Please use a PC Browser to access Register-Tadawul

Did Dropbox’s (DBX) Massive Buyback and New Loan Capacity Just Shift Its Investment Narrative?

Dropbox DBX | 28.32 | +2.53% |

- Earlier this month, Dropbox, Inc. amended its credit agreement to allow up to US$700 million in additional secured term loans and announced a new US$1.5 billion share repurchase program for its class A common shares.

- This combination of capital structure flexibility and a large buyback authorization highlights management’s active approach to shareholder returns and balance sheet optimization.

- We'll explore how Dropbox’s expanded buyback program may influence its current investment narrative and analyst outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dropbox Investment Narrative Recap

To be a Dropbox shareholder today, you need to believe that the company can transition beyond cloud storage into higher-value AI-powered productivity and collaboration tools despite recent revenue declines and user contraction. The new debt facility and share repurchase plan sharpen management's tools to reward shareholders, but they do not materially shift the company’s biggest short-term catalyst, successful monetization of new AI products, or the key risk: ongoing user base and revenue shrinkage in a competitive sector.

Of the recent announcements, the expanded US$1.5 billion share buyback stands out, as it signals confidence in Dropbox’s cash generation and offers short-term support to the share price amidst cautious market sentiment. However, as revenue headwinds persist, buybacks alone may not offset top-line pressure, so investor attention remains fixed on product adoption and user trends.

Yet, if revenue continues to decline faster than cost savings and buybacks can compensate, investors should be aware that ...

Dropbox's narrative projects $2.5 billion revenue and $494.6 million earnings by 2028. This assumes a 1.1% annual revenue decline and a $9.2 million increase in earnings from $485.4 million currently.

Uncover how Dropbox's forecasts yield a $28.12 fair value, a 9% downside to its current price.

Exploring Other Perspectives

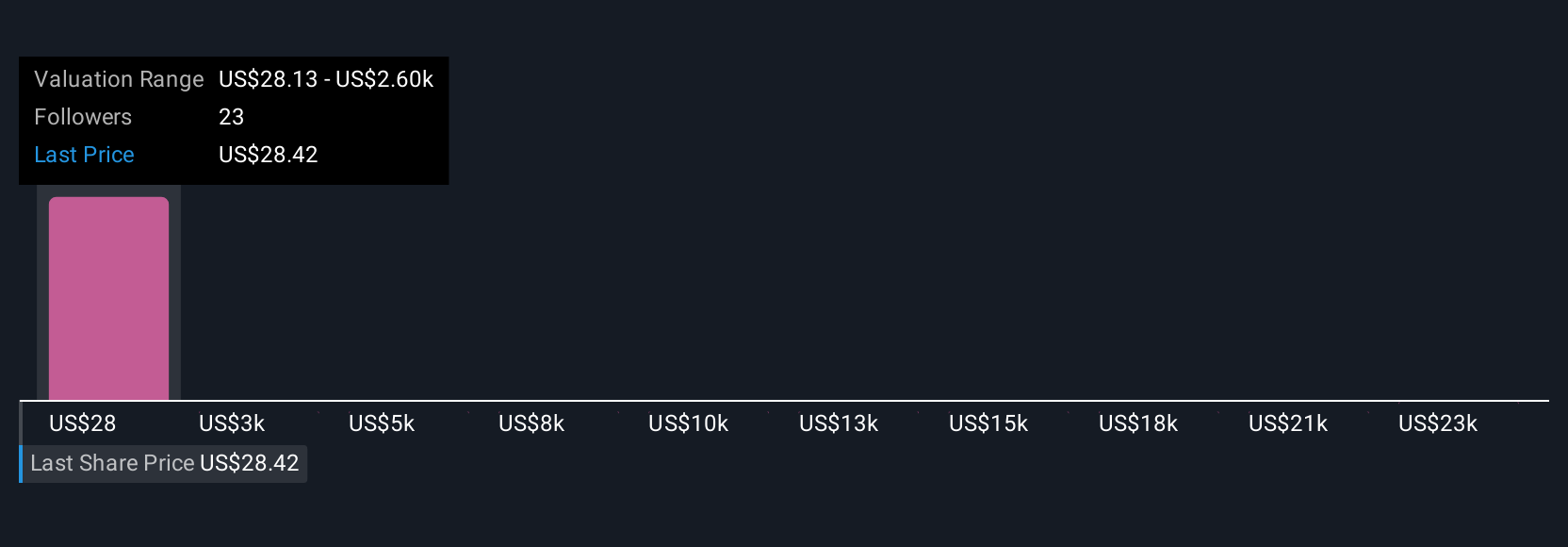

Simply Wall St Community members provided four fair value estimates for Dropbox, ranging from US$28.13 to US$25,709.96 per share. Against this backdrop, user contraction remains a central issue and may explain why opinions on future prospects and valuation differ so widely, see what other investors think.

Explore 4 other fair value estimates on Dropbox - why the stock might be a potential multi-bagger!

Build Your Own Dropbox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dropbox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dropbox's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.