Please use a PC Browser to access Register-Tadawul

Did KB Home’s (KBH) Multi-State Community Launches Just Reshape Its Growth Narrative?

KB Home KBH | 62.94 | -1.52% |

- In recent days, KB Home announced the grand openings of several new residential communities in California, Colorado, and Arizona, featuring modern, ENERGY STAR certified homes with a variety of customizable options for buyers.

- These community launches reflect a concentrated effort to expand KB Home’s presence in commuter-accessible, high-demand areas with a focus on design personalization and customer experience.

- We'll explore how this multi-market expansion may influence KB Home’s outlook by supporting growth opportunities and buyer engagement.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

KB Home Investment Narrative Recap

To be a shareholder in KB Home, you have to believe in the company’s ability to accelerate growth in a challenging housing environment despite recent year-over-year revenue and net income declines. The announcement of multiple new communities highlights a strategy to boost buyer engagement and address high-demand markets, but the near-term business outlook is still closely tied to consumer confidence and demand, currently the biggest catalyst and risk. The recent expansions may aid longer-term growth, but the impact on immediate financial results appears limited.

Among the latest openings, Belcourt Place in El Monte, California stands out for combining commuter-friendly access, customizable home features, and ENERGY STAR certification. This aligns with KB Home’s emphasis on innovation and customer satisfaction, which are important factors supporting their growth strategy in high-demand regions. Investors focused on operational catalysts may see this as a signal of efforts to sustain sales, but persistent macroeconomic risks remain.

On the other hand, investors should be aware of...

KB Home's outlook forecasts $6.8 billion in revenue and $496.4 million in earnings by 2028. This scenario assumes revenue will decline by 0.2% annually and earnings will decrease by $125.1 million from the current level of $621.5 million.

Uncover how KB Home's forecasts yield a $63.58 fair value, a 3% downside to its current price.

Exploring Other Perspectives

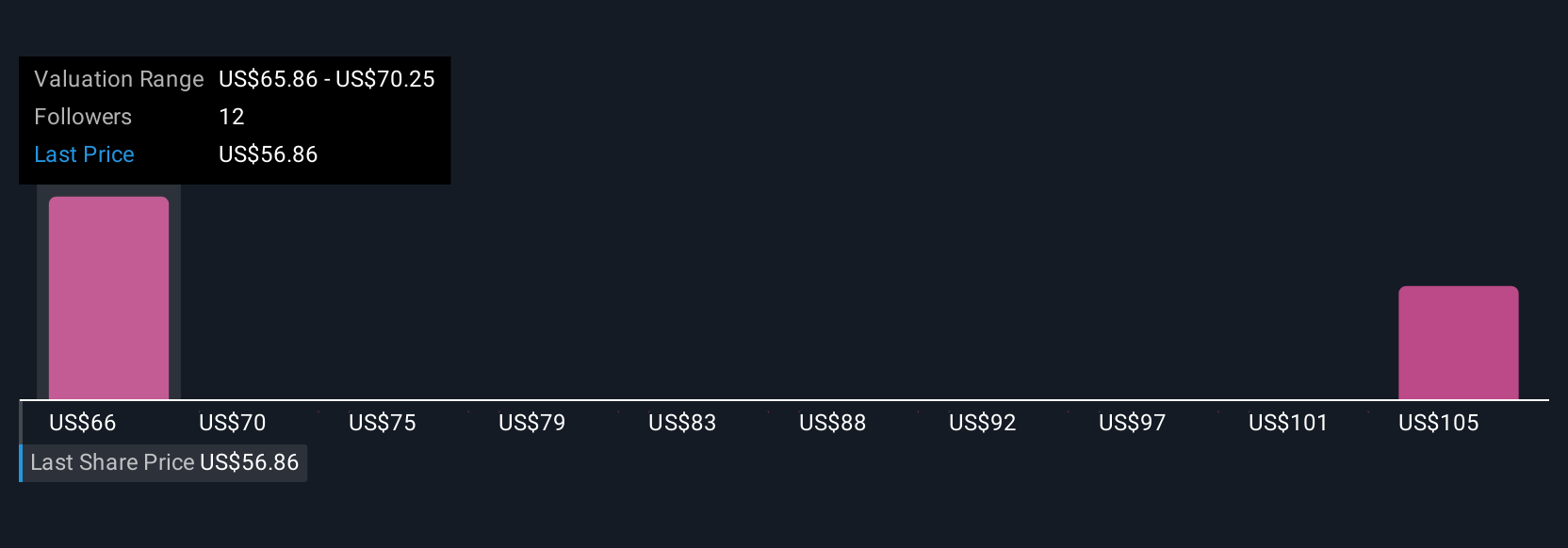

Simply Wall St Community members have set fair values from US$63.58 up to US$102.66 across three analyses. While some see substantial upside, many continue to flag softening consumer demand as a concern that could affect the company’s performance and future outlook.

Explore 3 other fair value estimates on KB Home - why the stock might be worth just $63.58!

Build Your Own KB Home Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KB Home research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free KB Home research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KB Home's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.