Please use a PC Browser to access Register-Tadawul

Did Strong Q2 Results and Upbeat Guidance Just Shift Amgen's (AMGN) Earnings Outlook?

Amgen Inc. AMGN | 317.74 | +0.11% |

- Amgen recently reported second-quarter 2025 earnings, unveiling US$9.18 billion in revenue and US$1.43 billion in net income, alongside issuing improved full-year guidance and affirming its quarterly dividend at US$2.38 per share.

- Notably, Amgen continued its buyback program with no new shares repurchased last quarter, while having already completed the repurchase of over 425 million shares since 2011.

- We'll explore how Amgen's strong revenue and profit growth this quarter might influence its future earnings outlook and analyst expectations.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Amgen Investment Narrative Recap

For me, being an Amgen shareholder means believing in the company’s ability to capitalize on its robust drug pipeline and maintain growth despite competitive and pricing pressures. The recent Q2 earnings beat and updated full-year guidance reinforce an optimistic short-term outlook, but these results do not fundamentally alter the biggest immediate risk: intensifying biosimilar competition and drug pricing reforms. Investors should keep these factors front of mind as they assess the sustainability of recent momentum.

The affirmation of Amgen’s quarterly dividend at US$2.38 per share following a strong second-quarter performance is especially relevant. Consistent dividend payouts underscore management’s confidence in cash flow, which could be a stabilizing factor even as market share faces challenges from biosimilars and pricing headwinds.

Yet, in contrast, it’s important for investors to be mindful of how industry-wide reimbursement and pricing changes could accelerate revenue pressures in the coming quarters...

Amgen's outlook anticipates $37.0 billion in revenue and $8.7 billion in earnings by 2028. This implies a 2.7% annual revenue growth rate and an earnings increase of $2.8 billion from current earnings of $5.9 billion.

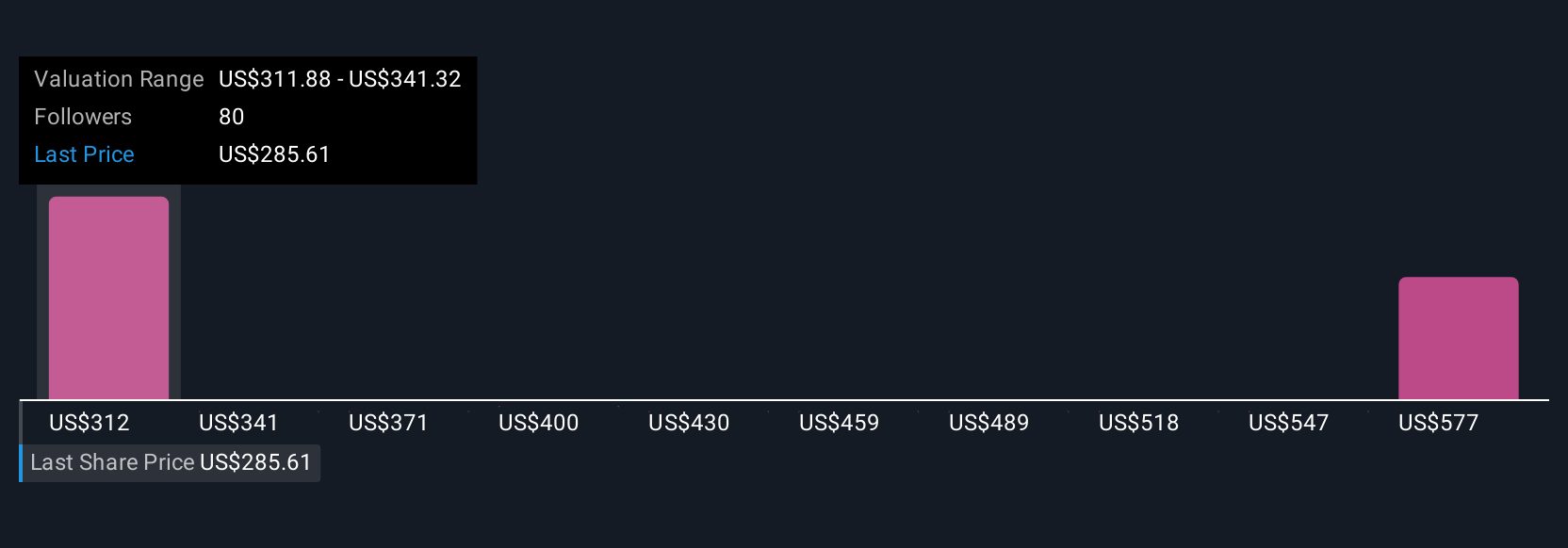

Uncover how Amgen's forecasts yield a $313.48 fair value, a 9% upside to its current price.

Exploring Other Perspectives

While the baseline consensus sees steady growth, the most cautious analysts projected revenues could slip to about US$34.6 billion by 2028. If you believe that persisting pricing and biosimilar pressures outweigh pipeline successes, their more pessimistic outlook highlights just how much investor expectations can differ, with earnings forecasts and share price targets that may shift in light of recent results.

Explore 5 other fair value estimates on Amgen - why the stock might be worth over 2x more than the current price!

Build Your Own Amgen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Amgen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amgen's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.