Please use a PC Browser to access Register-Tadawul

Did Renewed Analyst Support Around Grid and Energy Projects Just Shift MasTec's (MTZ) Investment Narrative?

MasTec, Inc. MTZ | 283.86 | +2.99% |

- MasTec recently attracted renewed attention after analysts, including Barclays’ Adam Seiden, reiterated positive views on the company’s outlook, citing its role in key infrastructure, energy transition, and telecom projects.

- This analyst support builds on earlier reports of strong earnings momentum and margin improvement, highlighting MasTec’s execution on complex, long-cycle infrastructure work.

- We’ll now look at how MasTec’s exposure to power grid modernization and energy transition projects shapes its evolving investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is MasTec's Investment Narrative?

For MasTec, the core belief for shareholders is that demand for power grid modernization, renewables buildout and telecom upgrades will keep feeding a growing backlog of complex, long-cycle projects the company knows how to execute. Recent quarterly results showed improving margins and earnings, and management has been confident enough to lift full-year guidance more than once. That backdrop is now being reinforced by fresh analyst support, including Barclays’ reiterated positive stance, which underlines continued confidence in MasTec’s role across key U.S. infrastructure and energy transition spending. In the short term, this endorsement is more sentiment support than game changer, but it may help sustain attention on upcoming execution and margin trends, especially after the stock’s pullback. The bigger near-term risks still look tied to high debt levels, cost inflation on large contracts, and any slowdown in utility or government project awards.

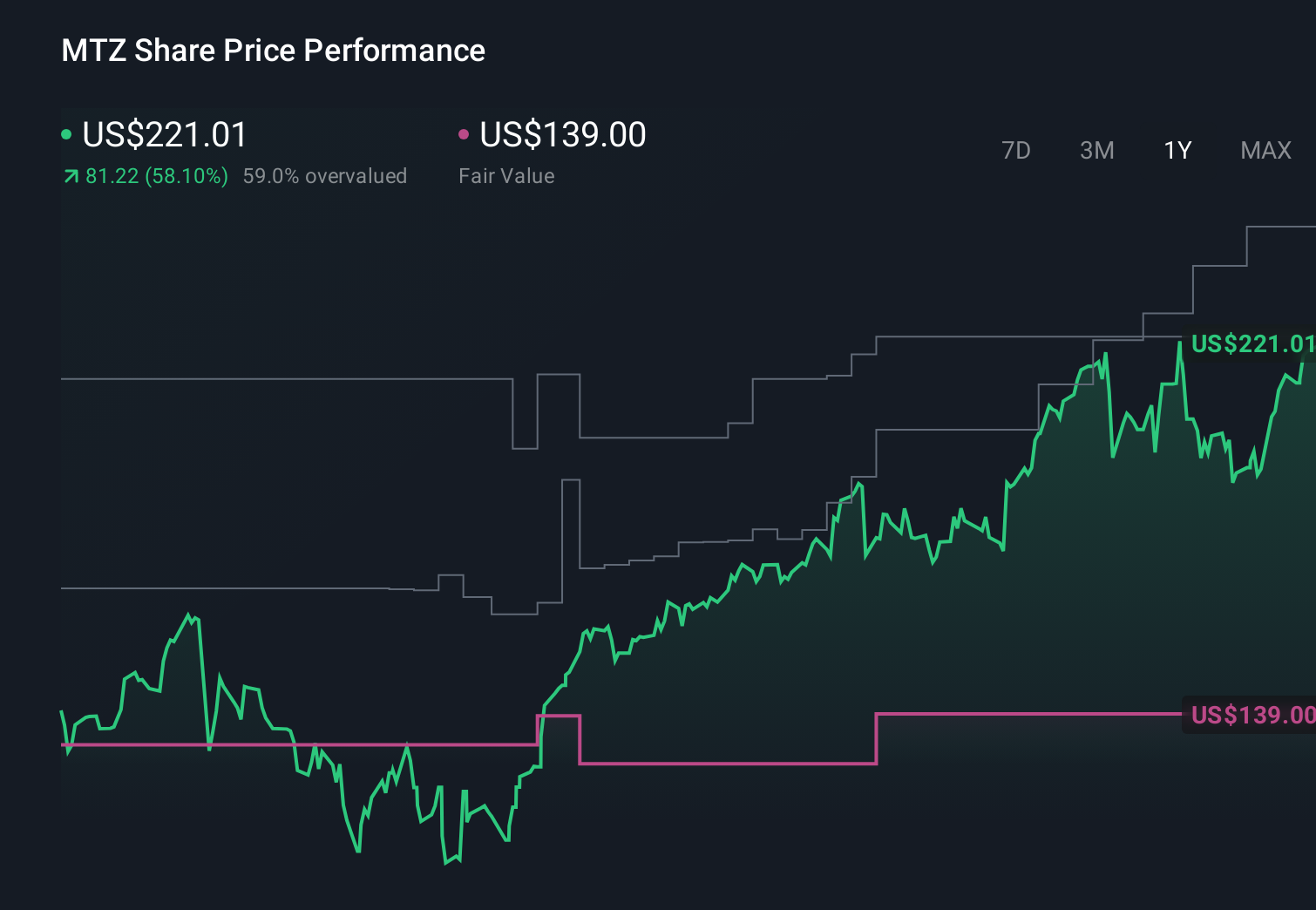

However, investors should be aware of how MasTec’s high debt could constrain flexibility if conditions tighten. MasTec's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 4 other fair value estimates on MasTec - why the stock might be worth 41% less than the current price!

Build Your Own MasTec Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MasTec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MasTec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MasTec's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.