Please use a PC Browser to access Register-Tadawul

Delta Air Lines (DAL): Assessing Valuation After U.S. Blocks Aeromexico Joint Venture

Delta Air Lines, Inc. DAL | 69.81 69.81 | -1.06% 0.00% Pre |

Delta Air Lines (DAL) is back in the spotlight after the U.S. Department of Transportation ordered it to dismantle its long-standing joint venture with Aeromexico. For investors, this regulatory move is more than just a headline; it directly shakes up Delta's carefully crafted cross-border network and casts doubt on future international expansion plans. The markets have taken note, as shares slipped and broke below key technical levels in the aftermath. This highlights just how sensitive the stock is to shifts in regulation and global strategy.

This fresh bout of uncertainty comes after an eventful year for Delta. The stock pushed ahead of the broader market over the past year and logged steady gains in the last three months, even as recent weeks brought a pullback. While there have been positive signs, like ongoing aircraft upgrades to boost efficiency and promising quarterly revenue trends, the dismantling of the Aeromexico alliance is a stark reminder that external risks can quickly shift the narrative. Momentum had been building, but current headwinds raise questions about how much of Delta’s premium and international growth story is reflected in today’s price.

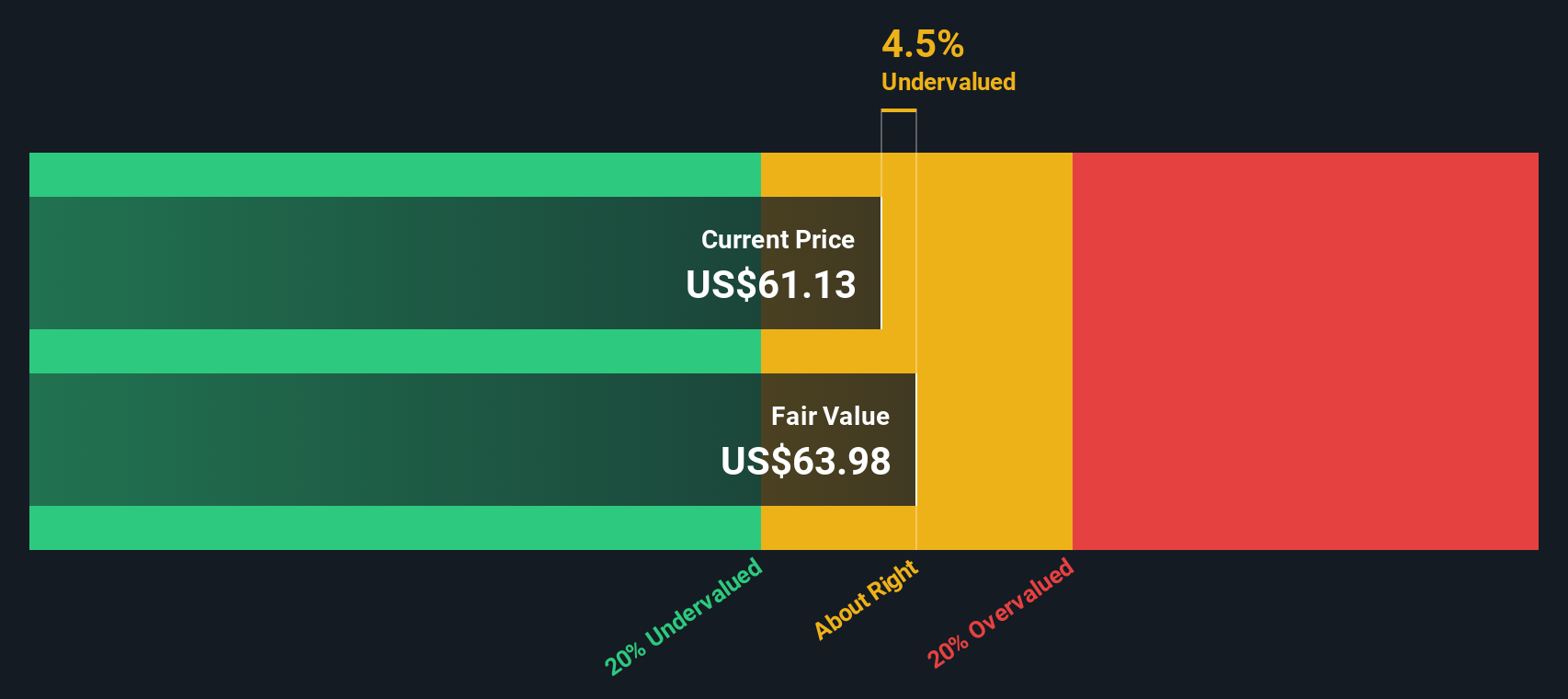

After this run and the latest regulatory jolt, could Delta Air Lines be undervalued now, or has the market fully priced in both the risks and the future growth story?

Most Popular Narrative: 10% Undervalued

The current narrative signals that Delta Air Lines is undervalued, with a margin that hints at upside potential, according to PittTheYounger.

That said, there are two major threats to the company's prospects that should not go unnoticed. First, as with all major US airlines, its balance sheet is somewhat strained and always at risk of sudden, exogenous shocks such as another pandemic or a trade war in North America going rogue. Second, margins are so thin they simply cannot accommodate any major impact, so you need to be vigilant when investing in an airline even as big as this one.

What is the secret financial engine powering this bullish view? The narrative is underpinned by a fresh model with sharply updated profit multiples and revised growth assumptions. Want to see what bold moves and shifting forecasts shape Delta’s new fair value? Dive below the surface to uncover the key drivers that just might surprise you.

Result: Fair Value of $59.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, volatile travel demand and thin industry margins remain. These factors could quickly flip sentiment if conditions deteriorate further.

Find out about the key risks to this Delta Air Lines narrative.Another View: SWS DCF Model

Our SWS DCF model also points to Delta being undervalued, which reinforces the earlier bullish narrative. However, every model interprets the future a little differently. Could both perspectives still be overlooking something important?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Delta Air Lines Narrative

If you see the story unfolding differently, or want to dig into the numbers on your own terms, you can shape your personal narrative in just minutes with Do it your way.

A great starting point for your Delta Air Lines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Want a real edge? Take your portfolio to the next level and get ahead of market trends. Don’t settle for just one stock story when breakthrough opportunities could be one click away.

- Uncover overlooked companies with explosive growth prospects by tapping into penny stocks with strong financials. These companies are building momentum with strong financials and bold strategies.

- Tap into the unstoppable surge of artificial intelligence. AI penny stocks could help pinpoint tomorrow’s leaders in automation and digital innovation.

- Boost your income by selecting dividend stocks with yields > 3% that offer robust yields, helping you compound wealth and stay ahead in any market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.