Please use a PC Browser to access Register-Tadawul

Did Nelnet's (NNI) Big Earnings Surge and Dividend Declaration Just Shift Its Investment Narrative?

Nelnet, Inc. Class A NNI | 135.10 135.10 | +1.70% 0.00% Pre |

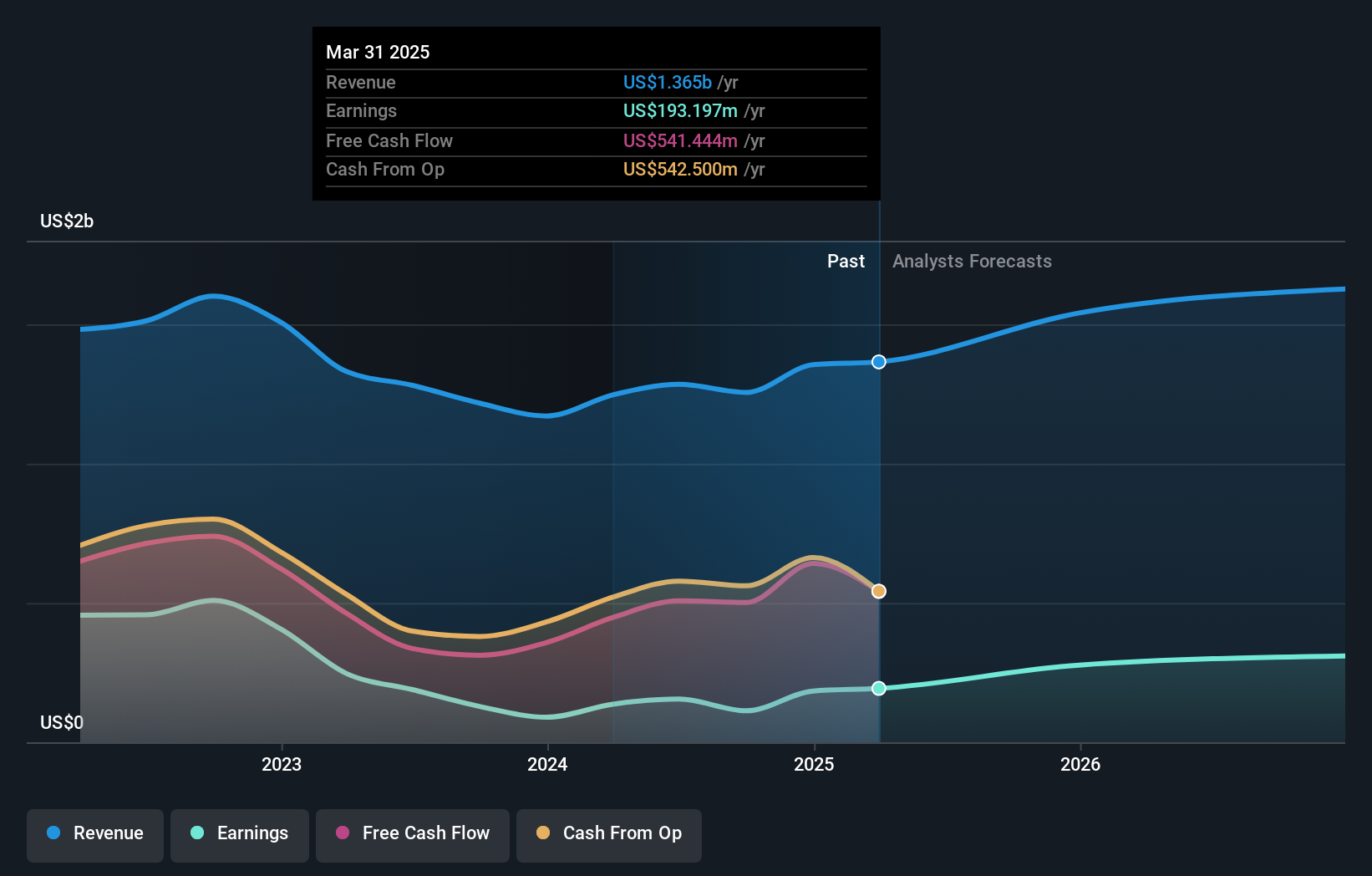

- Nelnet recently reported third-quarter and nine-month earnings, with net income reaching US$106.68 million for the quarter and US$370.7 million year-to-date, and also declared a US$0.33 per share dividend to be paid in December 2025.

- The company’s results reflect a dramatic rise in profitability compared to the previous year, driven by substantial gains in both quarterly and year-to-date earnings per share.

- We'll examine how Nelnet's significant earnings jump and shareholder dividend influence the company's overall investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Nelnet's Investment Narrative?

Being a Nelnet shareholder is all about believing that the recent surge in profitability, highlighted by much stronger quarterly and year-to-date earnings, could mark a turning point for the business and its stock story. The Q3 results underscore an exceptionally large uptick in net income and earnings per share versus last year, alongside a continued commitment to returning cash through steadily increasing dividends. These developments appear to ease near-term worries about earnings volatility and cash returns, previously considered major risks, and may act as key short-term catalysts. However, it's important to consider that much of Nelnet’s historical performance has been marked by fluctuating revenue, and projections suggest revenue may trend lower over coming years. The latest news gives optimism around operational progress and diversification, but it does not fully remove the risk that declines in core lending and payments could counterbalance current gains. It will be crucial for investors to watch whether this profitability momentum can be sustained as part of the broader investment case. On the other hand, ongoing declines in revenue remain a concern investors should not overlook.

Nelnet's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Nelnet - why the stock might be worth as much as $135.00!

Build Your Own Nelnet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nelnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nelnet's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.