Please use a PC Browser to access Register-Tadawul

Did PagerDuty’s (PD) New CRO and Profitability Signal a Turning Point for Its Growth Strategy?

PagerDuty PD | 6.89 | -0.86% |

- PagerDuty announced the appointment of Todd McNabb as Chief Revenue Officer, effective September 29, 2025, bringing more than 25 years of experience in scaling enterprise organizations, alongside reporting a return to profitability with second quarter sales of US$123.41 million and net income of US$9.78 million.

- The return to profitability and leadership change highlight PagerDuty’s operational progress and sharpen its focus on revenue growth and retention.

- We'll explore how Todd McNabb's leadership and PagerDuty's earnings turnaround could influence the company's future investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

PagerDuty Investment Narrative Recap

For shareholders, PagerDuty has always been an investment grounded in the belief that real-time operations management and enterprise automation are mission-critical to the digital economy. The recent appointment of a new Chief Revenue Officer and a return to profitability do not immediately alter the most meaningful short-term catalyst, which remains effective execution of usage-based pricing, or the most present risk, which is customer seat optimization limiting future revenue growth.

Among recent company developments, PagerDuty’s M&A exploration stands out, as the confirmed engagement with Qatalyst Partners following acquisition interest could influence short-term valuation far more than leadership changes, especially if buyout prospects accelerate or fade.

But while headline improvements and leadership transitions may draw attention, investors should also be alert to the ongoing risk that automation and AI could...

PagerDuty's narrative projects $572.1 million in revenue and $74.9 million in earnings by 2028. This requires 6.3% annual revenue growth and a $111.8 million increase in earnings from the current $-36.9 million.

Uncover how PagerDuty's forecasts yield a $19.14 fair value, a 16% upside to its current price.

Exploring Other Perspectives

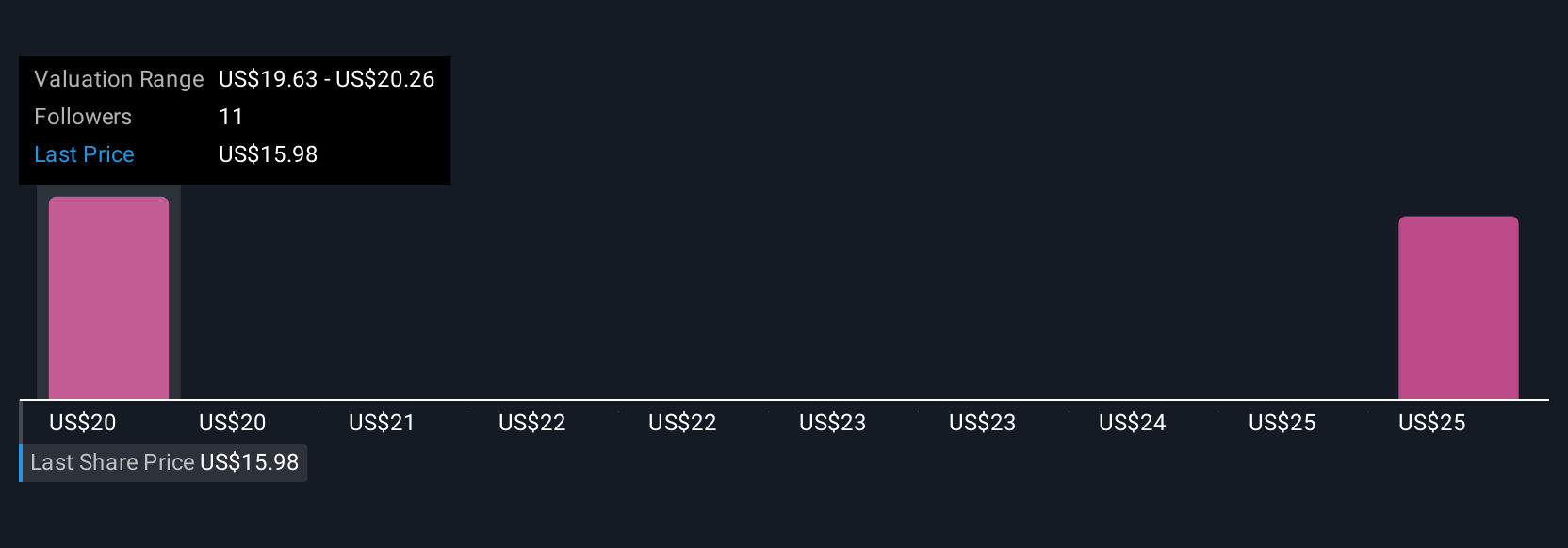

Three fair value estimates from the Simply Wall St Community range from US$19.14 to US$27.24 per share. Some expect further upside, but with usage-based pricing still unproven, your view on sustainable revenue growth may differ sharply from others.

Explore 3 other fair value estimates on PagerDuty - why the stock might be worth as much as 65% more than the current price!

Build Your Own PagerDuty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PagerDuty research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PagerDuty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PagerDuty's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.