Please use a PC Browser to access Register-Tadawul

Did Analyst Upgrades Just Shift Virtu Financial's (VIRT) Value-Focused Investment Narrative?

Virtu Financial, Inc. Class A VIRT | 33.71 | -1.52% |

- In the past week, Virtu Financial attracted increased analyst attention as five analysts raised their earnings estimates, reflecting growing optimism about the company's operations and fundamentals.

- This momentum coincides with Virtu's strong standing among value-focused metrics, including a leading Zacks Rank and compelling Value and VGM Style Scores, which have captured the interest of market participants.

- We'll examine how this wave of upward analyst earnings revisions may influence Virtu Financial's investment narrative going forward.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Virtu Financial Investment Narrative Recap

Shareholders in Virtu Financial need to believe in the company’s ability to harness technology and scale to remain a top liquidity provider even as digital assets and alternative trading platforms transform capital markets. This wave of upward analyst earnings estimate revisions signals fresh optimism, but it does not fundamentally change the primary near-term catalyst, higher volatility driving trading activity, nor does it materially reduce the biggest risk of revenue pressure as tokenization and blockchain technologies gain traction outside legacy financial channels. One recent announcement relevant to the growing analyst confidence is Virtu’s strong second quarter results, with revenue up to US$999.57 million and net income more than doubling year-over-year, metrics that help reinforce a positive earnings outlook in the face of evolving market structure risks. These strong financials coincide with ongoing share repurchases and payout of a steady US$0.24 dividend, but changes in liquidity needs or technology costs could quickly alter the risk-reward balance for current and future shareholders. Yet, in contrast to this momentum, the long-term impact of tokenization on Virtu’s core business is a detail investors should not overlook...

Virtu Financial's outlook anticipates $1.5 billion in revenue and $561.6 million in earnings by 2028. This relies on a 17.3% annual revenue decline and an earnings increase of $182.4 million from current earnings of $379.2 million.

Uncover how Virtu Financial's forecasts yield a $47.14 fair value, a 29% upside to its current price.

Exploring Other Perspectives

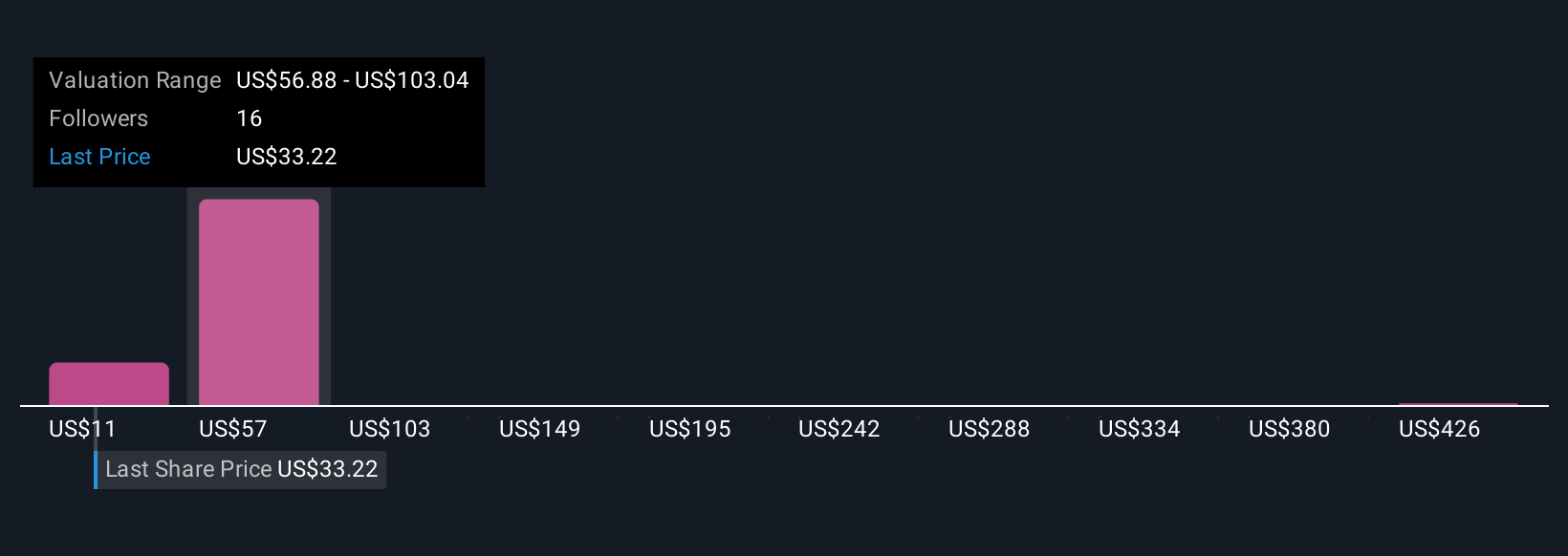

Six community fair value estimates for Virtu range from US$10.71 to US$472.36, illustrating sharply varied outlooks among Simply Wall St Community members. As market volatility fuels near-term catalysts for Virtu, these contrasting perspectives invite you to consider the many paths the company’s performance could take.

Explore 6 other fair value estimates on Virtu Financial - why the stock might be a potential multi-bagger!

Build Your Own Virtu Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Virtu Financial research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Virtu Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Virtu Financial's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.