Please use a PC Browser to access Register-Tadawul

DigitalOcean Holdings (DOCN): Exploring Valuation Following Recent Share Price Momentum

DigitalOcean Holdings, Inc. DOCN | 47.66 | -3.07% |

DigitalOcean Holdings’ latest share price moves point to a cautious but positive trend, with its recent 90-day share price return suggesting some renewed momentum. Over the past year, however, its total shareholder return has been slightly in the red, highlighting some of the volatility and shifting risk perceptions that come with growth-focused tech stocks.

If you’re curious to see what other innovative businesses are gaining traction, this is a great moment to discover fast growing stocks with high insider ownership.

All of this raises an important question for investors. Is DigitalOcean's recent upward momentum a sign that shares are undervalued, or has the market already priced in the company's growth prospects?

Most Popular Narrative: 6.9% Undervalued

DigitalOcean Holdings’ current price of $38.71 sits below the $41.60 fair value suggested by the leading narrative, signaling room for upside if the assumptions hold. Recent market enthusiasm appears to echo at least some of this more optimistic outlook, making the drivers behind the valuation projection worth a closer look.

The proliferation of easy-to-consume AI platform services (Gradient AI Platform & Agents) lowers barriers for SaaS providers and software developers to integrate AI, likely to drive higher customer acquisition, cross-sell, and upsell activity across the product ecosystem. This is anticipated to positively affect ARPU and long-term revenue stability.

Want to see what’s powering this bullish narrative? The valuation hangs on some bold revenue expansion and margin bets, plus a future profit ratio that is a major surprise for this sector. Which specific financial leaps is the consensus banking on? Dive in to uncover the numbers the market is watching.

Result: Fair Value of $41.60 (UNDERVALUED)

However, heightened competition from major cloud providers and rapid changes in AI and infrastructure tech could slow DigitalOcean’s growth and test the bullish outlook.

Another View: The SWS DCF Model

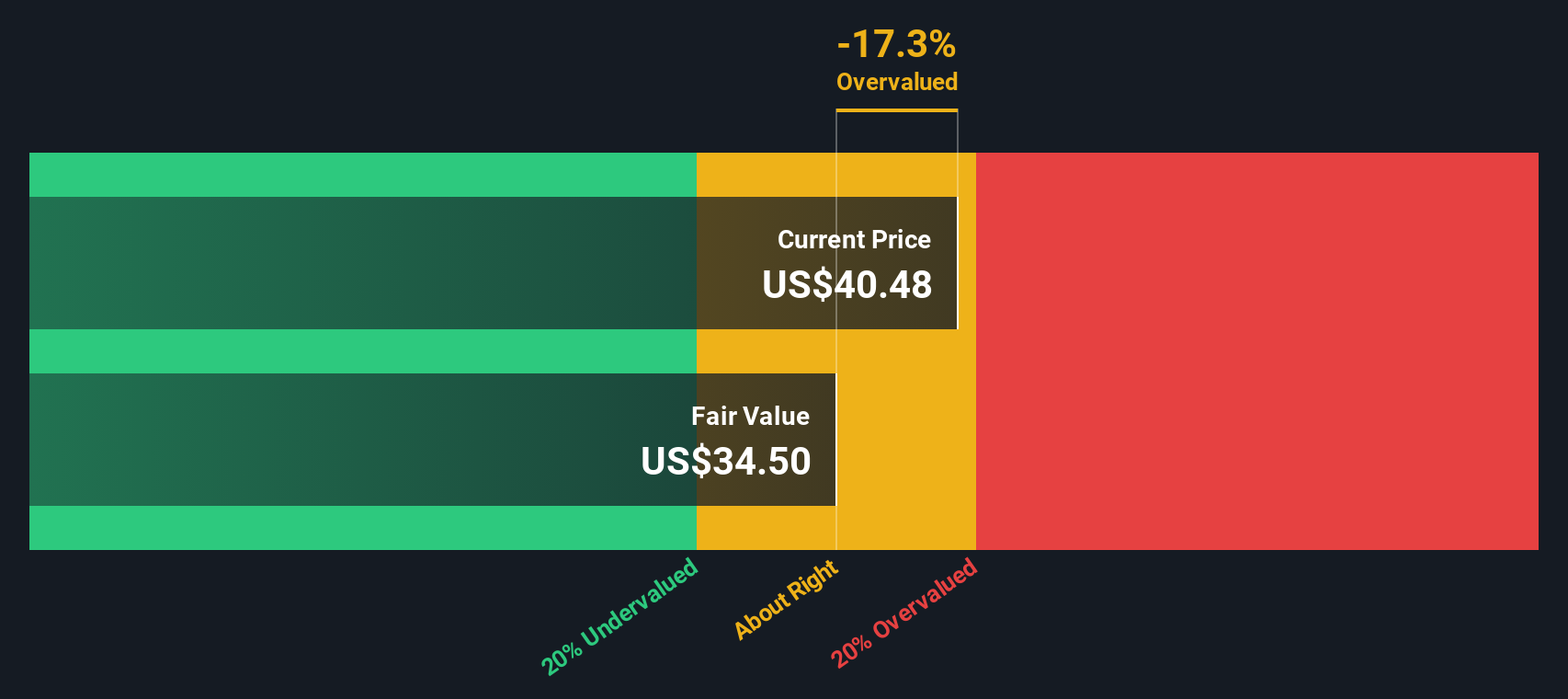

While the consensus price target points to upside, our SWS DCF model suggests a more conservative outlook. According to this method, DigitalOcean's recent share price sits above its estimated fair value. This contrast highlights the classic debate: are the market’s growth assumptions too optimistic, or is the crowd missing something?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DigitalOcean Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DigitalOcean Holdings Narrative

If you see things differently or want to dig into the numbers on your own terms, you can shape your own analysis in just minutes. Do it your way.

A great starting point for your DigitalOcean Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let this be where your search ends. Use the Simply Wall Street Screener to find promising stocks before they catch the spotlight. Your next winning idea could be just a click away.

- Spot future market leaders by starting your research with these 24 AI penny stocks. Seize the momentum driving AI innovation.

- Capture potential high-yield income by reviewing these 19 dividend stocks with yields > 3%, which showcases companies with dependable dividend payouts and strong fundamentals.

- Ride trends in digital finance by browsing these 78 cryptocurrency and blockchain stocks to uncover stocks that could benefit from blockchain and cryptocurrency growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.