Please use a PC Browser to access Register-Tadawul

Did SPS Commerce's (SPSC) M&A Commitment Just Reshape Its Investment Narrative?

SPS Commerce, Inc. SPSC | 86.23 | +0.31% |

- On September 23, 2025, SPS Commerce's Executive VP & CFO reaffirmed the company’s ongoing focus on mergers and acquisitions to broaden product offerings, geographic reach, and customer acquisition using available capital when conditions are favorable.

- An interesting insight is the company's willingness to deploy capital for M&A as a core lever for accelerating customer acquisition and enhancing its comprehensive retail network platform.

- We'll explore how SPS Commerce's commitment to M&A as a pathway for growth could influence its investment narrative and future outlook.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

SPS Commerce Investment Narrative Recap

To be a shareholder in SPS Commerce, you need to believe in the sustained digitization of retail supply chains and the company’s ability to expand its network through targeted acquisitions. The recent reaffirmation of M&A as a growth lever is consistent with SPS Commerce’s strategy, but it does not materially change the biggest near-term catalyst: continued new customer additions and cross-sell, nor does it mitigate the ongoing risk of cautious technology spending from U.S.-based suppliers.

Among recent announcements, SPS Commerce’s strong Q2 2025 results, posting year-over-year revenue growth to US$187.4 million and positive net income trends, are highly relevant, as they reinforce investor confidence in the company's core business momentum even as management signals more deal-making. In context of the catalysts, solid earnings create a foundation for further expansion, while careful capital allocation remains crucial for sustaining both organic and acquired growth.

On the flip side, investors should be mindful that incremental network expansion through M&A doesn’t entirely protect the company if U.S.-based supplier caution persists and…

SPS Commerce's narrative projects $966.0 million in revenue and $139.1 million in earnings by 2028. This requires 11.1% yearly revenue growth and a $56.2 million increase in earnings from the current $82.9 million.

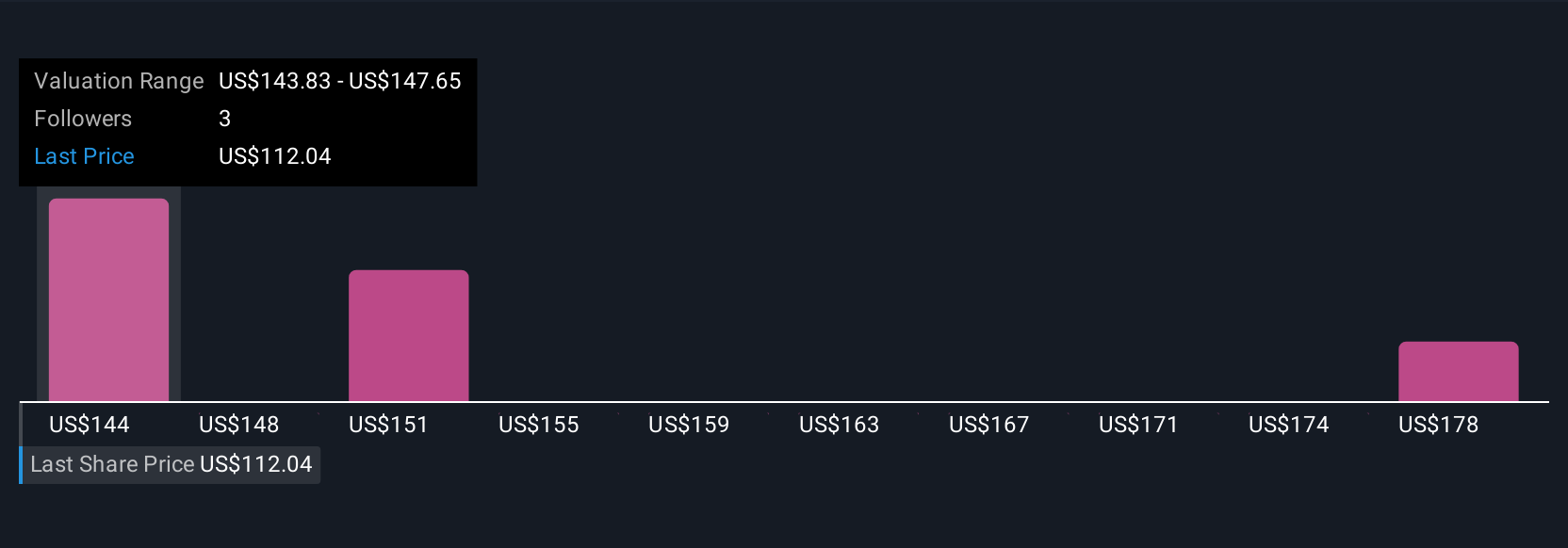

Uncover how SPS Commerce's forecasts yield a $147.82 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community place SPS Commerce between US$123.25 and US$182.03 per share. While these views vary widely, the company’s reliance on new customer adds for near-term growth is a key issue influencing debate around future performance.

Explore 3 other fair value estimates on SPS Commerce - why the stock might be worth just $123.25!

Build Your Own SPS Commerce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SPS Commerce research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free SPS Commerce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SPS Commerce's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.