Please use a PC Browser to access Register-Tadawul

Digi International (DGII): Assessing Valuation as Z45 Controller Gains T-Mobile Certification

Digi International Inc. DGII | 45.51 | -3.60% |

Digi International (DGII) has just secured certification for its Digi Z45 Industrial Controller on T-Mobile’s network. This expands its reach for companies seeking instant, cellular-based monitoring and control solutions. This move boosts its appeal in automation sectors.

After a fairly steady period, Digi International’s recent controller certification appears to have sparked renewed interest as investors are weighing the company’s expanding industrial automation footprint. The stock’s latest share price of $36.89 puts its 1-year total shareholder return at a solid 27%, underlining momentum as its product lineup gains visibility.

If Digi’s leap in industrial connectivity piques your curiosity, take the next step and discover See the full list for free.

With Digi International’s share price rallying and robust growth in both revenue and net income, the key question for investors now is whether the stock is still undervalued or if the market is already reflecting all its future gains.

Most Popular Narrative: 8.9% Undervalued

Digi International’s last close price is $36.89, while the most followed narrative estimates fair value at $40.50. This notable gap is built on expectations of recurring revenue and edge connectivity transforming the company’s profit profile.

“The accelerating transition of customers to Digi's subscription-based and recurring revenue solutions, including higher attach rates on IoT products such as cellular routers and infrastructure management devices, points to ongoing double-digit annual recurring revenue (ARR) growth and improved profit margins. This is expected to boost both revenue stability and long-term earnings.”

Curious which future assumptions push Digi’s valuation well above its current price? The narrative banks on outsized profit expansion and a future earnings multiple that few anticipate. See which forecasts power this calculation and dive in to discover the big swings behind the headline number.

Result: Fair Value of $40.50 (UNDERVALUED)

However, flat revenue guidance for 2025 and regional demand volatility remain real risks that could challenge Digi’s upbeat forecast if recurring growth slows.

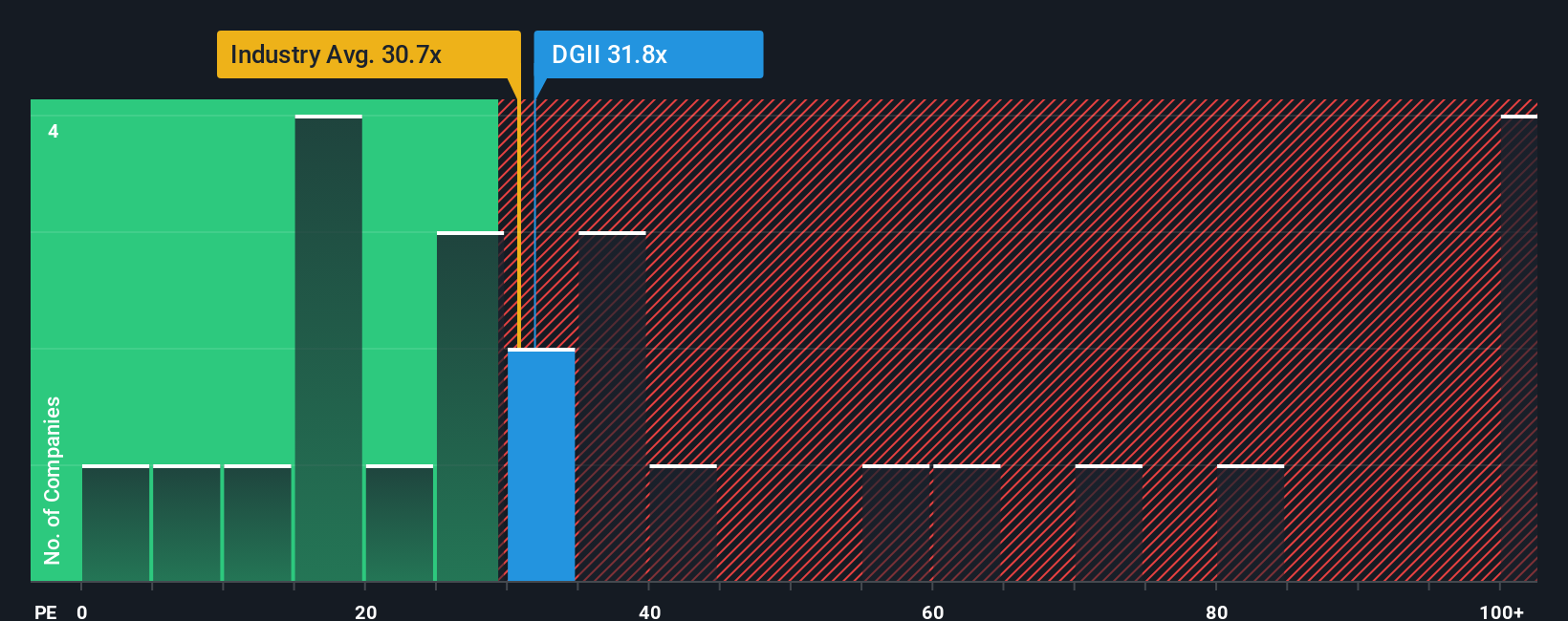

Another View: Comparing Market Multiples

Taking a closer look at Digi International through the lens of its price-to-earnings ratio presents a more cautious picture. The stock trades at 32.1 times earnings, significantly higher than both its peer average of 23.8 and the US Communications sector average of 29.9. Even when compared to its fair ratio of 27.5, it stands out as expensive. This premium suggests investors expect strong future growth, but it also means there is less margin for error if performance slips. Could the market be overestimating Digi’s upside?

Build Your Own Digi International Narrative

If you’re seeking a different perspective or want to test your own assumptions, you can easily assemble your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Digi International.

Looking for More Investment Ideas?

Step beyond Digi International and seize your next opportunity by putting Simply Wall Street’s unique stock screeners to work for you. You really do not want to miss these fast-moving trends and financial standouts.

- Tap into the momentum of AI innovation with these 24 AI penny stocks, which are pushing the boundaries of automation, smart data, and digital transformation.

- Unlock steady streams of income by reviewing these 19 dividend stocks with yields > 3%, which consistently deliver yields above the market average for stronger portfolio stability.

- Seize overlooked growth potential among these 900 undervalued stocks based on cash flows, where pricing may not fully reflect upcoming gains just waiting to be realized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.