Please use a PC Browser to access Register-Tadawul

Did Instacart’s Surge in Tech Partnerships Just Shift Maplebear’s (CART) Investment Narrative?

Instacart, Inc. (Maplebear Inc.) CART | 44.96 | +0.69% |

- In recent days, Instacart announced that a growing number of independent grocers across the U.S. have adopted its enterprise technology offerings, including Caper Carts, Storefront Pro, and FoodStorm, while Northeast Grocery and Restaurant Depot have launched new digital platforms powered by Instacart’s solutions.

- This wave of adoption highlights Instacart’s expanding role as a technology partner, showcasing momentum in delivering unified digital and in-store experiences for grocers and foodservice operators nationwide.

- We’ll take a look at how Instacart’s expanding enterprise partnerships could shape the company’s longer-term investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Maplebear Investment Narrative Recap

To be a Maplebear shareholder, you need to believe that grocery and essential goods shopping will keep moving online, and that Instacart’s expanding suite of omnichannel retailer technologies will secure recurring, higher-margin revenue streams. While the surge in enterprise adoption of Instacart’s tech, such as Caper Carts and Storefront Pro, reinforces optimism about margin expansion, it is not a material catalyst for the upcoming Q3 earnings report, nor does it lessen the biggest risk: continued intense competition from other delivery platforms and retailer-led solutions.

The launch of redesigned websites and mobile apps for Northeast Grocery, using Instacart’s Storefront Pro, is especially relevant. It directly speaks to the company’s efforts to deepen enterprise partnerships and power growth in its white-label technology offerings, a key catalyst for improving the stickiness and profitability of the Instacart platform.

But investors should also keep in mind the threat of heightened price competition as delivery tech becomes more commoditized, especially since...

Maplebear's narrative projects $4.6 billion revenue and $779.9 million earnings by 2028. This requires 9.3% yearly revenue growth and a $300.9 million earnings increase from $479.0 million today.

Uncover how Maplebear's forecasts yield a $56.81 fair value, a 45% upside to its current price.

Exploring Other Perspectives

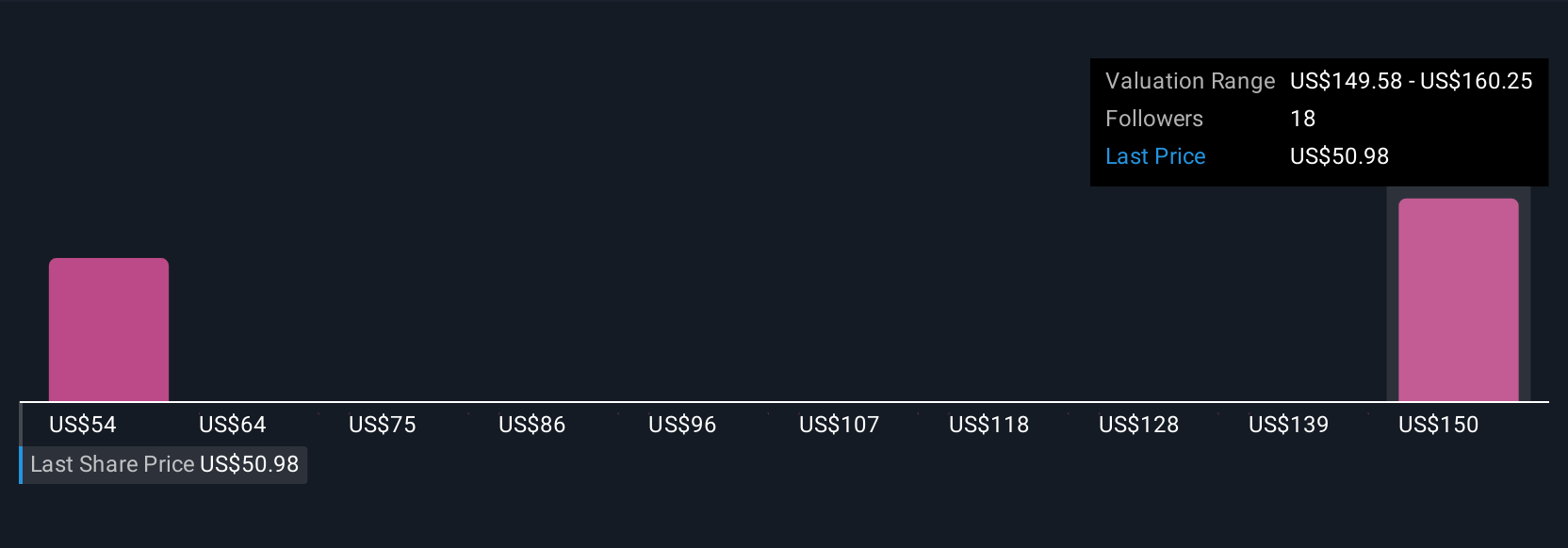

Fair value estimates from three Simply Wall St Community members span from US$46.47 to US$106.37 per share. Amid such differing viewpoints, rising competition and potential margin pressure remain top of mind for many tracking Maplebear’s future performance.

Explore 3 other fair value estimates on Maplebear - why the stock might be worth just $46.47!

Build Your Own Maplebear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maplebear research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Maplebear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maplebear's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.