Please use a PC Browser to access Register-Tadawul

Dell Technologies (DELL): Evaluating Valuation Following Bullish Analyst Calls and AI Growth Announcements

Dell Technologies, Inc. Class C DELL | 121.05 | +4.91% |

If you are weighing your next move with Dell Technologies (DELL), there’s no shortage of headlines vying for your attention this week. The buzz started when Bernstein kicked off coverage, highlighting Dell’s unique position in the AI server market and painting a bullish picture for its long-term growth in artificial intelligence infrastructure. Add to this Dell’s recent string of announcements, such as new product launches targeting AI workloads, record backlogs, and strategic AI partnerships, and it is clear why investors are taking a closer look at the stock.

This latest wave of optimism comes on the back of a steady climb for Dell this year. The stock is up 14% over the past year, outpacing the broader market, with momentum clearly building as returns for the past 3 months alone hit nearly 12%. The company hasn’t just caught a narrative lift from AI enthusiasm, either. Recent buyback activity, an affirmed financial outlook, and news of backlog growth in AI servers, as well as ongoing strategic collaborations, have supported investor sentiment and signaled operational resilience.

After a year of steady traction, and with Wall Street’s expectations and company initiatives lining up, is Dell Technologies presenting investors with an attractive entry point right now, or has the market already priced in the next leg of its AI-fueled growth?

Most Popular Narrative: 11% Undervalued

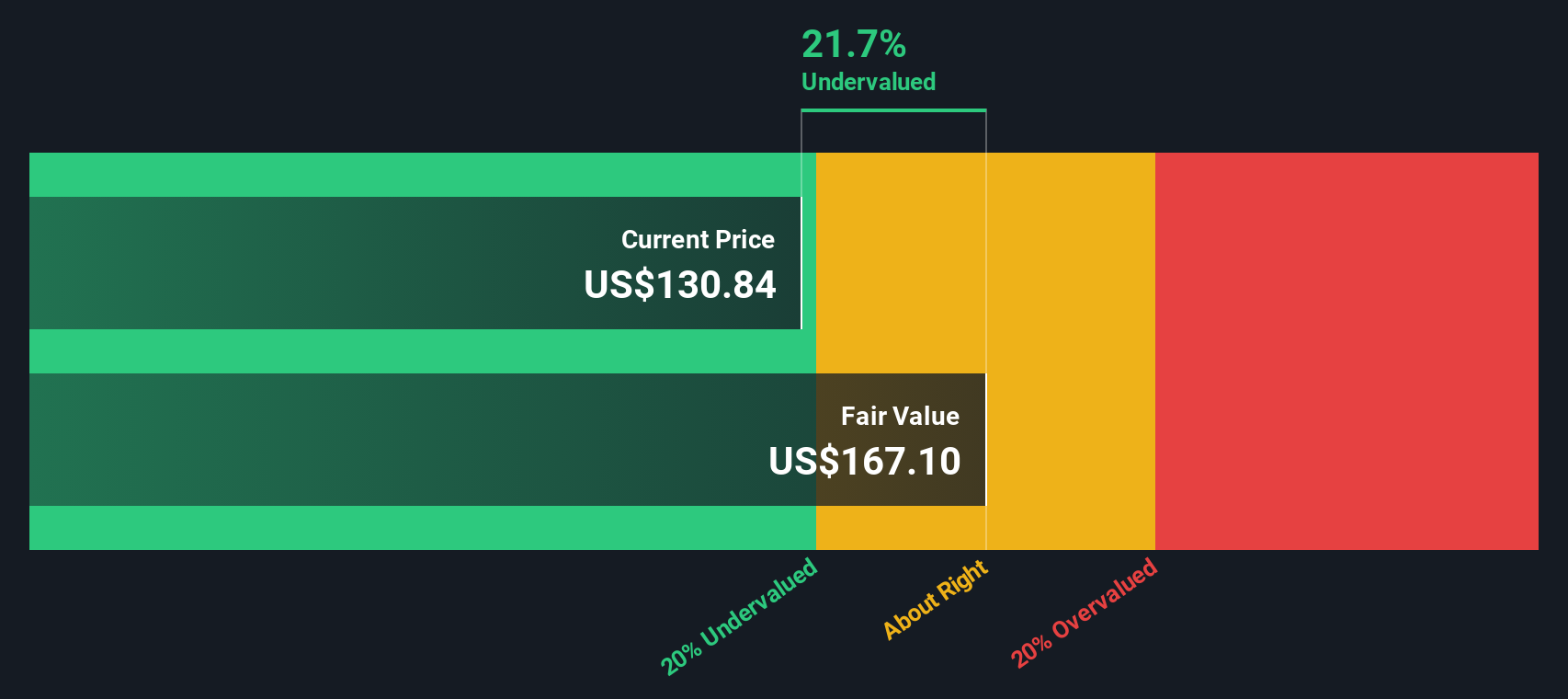

According to the most widely followed narrative, Dell Technologies is currently trading at a notable discount to its estimated fair value, suggesting there could be significant upside for investors if the company achieves projected growth.

Persistent growth in global data creation and analytics, along with the expansion of remote/hybrid work, is driving demand for scalable compute, storage, and commercial PCs. This is underpinning sustained growth in Dell's core product lines and supporting multi-year top-line growth.

Craving a deeper look at what’s fueling this valuation gap? The narrative hinges on aggressive upward profit shifts, a tighter projected earnings horizon, and expectations that put Dell’s standing among its tech peers to the test. Want to uncover which ambitious targets and financial turning points justify this bullish outlook? You’ll need to see the details for yourself, as there is more than meets the eye behind these numbers.

Result: Fair Value of $148 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, margin pressures from hardware commoditization and ongoing reliance on a volatile PC segment could quickly challenge Dell’s optimistic growth outlook if trends reverse.

Find out about the key risks to this Dell Technologies narrative.Another View: Our DCF Model Weighs In

While analyst consensus and market multiples point to Dell being undervalued, our SWS DCF model independently arrives at a similar conclusion. However, could future cash flow assumptions be too optimistic, or is this opportunity real?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dell Technologies Narrative

If you see things differently, or want to dig deeper into the numbers behind Dell Technologies, you can build your own narrative with just a few minutes and data-driven insights. Do it your way.

A great starting point for your Dell Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunity favors those who act, and the market is packed with stocks flying under most investors’ radar. Don’t miss your chance to get ahead with these handpicked investment spotlights using Simply Wall Street’s powerful tools:

- Supercharge your portfolio by targeting shares with consistently strong cash flows and untapped upside through our undervalued stocks based on cash flows.

- Capture the next wave in digital healthcare by focusing on innovative companies transforming medicine with artificial intelligence in our healthcare AI stocks.

- Boost your passive income stream by uncovering high-yield opportunities above 3% with our dedicated dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.