Please use a PC Browser to access Register-Tadawul

Did Joby Aviation’s (JOBY) Uber Integration and Blade Acquisition Just Transform Its Urban Air Strategy?

Joby Aviation JOBY | 14.85 14.93 | -4.56% +0.54% Pre |

- Joby Aviation and Uber Technologies recently announced plans to integrate Blade's air mobility services into the Uber app following Joby's acquisition of Blade's passenger business, enabling users to book urban air travel routes across New York and Southern Europe.

- This move, combined with Joby's successful demonstration of its Superpilot autonomous flight technology, highlights the company's accelerating progress in both commercial urban air mobility and defense applications.

- We'll examine how integrating Blade's established network with Uber's platform could reshape Joby's long-term investment outlook in urban transportation.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Joby Aviation's Investment Narrative?

To be a shareholder in Joby Aviation, you need conviction in a future where urban air mobility becomes a mainstream transportation option, one where Joby’s zero-emission electric aircraft, regulatory progress, and key alliances can deliver sustainable growth. The Uber integration of Blade’s network, announced after the acquisition, could accelerate user adoption by granting Joby access to a large, urban customer base much sooner, potentially shifting a key commercial launch catalyst forward. This broader exposure through Uber may also ease some concerns about the near-term ramp in passenger volume and network utilization, especially as regulatory milestones and FAA certification are still pending. On the other hand, rising quarterly losses and delays in scaling production remain immediate risks, and the recent volatility in share price signals that the market is watching these developments closely. The Uber-Blade news is material, as it meaningfully links the promise of Joby’s technology to actual ride-booking demand, but the biggest tests, consistent execution and achieving profitability, still lie ahead.

However, regulatory and commercial timing risks are especially critical for those considering Joby stock.

Exploring Other Perspectives

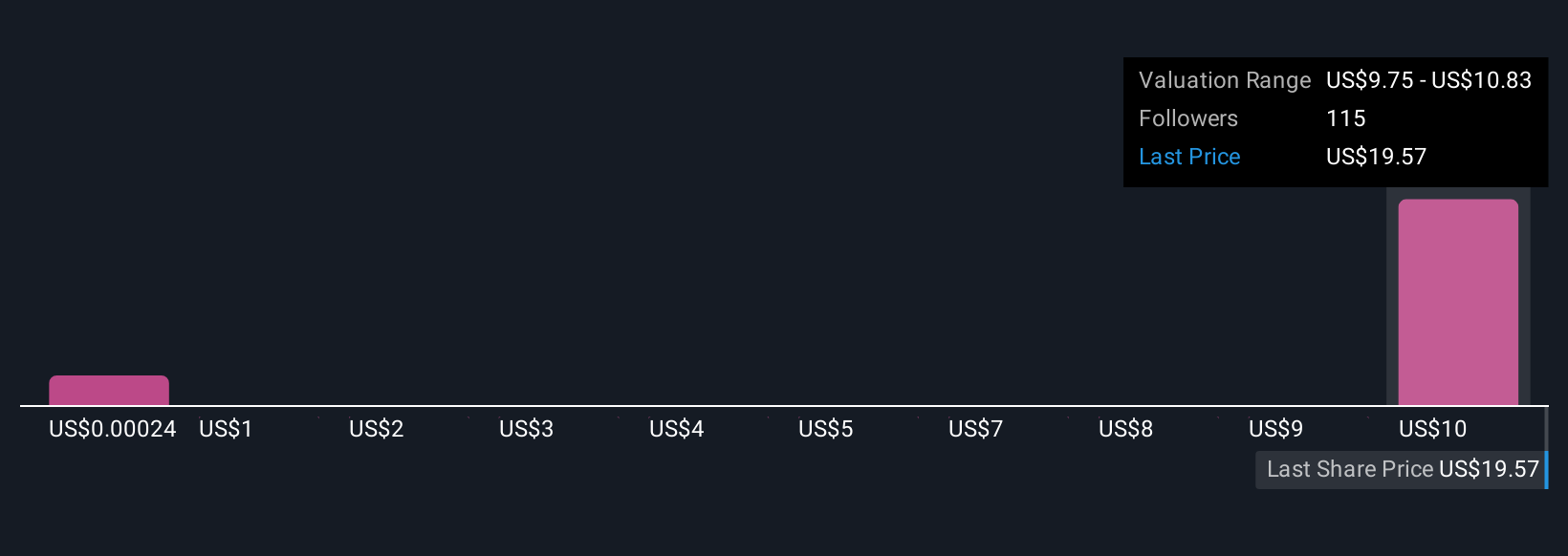

Explore 12 other fair value estimates on Joby Aviation - why the stock might be worth as much as $10.83!

Build Your Own Joby Aviation Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Joby Aviation research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Joby Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Joby Aviation's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.