Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | Wolfspeed: Overnight gain 95.8%, Bankruptcy restructuring plan boosts investor confidence, driving significant stock rally despite yearly decline

Wolfspeed WOLF | 17.85 18.20 | +0.62% +1.96% Pre |

Strive ASST | 0.86 0.87 | +9.02% +0.80% Pre |

Pelthos Therapeutics Inc. Common Stock PTHS | 21.83 21.83 | -1.89% 0.00% Pre |

Viomi Technology Co., Ltd. VIOT | 2.14 2.14 | -1.38% 0.00% Pre |

Vor Biopharma, Inc. VOR | 15.82 16.58 | +17.10% +4.80% Pre |

Editor's Note: the "Trending USA Stocks" column tracks the day's top bullish stocks in the USA market, aiding investors in promptly identifying opportunities for potential gains.

07/07/2025 Eastern Time in USA The Dow Jones Industrial Average dropped by 0.94%, closing at 44406.36 points; the Nasdaq Composite dropped by 0.92%, closing at 20412.52 points; the S&P 500 Index dropped by 0.79%, closing at 6229.98 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

Wolfspeed(WOLF.US) : Overnight gain 95.8%, Bankruptcy restructuring plan boosts investor confidence, driving significant stock rally despite yearly decline

Wolfspeed, Inc. (NYSE: WOLF), a pioneer in wide bandgap semiconductor technology, is at the forefront of innovation in silicon carbide (SiC) and gallium nitride (GaN) materials and devices. The company's product portfolio spans power and radio frequency (RF) applications, catering to high-growth markets including electric vehicles (EVs), 5G infrastructure, renewable energy, and aerospace. Wolfspeed's advanced materials and power devices play a crucial role in the electrification of transportation, motor drives, and power systems. The company's RF devices are integral to military communications, radar systems, and satellite applications, underscoring its strategic importance in defense and telecommunications sectors. Founded in 1987 and headquartered in Durham, North Carolina, Wolfspeed has established itself as a key player in the semiconductor industry. The company's focus on wide bandgap technologies positions it to capitalize on the growing demand for high-efficiency, high-performance semiconductor solutions across multiple industries. As global markets increasingly prioritize energy efficiency and technological advancement, Wolfspeed's innovative product offerings are well-aligned with long-term market trends, potentially driving sustained growth and shareholder value.

Wolfspeed (WOLF) shares surged following the announcement of a significant restructuring plan. On July 1, 2025, the company unveiled a pre-packaged reorganization proposal under Chapter 11 of the U.S. Bankruptcy Code, expected to conclude by the end of Q3. This strategic move aims to reduce the company's debt by approximately 70%, equivalent to $4.6 billion, while cutting annual cash interest payments by 60%. The market responded positively, viewing the restructuring as a pivotal step towards enhancing Wolfspeed's financial health and long-term growth prospects. Despite a 65.3% year-to-date decline, Wolfspeed's stock price skyrocketed 95.8% in a single day on the restructuring news, signaling renewed investor confidence in the company's future. This development marks a potential turning point for Wolfspeed's financial trajectory and market perception.

Asset Entities Inc.(ASST.US) : Overnight gain 63.5%, Social media marketing growth and Discord services expansion drive stock surge

Asset Entities Inc., a Nevada-based technology firm incorporated on March 9, 2022, specializes in cross-platform social media marketing and content delivery services, with a particular focus on Discord community management solutions. The company's operations are structured around three core business segments: 1. Investment Education and Entertainment: Asset Entities operates Discord communities centered on investment education and entertainment, offering premium content subscriptions to its user base. 2. Social Media Marketing: The company develops and executes comprehensive social media marketing campaigns for its clients across various platforms. 3. Discord Server Management: Under its proprietary "AE.360.DDM" brand, Asset Entities provides Discord server design and management services, catering to clients seeking to establish and maintain a robust presence on the platform. This multi-faceted approach allows Asset Entities to leverage its expertise in social media engagement and community building, positioning itself as a versatile player in the rapidly evolving digital marketing and community management landscape.

Asset Entities Inc. (ASST) has experienced a notable surge in stock price, driven by several key factors: 1. Growing demand for social media marketing services, particularly on platforms like Discord and TikTok, has bolstered ASST's business growth. 2. The company's Discord server management services are expanding rapidly, contributing to the stock's upward trajectory. 3. ASST's investment education community on Discord has gained traction, especially amid current market volatility. 4. Successful social media marketing campaigns have enhanced brand visibility and investor interest. 5. Market recognition of ASST as an emerging player in the social media services sector has led to increased investor confidence. These factors collectively reflect the growing importance of social media marketing and community management services in today's digital landscape, positioning Asset Entities Inc. (ASST) as a potentially promising investment in this evolving market.

Pelthos Therapeutics Inc. Common Stock(PTHS.US) : Overnight gain 60.3%, Strategic merger, innovative product, and NYSE listing boost investor confidence and growth prospects.

Pelthos Therapeutics Inc. (NASDAQ: PLTH), a clinical-stage biotechnology firm founded in 2021, is at the forefront of developing innovative therapies for pain management. The company's research is primarily focused on selectively targeting NaV1.7 and other sodium ion channel receptors within the NaV family. Genetic studies have substantiated the crucial role of NaV1.7 in human pain perception. Notably, certain families with genetic NaV1.7 dysregulation exhibit congenital insensitivity to pain, a phenomenon that has piqued the interest of researchers in the field. Leveraging this mechanistic insight, Pelthos Therapeutics aims to pioneer novel analgesic compounds that could potentially revolutionize pain management. The company's approach represents a promising avenue in addressing the significant unmet need for effective and targeted pain therapies. As Pelthos Therapeutics advances its pipeline, investors and industry observers are closely monitoring its progress, given the substantial market potential for innovative pain management solutions. The company's focus on ion channel modulation aligns with current trends in neuroscience and drug development, positioning it as a noteworthy player in the biotechnology sector.

The recent surge in Pelthos Therapeutics Inc. Common Stock (PTHS) can be attributed to several factors. The company's strategic merger with Channel Therapeutics and successful $50.1 million private equity raise demonstrate robust financing capabilities and investor confidence. Additionally, PTHS plans to launch ZELSUVMI™ in July 2025, the first FDA-approved prescription treatment for molluscum contagiosum, indicating significant market potential. The company's upcoming listing on the NYSE American on July 2, 2025, is expected to enhance visibility and stock liquidity. Furthermore, Pelthos Therapeutics' diversified product pipeline and strategic partnership with Ligand provide a strong foundation for future growth. These developments collectively contribute to the positive market sentiment surrounding PTHS stock.

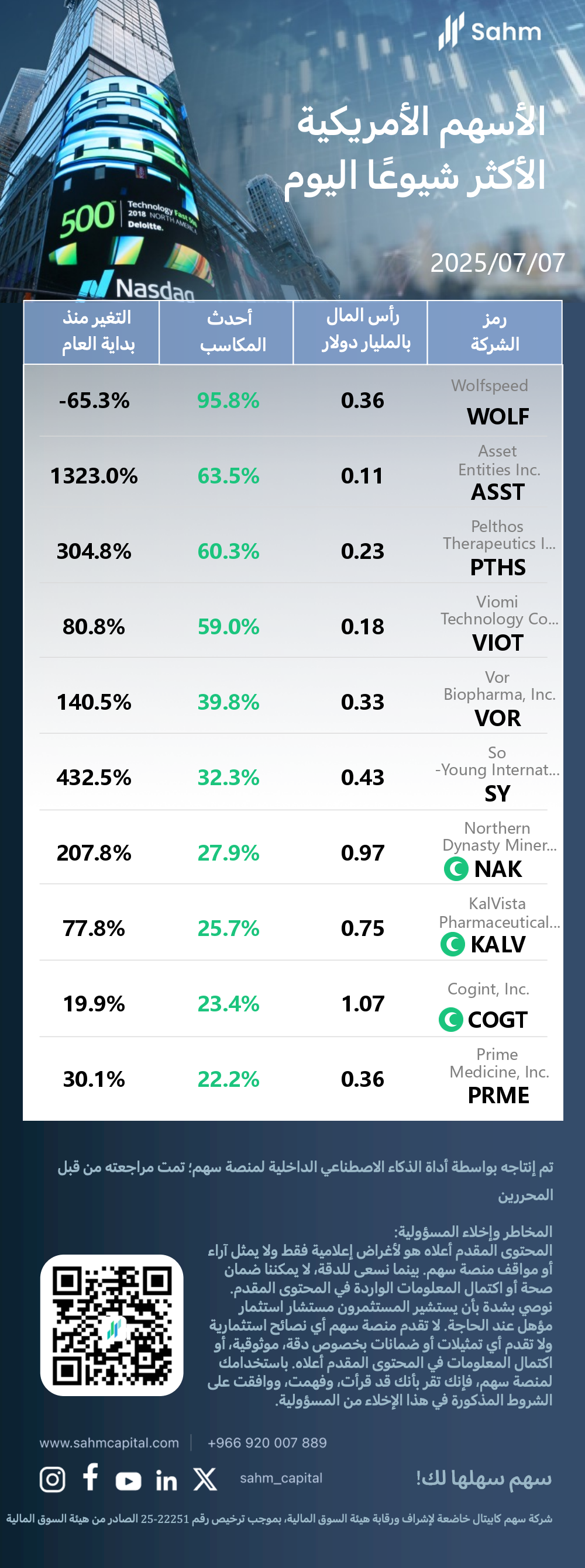

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

| Wolfspeed(WOLF.US) | 0.36 | 95.8% | -65.3% |

| Asset Entities Inc.(ASST.US) | 0.11 | 63.5% | 1323.0% |

| Pelthos Therapeutics Inc. Common Stock(PTHS.US) | 0.23 | 60.3% | 304.8% |

| Viomi Technology Co., Ltd.(VIOT.US) | 0.18 | 59.0% | 80.8% |

| Vor Biopharma, Inc.(VOR.US) | 0.33 | 39.8% | 140.5% |

| So-Young International Inc.(SY.US) | 0.43 | 32.3% | 432.5% |

| Northern Dynasty Minerals Ltd.(NAK.US) | 0.97 | 27.9% | 207.8% |

| KalVista Pharmaceuticals, Inc.(KALV.US) | 0.75 | 25.7% | 77.8% |

| Cogint, Inc.(COGT.US) | 1.07 | 23.4% | 19.9% |

| Prime Medicine, Inc.(PRME.US) | 0.36 | 22.2% | 30.1% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.