Please use a PC Browser to access Register-Tadawul

Did Expanded Buybacks And Mitsui Sumitomo’s Added Stake Just Shift W. R. Berkley’s (WRB) Investment Narrative?

W. R. Berkley Corporation WRB | 71.08 | +1.05% |

- Earlier in January 2026, W. R. Berkley’s board lifted the company’s share repurchase authorization to 25,000,000 shares, while major shareholder Mitsui Sumitomo Insurance Co. expanded its stake with US$32.64 million of open‑market purchases.

- Together, the larger buyback capacity and increased investment by a significant institutional owner highlight strong insider confidence in W. R. Berkley’s capital deployment and long‑term positioning.

- We’ll now examine how Mitsui Sumitomo’s growing ownership stake could influence W. R. Berkley’s investment narrative and future capital allocation priorities.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

W. R. Berkley Investment Narrative Recap

To own W. R. Berkley, you need to be comfortable with a commercial insurer that relies on disciplined underwriting while facing intense competition and evolving loss trends. The expanded 25,000,000‑share repurchase authorization and Mitsui Sumitomo’s US$32.64 million purchase do not materially change the key short term catalyst, which remains underwriting performance in a softening property and casualty market, nor the biggest risk, which is pressure on pricing discipline and combined ratios as competition intensifies.

Among recent developments, the higher share repurchase authorization stands out as most relevant, as it directly shapes how W. R. Berkley deploys capital around book value and earnings per share. While buybacks can support per share metrics, they sit alongside the ongoing risk that growing competition and more aggressive reinsurance capacity could erode underwriting margins just as investors focus on the company’s ability to sustain its historical profitability profile.

Yet investors should also be aware that growing competition in property and reinsurance could...

W. R. Berkley's narrative projects $14.3 billion revenue and $2.0 billion earnings by 2028. This requires 0.0% yearly revenue growth and a $0.2 billion earnings increase from $1.8 billion.

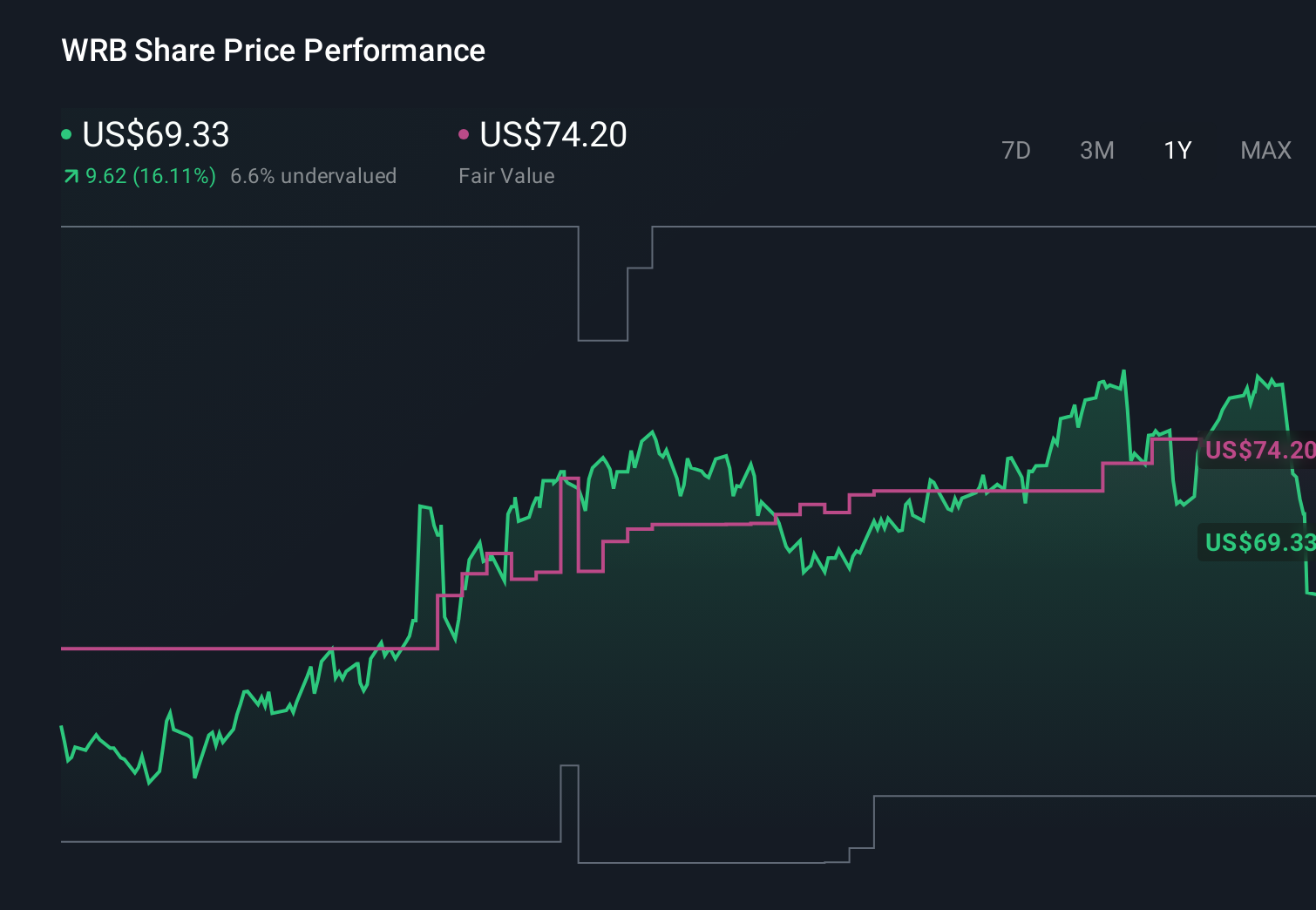

Uncover how W. R. Berkley's forecasts yield a $73.06 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span a wide range, from US$26.69 to US$118.48 per share, underscoring very different expectations. When you set these against concerns about rising competitive pressure and pricing discipline, it is clear there are several alternative viewpoints on how W. R. Berkley’s performance could evolve.

Explore 4 other fair value estimates on W. R. Berkley - why the stock might be worth as much as 72% more than the current price!

Build Your Own W. R. Berkley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W. R. Berkley research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free W. R. Berkley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W. R. Berkley's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.