Please use a PC Browser to access Register-Tadawul

(DIS) - Analyzing Walt Disney's Short Interest

Walt Disney Company DIS | 111.60 110.85 | +0.13% 0.00% Pre |

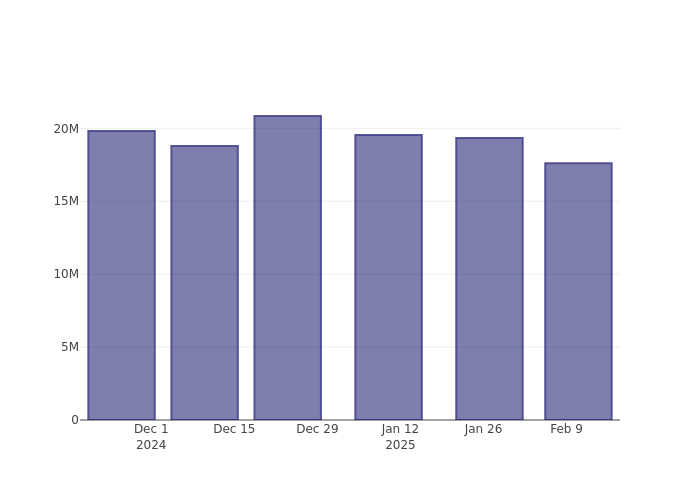

Walt Disney's (NYSE:DIS) short percent of float has fallen 9.35% since its last report. The company recently reported that it has 17.61 million shares sold short, which is 0.97% of all regular shares that are available for trading. Based on its trading volume, it would take traders 2.23 days to cover their short positions on average.

Why Short Interest Matters

Short interest is the number of shares that have been sold short but have not yet been covered or closed out. Short selling is when a trader sells shares of a company they do not own, with the hope that the price will fall. Traders make money from short selling if the price of the stock falls and they lose if it rises.

Short interest is important to track because it can act as an indicator of market sentiment towards a particular stock. An increase in short interest can signal that investors have become more bearish, while a decrease in short interest can signal they have become more bullish.

See Also: List of the most shorted stocks

Walt Disney Short Interest Graph (3 Months)

As you can see from the chart above the percentage of shares that are sold short for Walt Disney has declined since its last report. This does not mean that the stock is going to rise in the near-term but traders should be aware that less shares are being shorted.

Comparing Walt Disney's Short Interest Against Its Peers

Peer comparison is a popular technique amongst analysts and investors for gauging how well a company is performing. A company's peer is another company that has similar characteristics to it, such as industry, size, age, and financial structure. You can find a company's peer group by reading its 10-K, proxy filing, or by doing your own similarity analysis.

According to Benzinga Pro, Walt Disney's peer group average for short interest as a percentage of float is 7.94%, which means the company has less short interest than most of its peers.

Did you know that increasing short interest can actually be bullish for a stock? This post by Benzinga Money explains how you can profit from it.

This article was generated by Benzinga's automated content engine and was reviewed by an editor.