Please use a PC Browser to access Register-Tadawul

Did Launching Berkley Edge Mark a Strategic Shift for W. R. Berkley’s (WRB) Specialty Insurance Focus?

W. R. Berkley Corporation WRB | 69.92 | +0.97% |

- W. R. Berkley Corporation recently announced the formation of Berkley Edge, a new business focused on professional liability and casualty insurance for small to mid-sized businesses, with Jamie Secor appointed as president.

- This move highlights the company’s intent to address hard-to-place and distressed insurance risks, expanding its offerings through wholesale brokers and leveraging Secor’s deep experience in specialty underwriting.

- We’ll explore how the addition of Berkley Edge, targeting underserved insurance segments, reshapes W. R. Berkley’s investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

W. R. Berkley Investment Narrative Recap

Shareholders in W. R. Berkley typically believe in the company’s ability to expand specialty insurance offerings and maintain disciplined underwriting, even as competition and cost pressures remain key risks. The recent launch of Berkley Edge, while signaling growth ambitions in underserved segments, does not materially change the near-term earnings catalyst, which remains centered on sustaining profit margins in a tough pricing climate.

The most relevant announcement tied to short-term investor interests is July’s second-quarter earnings update, which showed growth in both revenue and net income. This momentum, together with new initiatives like Berkley Edge, suggests continued focus on growing the specialty insurance portfolio and strengthening the company’s value proposition.

By contrast, investors should be aware that increased competition and pricing pressure could quickly impact underwriting profitability if...

W. R. Berkley's outlook anticipates $14.3 billion in revenue and $2.0 billion in earnings by 2028. This scenario is based on flat annual revenue growth of 0.0%, and a $0.2 billion increase in earnings from the current $1.8 billion level.

Uncover how W. R. Berkley's forecasts yield a $72.73 fair value, in line with its current price.

Exploring Other Perspectives

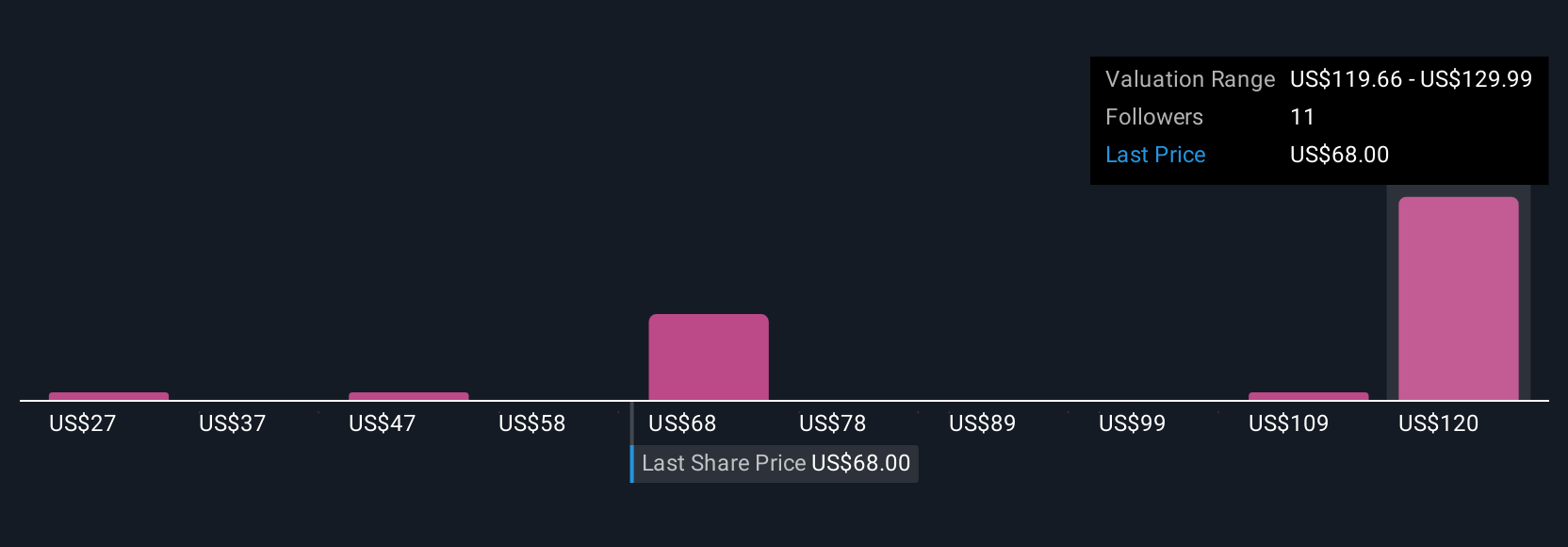

Six members of the Simply Wall St Community estimate W. R. Berkley’s fair value between US$26.69 and US$120.78. While many see upside potential in specialty insurance, persistent margin pressures remain a frequent concern when weighing future performance.

Explore 6 other fair value estimates on W. R. Berkley - why the stock might be worth as much as 69% more than the current price!

Build Your Own W. R. Berkley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W. R. Berkley research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free W. R. Berkley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W. R. Berkley's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.