Please use a PC Browser to access Register-Tadawul

Did Skyworks Solutions’ (SWKS) Index Removal and Strong Quarter Just Shift Its Investment Narrative?

Skyworks Solutions, Inc. SWKS | 66.97 | -1.88% |

- In September 2025, Skyworks Solutions was removed from the FTSE All-World Index after reporting a strong quarter, with revenues exceeding analyst expectations and both EPS and adjusted operating income coming in above estimates.

- This positive performance marks a contrast to recent industry concerns, highlighting early signs of operational improvement despite previous investor caution about sales growth and declining stock performance.

- We'll examine how Skyworks Solutions’ robust quarterly results may start to reshape its investment narrative focused on future growth drivers.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Skyworks Solutions Investment Narrative Recap

To own shares in Skyworks Solutions, an investor should believe in the company’s ability to adapt and grow despite its high reliance on a single major customer and the mobile handset market. The recent removal from the FTSE All-World Index does not materially change the main short-term catalyst, improving operational efficiency and broadening revenue sources, nor does it reduce the risk of revenue concentration from its largest customer.

Of the recent announcements, the 1% dividend increase to $0.71 per share stands out, as it extends Skyworks’ track record of returning capital to shareholders and signals a commitment to ongoing profitability. However, this move should be weighed alongside the importance of the company sustaining earnings growth, particularly as it continues to face concentrated exposure in its mobile segment.

By contrast, investors should remain aware of the persistent risk related to Skyworks’ dependence on a single customer and what could happen if demand from that customer suddenly shifts…

Skyworks Solutions' outlook anticipates $4.1 billion in revenue and $520.7 million in earnings by 2028. This reflects a 1.0% annual revenue growth rate and a $124.5 million increase in earnings from the current $396.2 million.

Uncover how Skyworks Solutions' forecasts yield a $72.47 fair value, a 6% downside to its current price.

Exploring Other Perspectives

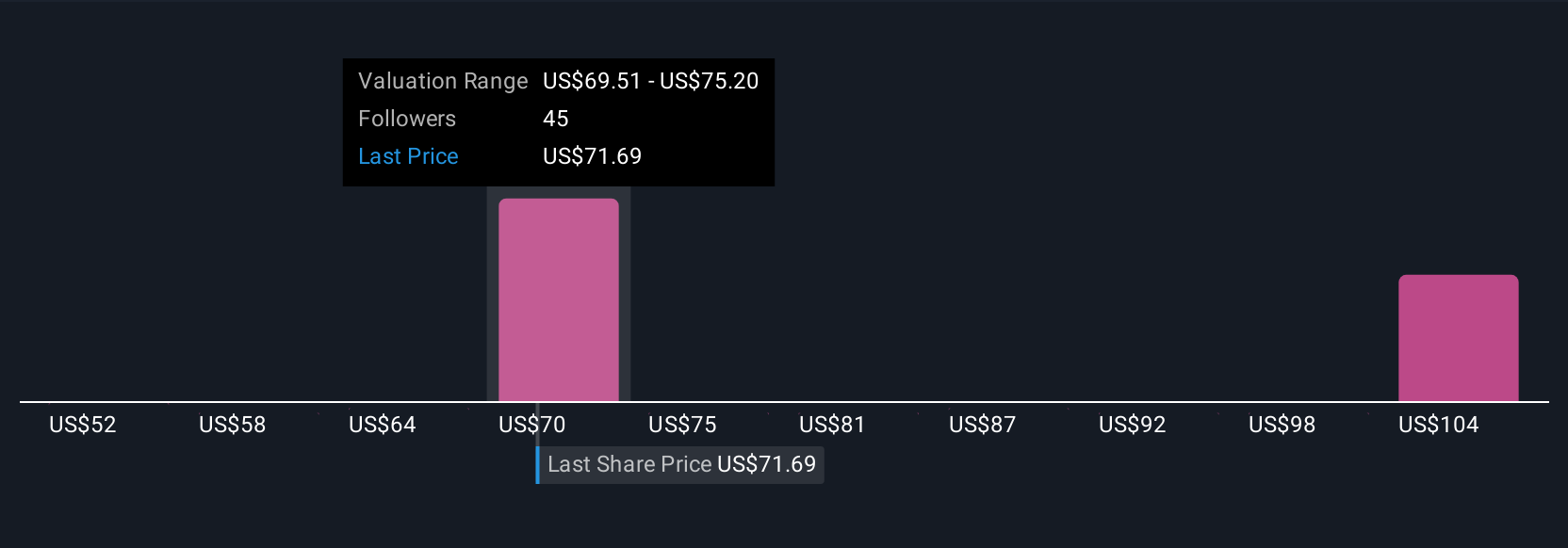

Simply Wall St Community members estimate Skyworks’ fair value from US$58 to US$110, across five viewpoints. This wide spread underscores how supply chain risks and revenue concentration may spark sharply different expectations for future performance.

Explore 5 other fair value estimates on Skyworks Solutions - why the stock might be worth as much as 43% more than the current price!

Build Your Own Skyworks Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Skyworks Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Skyworks Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Skyworks Solutions' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.