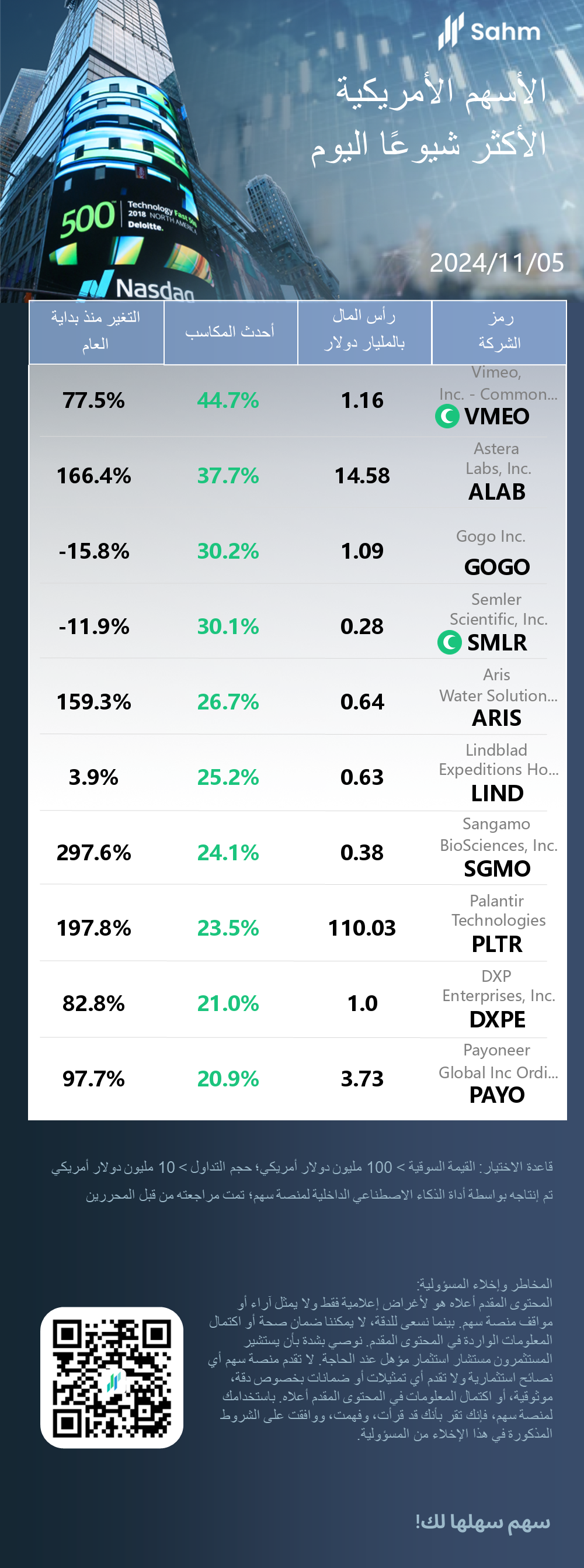

05/11/2024 Eastern Time in USA The Dow Jones Industrial Average rose by 1.02%, closing at 42221.88 points; the Nasdaq Composite rose by 1.43%, closing at 18439.17 points; the S&P 500 Index rose by 1.23%, closing at 5782.76 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

Vimeo, Inc. - Common Stock: Overnight gain 44.7%, Earnings beat expectations, boosting investor confidence in growth prospects and financial performance.

Vimeo, Inc. (NASDAQ: VMEO), a Delaware-based corporation, is a leading provider of integrated video software solutions. The company operates on a Software-as-a-Service (SaaS) model, offering a comprehensive suite of video tools that enable users to create and distribute high-quality video content on a single platform. Addressing the challenges businesses face in video applications, Vimeo delivers user-friendly video tools through cloud-based software subscription services. These services cater to both individual and enterprise users, meeting fundamental video needs across various sectors. The company's platform services have a global reach, serving markets worldwide. Vimeo's all-in-one video solution aims to streamline the video creation and distribution process, positioning itself as a key player in the rapidly evolving digital content landscape. As businesses increasingly rely on video for communication and marketing, Vimeo's scalable solutions provide a competitive edge in the burgeoning video software market. The company continues to innovate and expand its offerings to meet the growing demand for professional-grade video tools in an increasingly digital-first business environment.

Vimeo, Inc. - Common Stock (VMEO) experienced a significant surge in stock price following its impressive third-quarter financial results for fiscal year 2024. The company reported a GAAP earnings per share of $0.05, substantially outperforming analyst expectations of $0.01 by 400%. Revenue reached $104.564 million, exceeding forecasts by 4.98%. Despite a slight year-over-year decline of 1.59%, the results still surpassed market projections. Vimeo's optimistic fourth-quarter revenue guidance of $100 million, surpassing analyst estimates, demonstrates confidence in future growth. These factors propelled VMEO's stock to soar 44.7% in a single day, bringing its year-to-date gain to 77.5%. The company's market capitalization now stands at $1.162 billion, reflecting investor confidence in Vimeo's improved performance and growth prospects.

Astera Labs, Inc.: Overnight gain 37.7%, Stellar earnings and AI infrastructure focus drive stock surge

Company profile missing.

Astera Labs, Inc. (ALAB) shares soared following an impressive third-quarter earnings report that significantly exceeded market expectations. The company reported adjusted earnings per share of $0.23 and revenue of $113.1 million, up 206% year-over-year, both surpassing analyst estimates. Astera Labs provided an optimistic outlook for the next quarter, projecting earnings per share between $0.25-$0.26 and revenue between $126-130 million, again beating analyst forecasts. The company's strategic positioning in AI connectivity infrastructure has been a key driver of stock performance. CEO Jitendra Mohan highlighted the volume ramp of multiple product lines on AI platforms, solidifying Astera Labs' critical role in the sector. As an NVIDIA partner, investors view the company's AI chip prospects favorably. Several investment firms raised their price targets for Astera Labs, with Barclays analyst Tom O'Malley maintaining an "Overweight" rating and increasing the target from $70 to $87. These factors collectively propelled ALAB shares up 37.7% on the day, bringing year-to-date gains to 166.4%.

Gogo Inc.: Overnight gain 30.2%, Technology advancements, strategic partnerships, and strong financial performance boost investor confidence.

Gogo Inc. (NASDAQ: GOGO), a global leader in inflight connectivity services, has pioneered wireless digital entertainment and other services in the commercial aviation market. The company enhances the flying experience for airline partners, flight crews, and passengers by providing inflight connectivity services and linking aircraft and crew with ground operations. Operating primarily through two indirectly managed subsidiaries, Gogo Inc. holds relevant licenses through its subsidiaries. The company's current corporate structure, which includes multiple subsidiaries and holding companies, is the result of several restructurings and name changes over time. Gogo's business model focuses on leveraging its proprietary technology to deliver high-speed internet, entertainment, and operational solutions to the aviation industry. This strategy has positioned the company as a key player in the growing market for inflight connectivity and digital services. As the demand for seamless connectivity continues to rise in the aviation sector, Gogo Inc. remains at the forefront of innovation, driving growth and expanding its market presence in this dynamic industry.

Gogo Inc. (GOGO) has experienced a significant stock price increase due to multiple factors. The company's Gogo Galileo HDX electronically steerable antenna successfully passed FAA certification tests, demonstrating its technological innovation aligns with aviation safety standards. Additionally, Gogo plans to launch new products in 2025, indicating ongoing technological advancements. The company has also strengthened its market position through strategic partnerships and the acquisition of Satcom Direct. Furthermore, Gogo's third-quarter financial performance exceeded analyst expectations, with GAAP earnings per share and revenue surpassing forecasts. The company also reported growth in AVANCE equipment installations and average monthly revenue per aircraft. These positive developments have collectively contributed to the substantial rise in Gogo Inc. (GOGO) stock price, reflecting investor confidence in the company's technological progress, market expansion, and financial performance.

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

| Vimeo, Inc. - Common Stock(VMEO.US) | 1.16 | 44.7% | 77.5% |

| Astera Labs, Inc.(ALAB.US) | 14.58 | 37.7% | 166.4% |

| Gogo Inc.(GOGO.US) | 1.09 | 30.2% | -15.8% |

| Semler Scientific, Inc.(SMLR.US) | 0.28 | 30.1% | -11.9% |

| Aris Water Solutions, Inc.(ARIS.US) | 0.64 | 26.7% | 159.3% |

| Lindblad Expeditions Holdings Inc(LIND.US) | 0.63 | 25.2% | 3.9% |

| Sangamo BioSciences, Inc.(SGMO.US) | 0.38 | 24.1% | 297.6% |

| Palantir Technologies(PLTR.US) | 110.03 | 23.5% | 197.8% |

| DXP Enterprises, Inc.(DXPE.US) | 1.0 | 21.0% | 82.8% |

| Payoneer Global Inc Ordinary Shares(PAYO.US) | 3.73 | 20.9% | 97.7% |