Please use a PC Browser to access Register-Tadawul

Did BKV's (BKV) Sustainability Milestones and Debut ESG Rating Just Shift Its Investment Narrative?

BKV Corp. BKV | 25.83 | -3.19% |

- Earlier this week, BKV Corporation released its 2024 Sustainability Report, highlighting major progress in carbon capture initiatives and unveiling new sustainability targets.

- BKV also announced receiving an 'A' ESG rating from MSCI in its inaugural assessment since going public in September 2024, reinforcing its environmental credibility in the energy sector.

- Let's explore how BKV's expanded carbon reduction initiatives and new ESG recognition shape its longer-term investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is BKV's Investment Narrative?

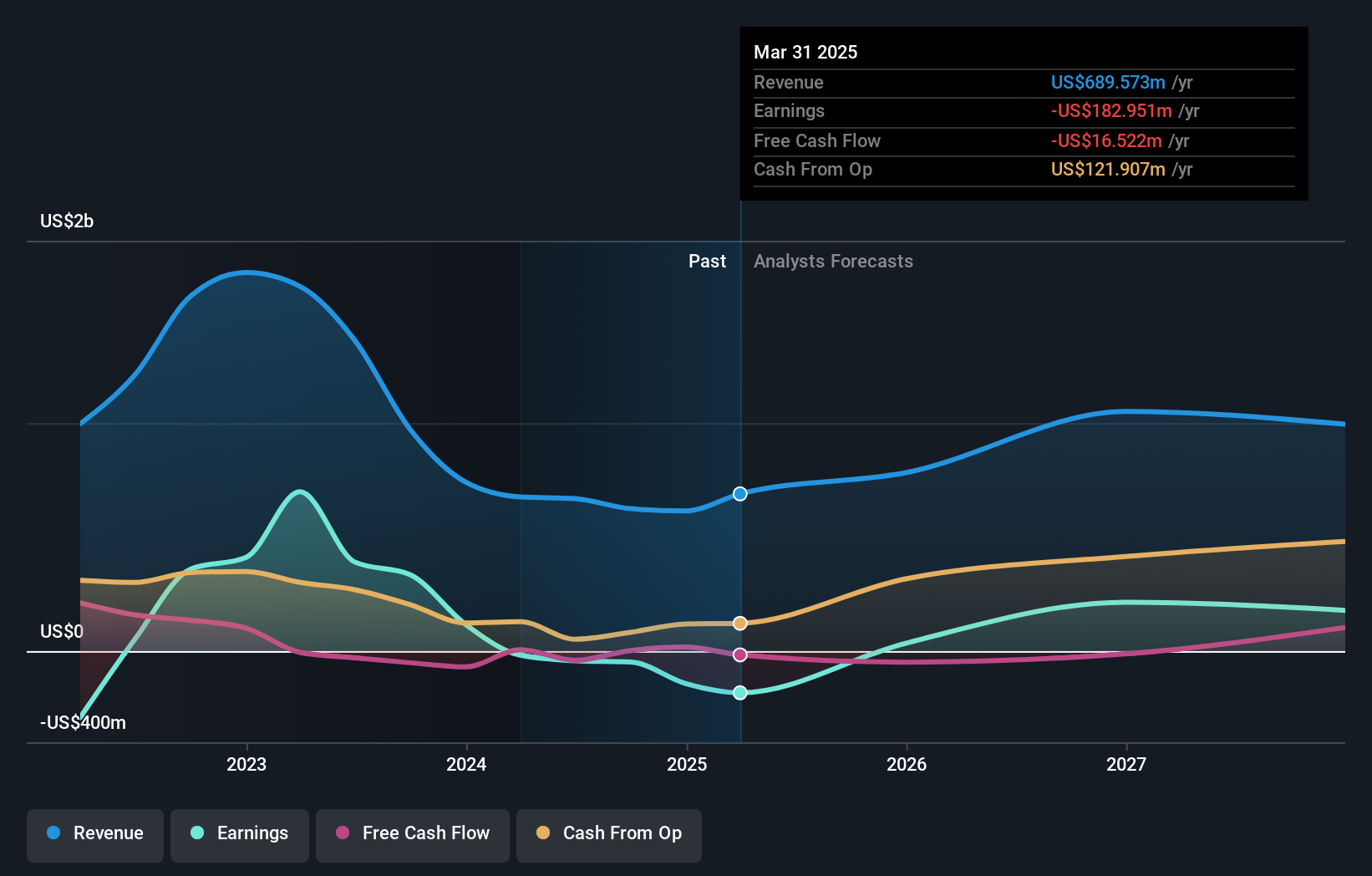

Being a BKV shareholder means believing in both the expansion of its core natural gas business and its ambitions in carbon capture and emissions reduction. The company's latest Sustainability Report and 'A' ESG rating from MSCI mark significant steps, helping to support its environmental leadership narrative at a critical moment in the energy transition. These developments may lend further weight to short-term catalysts like joint venture deals and production increases, while also boosting confidence in BKV’s ability to secure new project funding and partnerships. However, the stock's continued price weakness, recent index exclusions, and mixed board independence still present risks, particularly as BKV remains relatively unprofitable, and the management team is largely new. While the latest ESG recognition may support near-term sentiment, it does not fundamentally change the existing financial risks or resolve uncertainties around execution. Yet, it’s worth noting that board independence remains a concern for many investors.

Despite retreating, BKV's shares might still be trading 37% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on BKV - why the stock might be worth as much as 60% more than the current price!

Build Your Own BKV Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BKV research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free BKV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BKV's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.