Please use a PC Browser to access Register-Tadawul

DigitalOcean (DOCN): Evaluating Valuation After Launch of SSO Support for Enterprise Access Management

DigitalOcean Holdings, Inc. DOCN | 47.66 | -3.07% |

DigitalOcean Holdings (DOCN) is making headlines this week after announcing support for Single Sign-On, or SSO, aimed at organizations that want easier, more secure ways to manage their digital infrastructure. If you run a fast-growing team or want to reduce the hassle of access management, this new feature could be a real difference-maker. The move signals DigitalOcean’s intent to provide more robust tools to digital native businesses, especially those concerned about secure, centralized user authentication.

Investors have been tuning in to DigitalOcean’s journey, watching share price momentum build over recent months. The stock has climbed 12% in the past month and 33% over the past 3 months, signaling renewed confidence following a somewhat challenging year that saw shares decline 11%. Combined with annual growth in both revenue and net income, this latest product launch could be shaping new expectations among both growth and value investors.

With momentum picking up, the big question now is whether DigitalOcean is trading below its true value or if investors are already counting on even faster growth ahead.

Most Popular Narrative: 28.6% Undervalued

The prevailing narrative, according to Nenad, sees DigitalOcean as notably undervalued relative to a much higher fair value estimate. This view is based on the company's aggressive moves in innovation and business expansion.

The acquisition of Paperspace enables DigitalOcean to offer accessible AI/ML tools, opening a new revenue stream and attracting startups and developers working in AI. DigitalOcean can expand its market share by capturing these first-time cloud users.

Curious how this bold valuation is justified? The secret lies in ambitious revenue projections, tech-focused expansion, and a future profit formula you need to see to believe. There is a mathematical basis for this perspective as a few key forecast assumptions drive Nenad’s thesis regarding DigitalOcean’s potential for significant upside. Will the company really deliver on this growth script? The numbers might surprise you.

Result: Fair Value of $50.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, strong competition from larger cloud providers and the challenge of integrating new AI offerings could affect DigitalOcean’s growth trajectory.

Find out about the key risks to this DigitalOcean Holdings narrative.Another View: Discounted Cash Flow Model

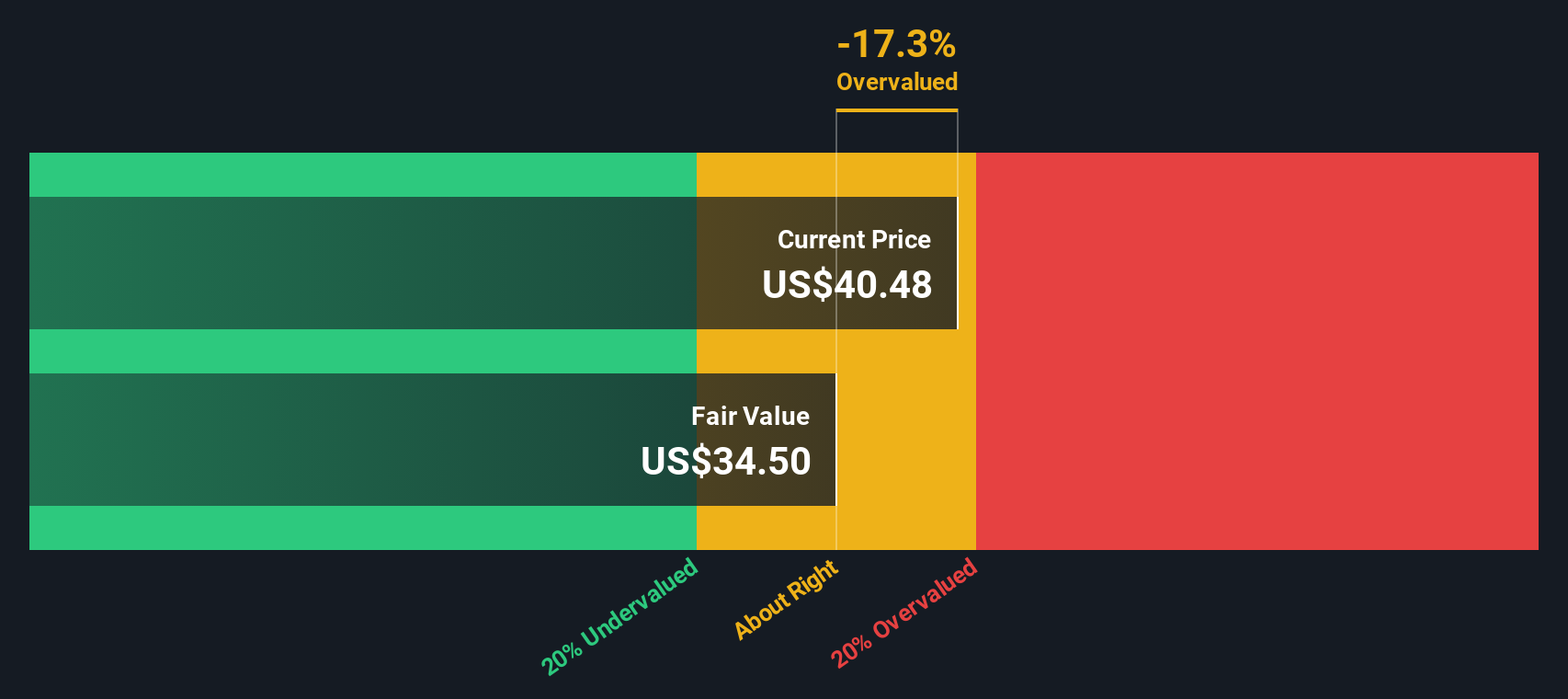

Taking a different approach, our SWS DCF model suggests DigitalOcean’s current share price is above its estimated fair value. This perspective relies less on growth assumptions and instead focuses on future cash flows. Could this mean expectations are running too high?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DigitalOcean Holdings Narrative

If you see things differently or want to dig into the numbers firsthand, you can shape your own perspective on DigitalOcean’s story in just a few minutes. Do it your way.

A great starting point for your DigitalOcean Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio with fresh stock opportunities using the Simply Wall Street Screener. Miss out and you may overlook trends driving tomorrow’s returns. Choose where your curiosity takes you:

- Spot high-yield opportunities and maximize your passive income potential by checking out dividend stocks with yields > 3%, which is built for yield-focused investors.

- Keep ahead of the digital revolution by researching AI penny stocks, featuring AI innovators transforming how businesses compete and grow.

- Capitalize on untapped value with undervalued stocks based on cash flows, revealing promising companies trading below their fair worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.