Please use a PC Browser to access Register-Tadawul

Digi International's Security-Focused IoT Launches Could Be a Game Changer for DGII

Digi International Inc. DGII | 45.60 | +0.21% |

- Earlier this month, Digi International announced several new IoT connectivity solutions, including the Digi XBee 3 BLU with Bluetooth LE 5.4 capabilities for industrial, healthcare, and smart building settings, a compliant Digi Connect EZ 4 serial server for medical environments, and the Digi XBee for Wi-SUN designed for secure mesh networks in smart cities and utilities.

- These rapid-fire product launches highlight Digi’s focus on advanced security, edge processing, and regulatory-compliant solutions across diverse high-value markets.

- We'll examine how Digi’s emphasis on security and edge intelligence in its latest products could shape its investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Digi International Investment Narrative Recap

To own Digi International as a shareholder, you need to believe that its focus on secure IoT, edge intelligence, and recurring software-driven revenues will support stable, long-term growth despite slow topline expansion. The recent roll-out of new connectivity solutions reinforces Digi’s ability to deliver in regulated, mission-critical markets, but this does not materially shift the most important short-term catalyst: accelerating annual recurring revenue growth. The biggest risk remains possible stagnation if ARR growth slows or hardware sales decline.

Among Digi’s latest announcements, the launch of the XBee 3 BLU module stands out for its alignment with trends toward secure, easy-to-integrate connectivity for industrial and healthcare settings. This solution, featuring edge processing and mobile management, directly supports Digi’s recurring revenue strategy, a key driver highlighted in management guidance, by enabling stickier, subscription-based services for enterprise customers.

By contrast, investors should be aware that ongoing geographic demand softness, especially in APAC, may not be...

Digi International's outlook anticipates $497.0 million in revenue and $72.6 million in earnings by 2028. This is based on analysts’ expectations of 5.7% yearly revenue growth and a $29.9 million increase in earnings from the current $42.7 million.

Uncover how Digi International's forecasts yield a $40.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

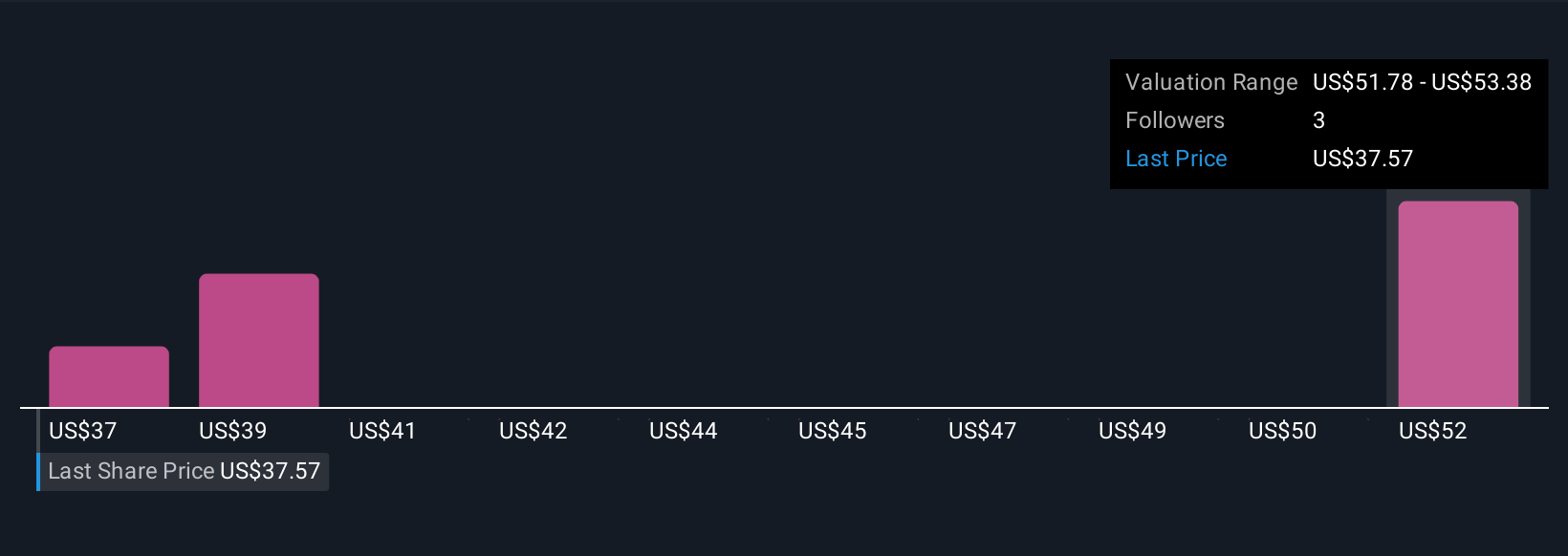

Three Simply Wall St Community fair value estimates for Digi International span from US$37.38 to US$53.28 per share. With recurring revenue growth as a major catalyst, these varied views reflect how differently participants weigh future performance and risk factors.

Explore 3 other fair value estimates on Digi International - why the stock might be worth just $37.38!

Build Your Own Digi International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Digi International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Digi International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Digi International's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.