Please use a PC Browser to access Register-Tadawul

Did Simmons First National's (SFNC) $550M Equity Raise Redefine Its Growth Strategy?

Simmons First National Corporation Class A SFNC | 19.57 19.57 | +1.03% 0.00% Pre |

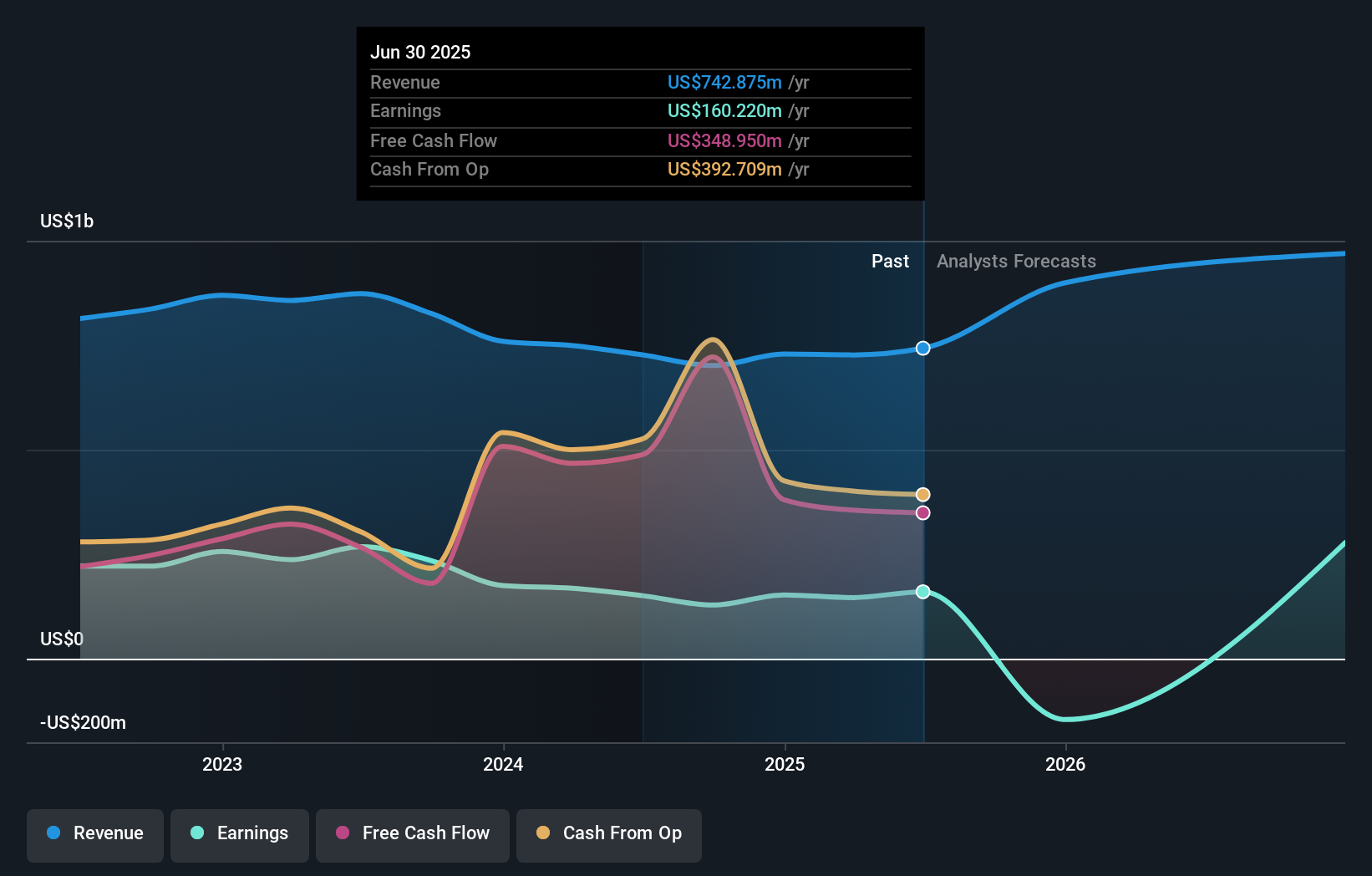

- Simmons First National Corporation recently completed follow-on equity offerings totaling more than US$550 million and reported improved quarterly results, including net interest income of US$171.82 million and net income of US$54.77 million for the quarter ended June 30, 2025.

- The timing of these offerings following stronger earnings highlights the company's move to build capital on the back of operational momentum and may influence future growth and capital allocation decisions.

- Next, we'll assess how Simmons First National's substantial capital raise could shape its investment outlook and growth opportunities.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Simmons First National Investment Narrative Recap

To hold Simmons First National stock, shareholders need confidence in the company’s ability to leverage digital innovation and market expansion across southern and midwestern regions, while navigating earnings pressures tied to loan growth and deposit costs. The recent completion of follow-on equity offerings strengthens Simmons’ capital base and could accelerate investment in technology and new lending, but does not materially reduce the near-term risk from volatility in loan balances or the potential for slower revenue growth if pricing competition remains fierce.

The most relevant recent announcement is Simmons’ improved second-quarter earnings, with net income rising to US$54.77 million and net interest income reaching US$171.82 million. This positive momentum supports the company’s underlying growth catalysts, including investments in higher-yielding variable-rate loans and continued focus on enhancing digital banking capabilities, but short-term unpredictability remains around seasonality and competitive loan pricing.

Yet, investors should also be aware that even as capital improves, the exposure to volatile loan growth still...

Simmons First National's outlook projects $1.2 billion in revenue and $340.9 million in earnings by 2028. This requires annual revenue growth of 16.4% and a $180.7 million increase in earnings from the current $160.2 million.

Uncover how Simmons First National's forecasts yield a $22.40 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Simmons First National range from US$22.40 to US$33.83, reflecting a wide spread across two investor viewpoints. Amid this diversity, remember that loan growth unpredictability continues to weigh on near-term revenue outlooks.

Explore 2 other fair value estimates on Simmons First National - why the stock might be worth as much as 71% more than the current price!

Build Your Own Simmons First National Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simmons First National research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Simmons First National research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simmons First National's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.