Please use a PC Browser to access Register-Tadawul

Did Cognizant's (CTSH) AI-Powered Coding Blueprint Just Expand Its Long-Term Growth Story?

Cognizant Technology Solutions Corporation Class A CTSH | 83.94 | +0.14% |

- Earlier this week, Cognizant Technology Solutions announced the launch of the Enterprise Vibe Coding Blueprint, a suite of AI-assisted coding services and reusable IP designed to help Global 2000 organizations operationalize secure, scalable, enterprise-grade AI-powered development across both technical and non-technical teams.

- An interesting insight is that the new blueprint leverages technologies proven during Cognizant’s Guinness World Record-setting Vibe Coding Week and aims to bridge business and IT collaboration, accelerating innovation and rapid prototyping within large, complex organizations.

- We’ll now assess how the introduction of enterprise-grade AI-assisted coding expands Cognizant’s long-term addressable market and growth story.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Cognizant Technology Solutions Investment Narrative Recap

For investors considering Cognizant Technology Solutions, the core belief centers on the company’s ability to harness AI and next-gen automation capabilities to capture a larger share of the booming enterprise digital transformation market, while driving consistent earnings and margin growth. This week’s launch of the Enterprise Vibe Coding Blueprint further supports key AI-driven catalysts by spotlighting Cognizant’s proprietary offerings, but near-term, this development may not dramatically alter the most immediate risk: accelerating adoption of generative AI potentially reducing demand for traditional labor-based services.

Among recent announcements, the July launch of Cognizant Agent Foundry stands out as directly relevant. Both Foundry and the new Vibe Coding Blueprint expand the company’s proprietary AI product stack, reinforcing efforts to win large-scale contracts as clients shift toward agentic and automated solutions, the very area expected to drive future growth, but also amplify margin and competitive challenges.

By contrast, investors should be aware that as more clients adopt generative and agentic AI, the possibility grows that...

Cognizant Technology Solutions is forecast to reach $23.5 billion in revenue and $2.9 billion in earnings by 2028. This outlook relies on a 4.7% annual revenue growth rate and a $0.5 billion increase in earnings from the current $2.4 billion.

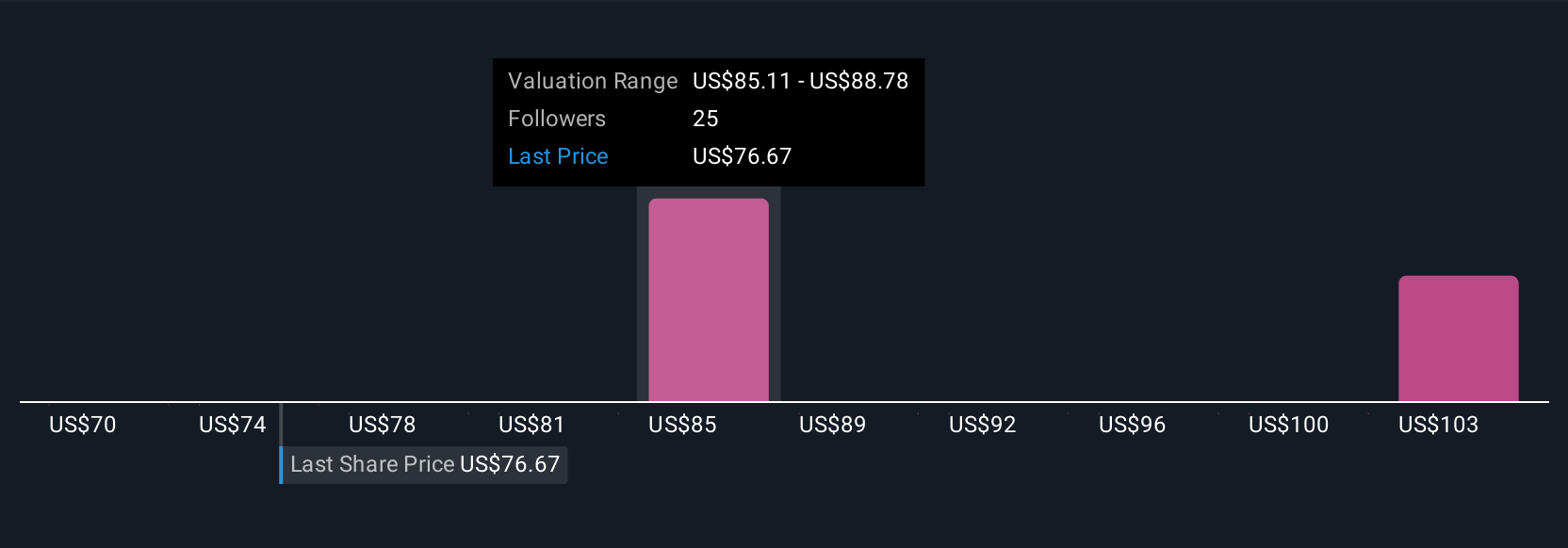

Uncover how Cognizant Technology Solutions' forecasts yield a $85.80 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community members estimate Cognizant’s fair value between US$59.15 and US$90 per share. While AI-driven platform launches may expand growth opportunities, participants should consider how increased automation could eventually impact services demand and pricing power.

Explore 7 other fair value estimates on Cognizant Technology Solutions - why the stock might be worth 10% less than the current price!

Build Your Own Cognizant Technology Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognizant Technology Solutions research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cognizant Technology Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognizant Technology Solutions' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.