Please use a PC Browser to access Register-Tadawul

Did Insider Buying and Rising Management Ownership Just Shift MSC Industrial Direct's (MSM) Investment Narrative?

MSC Industrial Direct Co., Inc. Class A MSM | 86.74 86.74 | +0.16% 0.00% Pre |

- Over the past 12 months, multiple insiders, including Non-Executive Chairman Mitchell Jacobson, acquired a sizeable stake in MSC Industrial Direct Co., Inc., with Jacobson purchasing US$11 million of shares at a price below recent market levels.

- This activity has brought insider ownership to around 18%, reflecting a strong alignment between management and shareholder interests, which is frequently viewed as a positive indicator by the market.

- We'll examine how increased insider ownership and management confidence could influence MSC Industrial Direct's overall investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

MSC Industrial Direct Investment Narrative Recap

To be a shareholder in MSC Industrial Direct, you need to believe in the company’s ability to recover from recent soft demand and declining sales, as well as its capacity to leverage operational improvements for future growth. Insiders increasing their stake demonstrates management confidence, but this does not meaningfully change the company’s biggest near-term catalyst, potential improvement in industrial activity, nor does it offset the key risk of ongoing weak demand and margin pressure.

A recent leadership reorganization, including new appointments in sales and customer experience, is particularly relevant here. While these changes signal an effort to strengthen execution and operational focus, their effectiveness will depend on how well the company addresses declining sales and cost management, which are still the main near-term concerns.

On the other hand, given persistent soft demand and a 4.7% fall in average daily sales, a critical risk investors should watch for is…

MSC Industrial Direct's outlook anticipates $4.3 billion in revenue and $293.5 million in earnings by 2028. This projection assumes 4.5% annual revenue growth and an earnings increase of $95 million from the current $198.5 million.

Uncover how MSC Industrial Direct's forecasts yield a $90.29 fair value, in line with its current price.

Exploring Other Perspectives

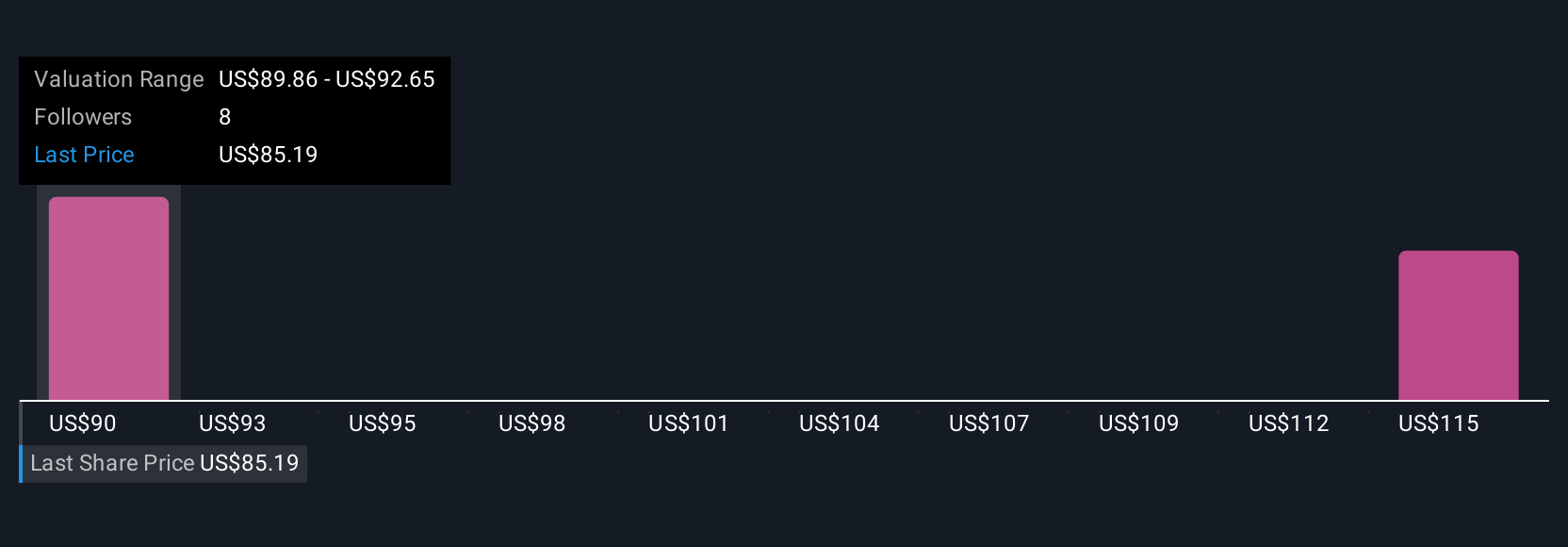

Two community members in the Simply Wall St Community estimate MSC Industrial Direct’s fair value between US$90 and US$111 per share. Differing views highlight the potential impact of current demand challenges on the company’s performance and invite you to explore several alternative perspectives.

Explore 2 other fair value estimates on MSC Industrial Direct - why the stock might be worth as much as 21% more than the current price!

Build Your Own MSC Industrial Direct Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSC Industrial Direct research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MSC Industrial Direct research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSC Industrial Direct's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.