Please use a PC Browser to access Register-Tadawul

Did European and U.S. Drug Approvals Plus Texas Expansion Just Shift Eli Lilly’s (LLY) Investment Narrative?

Eli Lilly and Company LLY | 1054.29 | -0.74% |

- In recent days, Eli Lilly secured European approval for Kisunla (donanemab) in early Alzheimer's disease and received U.S. FDA approval for Inluriyo for advanced breast cancer, while committing US$6.5 billion to build a new small molecule medicine facility in Texas.

- These milestones highlight Lilly's advancing capabilities in neuroscience and oncology, and underscore its commitment to scaling innovation in obesity and diabetes medicines through major manufacturing expansion.

- Next, we'll explore what these new approvals and manufacturing investments could mean for Eli Lilly's long-term growth outlook and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Eli Lilly Investment Narrative Recap

To support the case for being an Eli Lilly shareholder, I focus on the company’s ability to lead in innovative therapies for obesity, diabetes, oncology, and neuroscience, backed by strong research and global manufacturing expansion. Recent European approval for Kisunla and the launch of Inluriyo add further depth to the portfolio, but the most important short-term catalyst remains the anticipated launch and scaling of oral GLP-1 therapies like orforglipron. None of the recent news events appear to materially reduce the largest current risk: policy-driven pricing pressure in the U.S. and Europe.

One announcement that stands out amid this momentum is the $6.5 billion investment in a new manufacturing facility in Texas, which directly addresses concerns about capacity constraints and underpins further scaling of obesity and diabetes medicines. This expansion is highly relevant as it supports the projected demand growth following new product approvals and clinical data, reinforcing Lilly's push to maintain leadership in high-growth therapeutic areas.

In contrast, investors should be mindful of mounting regulatory pricing pressures, which could affect margins and profitability over the coming years...

Eli Lilly's narrative projects $89.1 billion in revenue and $34.2 billion in earnings by 2028. This requires 18.7% yearly revenue growth and a $20.4 billion increase in earnings from the current $13.8 billion.

Uncover how Eli Lilly's forecasts yield a $891.62 fair value, a 23% upside to its current price.

Exploring Other Perspectives

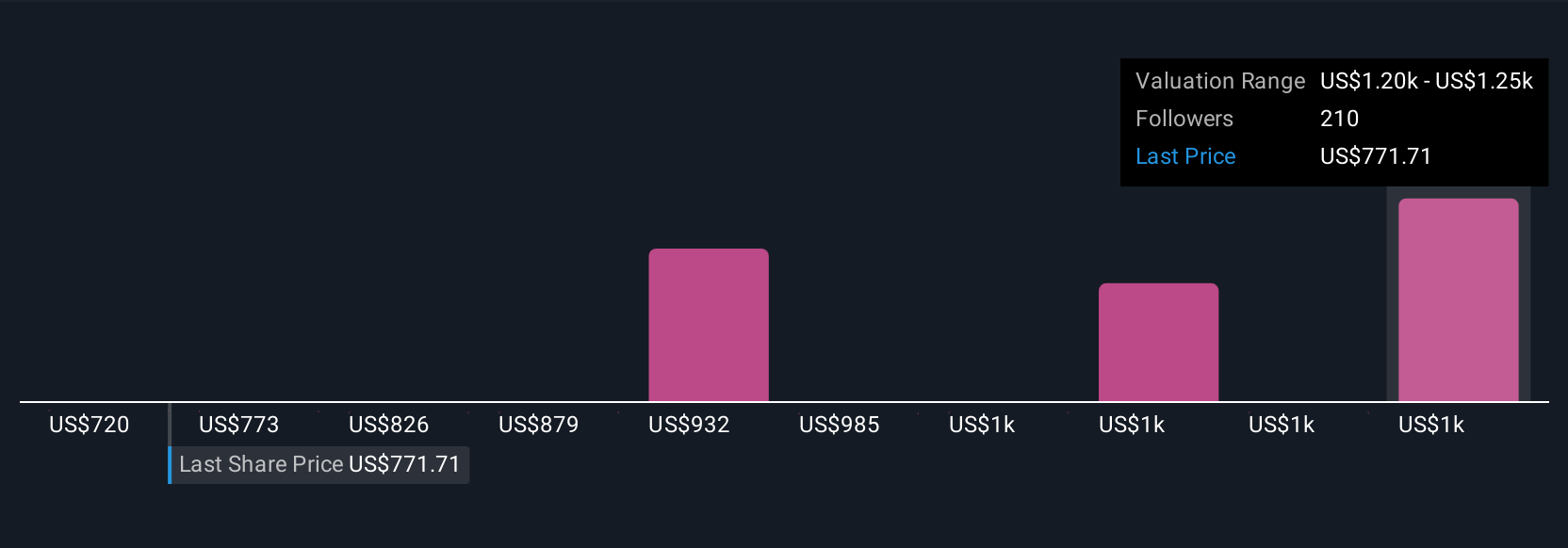

Simply Wall St Community members have issued 30 separate fair value estimates for Eli Lilly, spanning from US$650 to US$1,189 per share. As competition accelerates in obesity and diabetes treatments, these diverse perspectives reflect how policy changes or pricing shifts could drive significant debate around future earnings power.

Explore 30 other fair value estimates on Eli Lilly - why the stock might be worth 10% less than the current price!

Build Your Own Eli Lilly Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eli Lilly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eli Lilly's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.