Please use a PC Browser to access Register-Tadawul

Did Positive APG777 Data and Leadership Stock Sale Just Shift Apogee Therapeutics' (APGE) Investment Narrative?

Apogee Therapeutics APGE | 75.11 | -2.21% |

- In recent days, Apogee Therapeutics reported positive Phase 2a clinical trial data for its atopic dermatitis candidate, APG777, and provided an updated catalyst timeline for respiratory treatments.

- This period also saw Chief Medical Officer Carl Dambkowski sell US$103,198 of company stock through a pre-arranged Rule 10b5-1 trading plan, drawing attention to ongoing leadership activity amid clinical progress.

- We'll explore how the promising results for APG777 could reshape Apogee Therapeutics' broader investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Apogee Therapeutics' Investment Narrative?

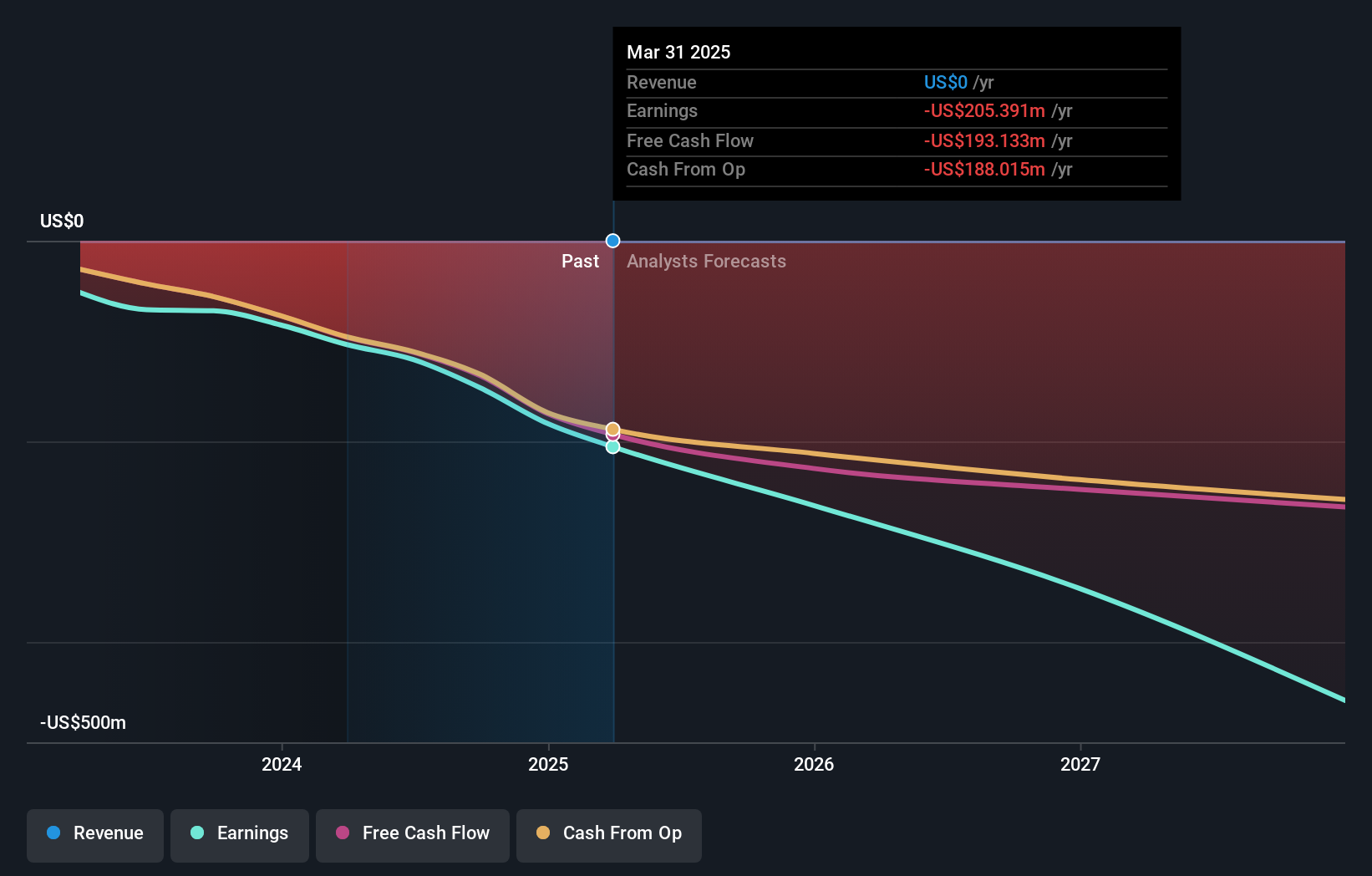

For anyone considering Apogee Therapeutics, it’s important to recognize that the investment case hinges chiefly on clinical milestones, particularly the success of APG777 in atopic dermatitis and the progress of its respiratory pipeline. The latest positive Phase 2a results for APG777 may shift sentiment around upcoming catalysts, providing new momentum as the company moves toward pivotal studies and future data releases. This development seems to have reinforced analyst optimism, as seen in recent price target adjustments, while the Chief Medical Officer’s planned sale doesn’t appear to materially impact the stock’s short-term trajectory. Still, the company remains pre-revenue and is reporting sizable, widening net losses, which keeps funding and dilution risks front and center for shareholders. With ongoing cash burn and a history of equity raises, investor focus will continue to be on execution and trial readouts over profitability in the near term.

But despite the fresh trial win, execution risk around future capital needs still looms. Insights from our recent valuation report point to the potential overvaluation of Apogee Therapeutics shares in the market.Exploring Other Perspectives

Explore 3 other fair value estimates on Apogee Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Apogee Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Apogee Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Apogee Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Apogee Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.