Please use a PC Browser to access Register-Tadawul

Did Fed Rate Cuts Just Shift Glacier Bancorp's (GBCI) Investment Narrative for Regional Bank Investors?

Glacier Bancorp, Inc. GBCI | 53.31 | +0.24% |

- Earlier this week, the Federal Reserve reduced its benchmark interest rate by 25 basis points and indicated the possibility of further cuts before year-end, prompting a surge in equities, most evidently among regional banks such as Glacier Bancorp.

- This policy shift has strengthened investor optimism around regional lenders, reflecting expectations that easier monetary conditions could support improved profitability and business activity across the sector.

- We'll examine how the prospect of ongoing Federal Reserve rate cuts could shift Glacier Bancorp's investment narrative and sector positioning.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Glacier Bancorp Investment Narrative Recap

To be a Glacier Bancorp shareholder, you typically believe in its long-term ability to deliver sustainable growth through acquisitions, margin expansion, and the resilience of core Mountain West markets. The Federal Reserve’s rate cut and loosening bias could serve as a strong short-term catalyst for net interest margin improvement, but integration of recent acquisitions and the company’s continued reliance on commercial real estate lending remain key business risks; the Fed’s move does not materially diminish their importance to the investment case.

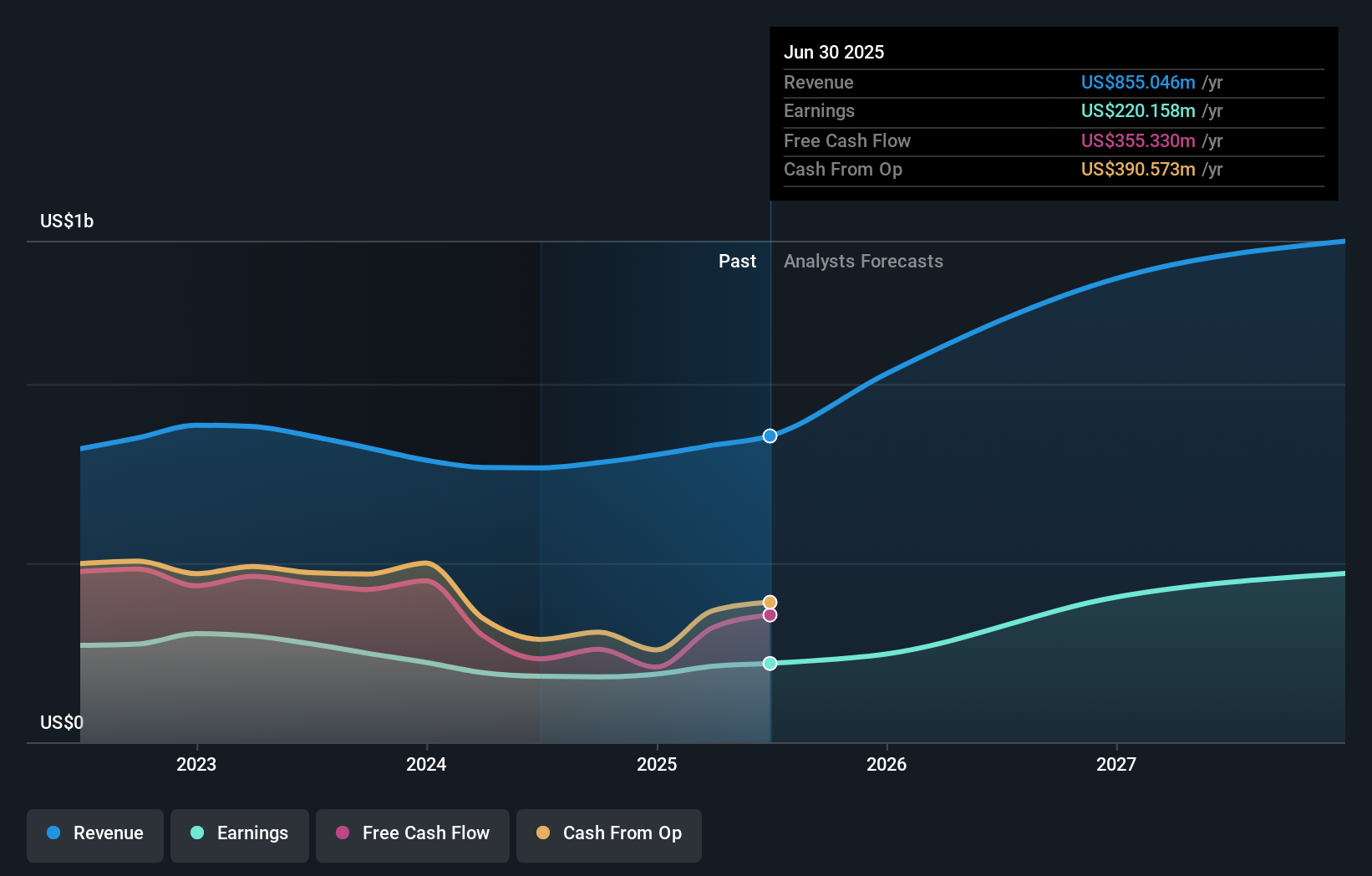

Among recent announcements, Glacier Bancorp’s Q2 2025 results stand out. A significant jump in net interest income and net income compared to a year ago reflects increased lending activity and higher yields on earning assets, both of which can receive a boost from Fed-fueled optimism and market liquidity. These financial gains underscore the importance of maintaining asset quality and operational efficiency as the company pursues growth amid shifting monetary conditions.

However, despite surging investor optimism, the potential for demographic headwinds in Glacier’s mostly rural and small urban core markets is an issue that every investor should keep in mind...

Glacier Bancorp's narrative projects $1.6 billion revenue and $581.0 million earnings by 2028. This requires 23.5% yearly revenue growth and a $360.8 million increase in earnings from $220.2 million.

Uncover how Glacier Bancorp's forecasts yield a $50.83 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted 1 fair value estimate for Glacier Bancorp, with all opinions clustering at US$50.83 per share. While some see opportunity in Fed policy shifts supporting regional banks, others may question whether slower population growth or acquisition integration will impact longer-term results. Compare your outlook with the full range of investor perspectives.

Explore another fair value estimate on Glacier Bancorp - why the stock might be worth just $50.83!

Build Your Own Glacier Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Glacier Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Glacier Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Glacier Bancorp's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.