Please use a PC Browser to access Register-Tadawul

Did RLJ Lodging Trust’s (RLJ) Share Buyback Amid Lower Earnings Reflect a Shift in Capital Allocation Strategy?

RLJ Lodging Trust RLJ | 7.97 | +2.84% |

- RLJ Lodging Trust recently reported second quarter 2025 earnings with sales and net income lower than the prior year, issued full-year earnings guidance, and completed two tranches of its share buyback program, acquiring 3,000,987 shares for US$3.87 million and 491,709 shares for US$3.47 million.

- These developments signal RLJ's continued focus on capital returns to shareholders despite year-over-year operational headwinds.

- We'll explore how RLJ Lodging Trust's completion of its share buyback and updated outlook shape its investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is RLJ Lodging Trust's Investment Narrative?

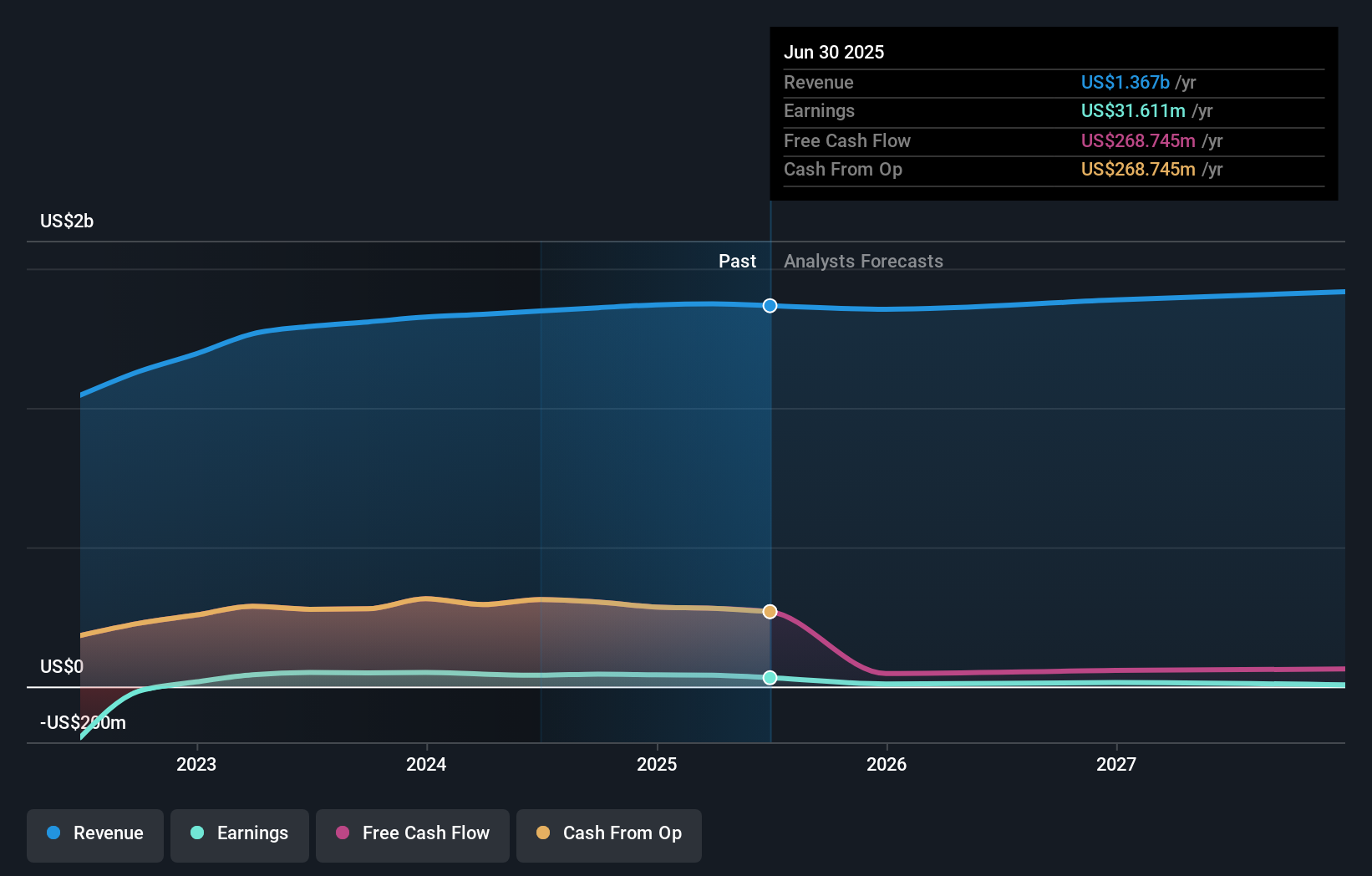

Being a shareholder in RLJ Lodging Trust means buying into a story of stable income returns even as the company tackles challenges like slowing revenue growth, pressured earnings, and underperformance versus both peers and the broader market. The latest buyback completions and reaffirmed earnings guidance highlight a continued commitment to rewarding shareholders, which may improve confidence in capital allocation strategy but do not fundamentally alter near-term operational risks. These include weak profit margins, declining earnings, expensive valuation compared to peers, and interest coverage concerns that could weigh on the business if conditions worsen. While the share price trades well below consensus price targets, this gap reflects existing risks, including ongoing industry headwinds and limited expected growth, rather than a sudden shift after these announcements. Investors should keep these factors in mind when weighing RLJ's position in their portfolios. However, concerns around shrinking profit margins could soon come into sharper focus.

RLJ Lodging Trust's shares have been on the rise but are still potentially undervalued by 50%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on RLJ Lodging Trust - why the stock might be worth just $8.97!

Build Your Own RLJ Lodging Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RLJ Lodging Trust research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free RLJ Lodging Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RLJ Lodging Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.