Please use a PC Browser to access Register-Tadawul

Discover Fractyl Health And 2 More Promising Penny Stocks

4D Molecular Therapeutics, Inc. FDMT | 10.84 | -0.73% |

Over the last 7 days, the United States market has dropped 4.4%, yet earnings are forecast to grow by 13% annually. For those looking to invest in smaller or newer companies, penny stocks can still offer surprising value despite their somewhat outdated name. With solid financial foundations, these stocks have the potential to outperform while offering greater stability, making them intriguing options for investors seeking under-the-radar opportunities with long-term potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.22 | $345.99M | ✅ 4 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $1.89 | $1.16B | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (NYSE:CINT) | $4.99 | $671.52M | ✅ 5 ⚠️ 0 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.89 | $16.25M | ✅ 4 ⚠️ 4 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.74 | $47.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.54 | $74.62M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.7902 | $5.88M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $218.76M | ✅ 3 ⚠️ 2 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.79 | $84.44M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.485 | $14.05M | ✅ 3 ⚠️ 5 View Analysis > |

Let's dive into some prime choices out of the screener.

Fractyl Health (NasdaqGM:GUTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fractyl Health, Inc. is a metabolic therapeutics company focused on developing treatments for type 2 diabetes and obesity, with a market cap of approximately $59.68 million.

Operations: The company's revenue is derived solely from its medical products segment, totaling $0.093 million.

Market Cap: $59.68M

Fractyl Health, Inc., with a market cap of approximately US$59.68 million, is pre-revenue and focused on metabolic therapeutics for type 2 diabetes and obesity. The company recently announced promising early data from its REMAIN-1 study, suggesting that its Revita treatment may help maintain weight loss after discontinuing GLP-1 drugs—a significant opportunity as global GLP-1 use grows. Despite high volatility and ongoing unprofitability, Fractyl's short-term assets exceed liabilities, providing financial stability. Recent capital raises through a $100 million equity offering and $300 million shelf registration aim to support continued research efforts in innovative therapies.

4D Molecular Therapeutics (NasdaqGS:FDMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 4D Molecular Therapeutics, Inc. is a late-stage biotechnology company focused on developing adeno-associated virus vectors using its proprietary synthetic vector discovery platform, Therapeutic Vector Evolution, operating in the Netherlands and the United States with a market cap of $141.69 million.

Operations: The company generates its revenue primarily from its biotechnology segment, amounting to $0.037 million.

Market Cap: $141.69M

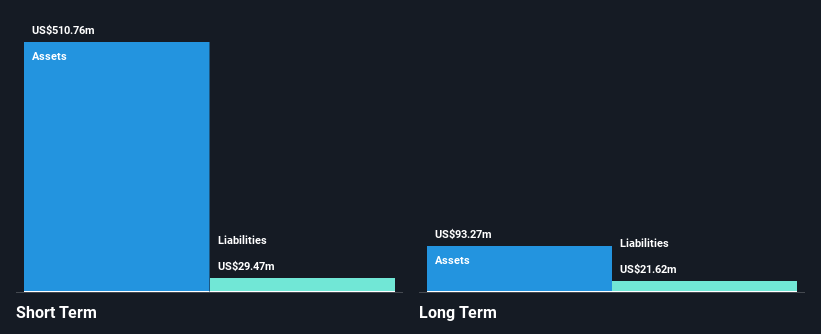

4D Molecular Therapeutics, Inc., with a market cap of US$141.69 million, is pre-revenue and focused on advancing its proprietary synthetic vector discovery platform. Despite an increase in losses over the past five years, the company remains debt-free and has sufficient short-term assets to cover liabilities. The recent enrollment of patients in its Phase 3 4FRONT-1 clinical trial for wet AMD highlights its commitment to innovative therapies aimed at reducing treatment burdens for patients. While earnings are forecasted to decline, the company maintains a cash runway exceeding three years and continues presenting at key healthcare conferences to attract investor interest.

Taysha Gene Therapies (NasdaqGS:TSHA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taysha Gene Therapies, Inc. is a clinical-stage biotechnology company dedicated to developing adeno-associated virus-based gene therapies for central nervous system monogenic diseases, with a market cap of approximately $254.20 million.

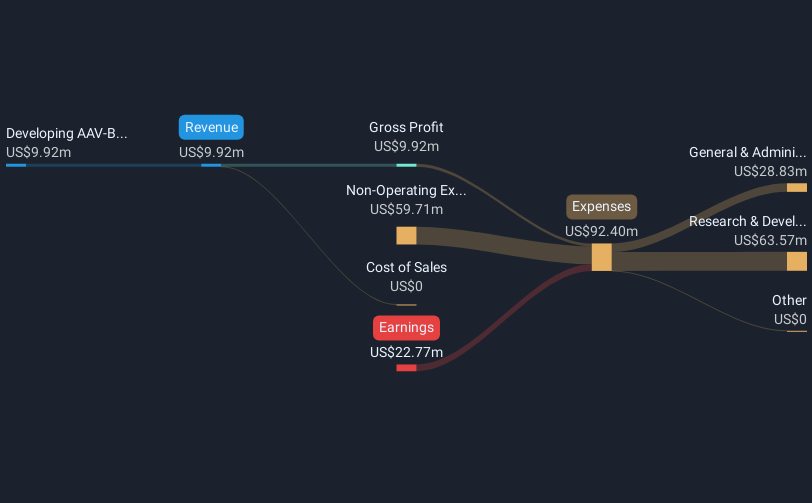

Operations: Taysha Gene Therapies generates revenue of $8.33 million from developing AAV-based gene therapies targeting rare monogenic diseases.

Market Cap: $254.2M

Taysha Gene Therapies, Inc., with a market cap of US$254.20 million, focuses on adeno-associated virus-based gene therapies for central nervous system diseases. Despite generating US$8.33 million in revenue for 2024, the company remains unprofitable and has seen increased losses over five years. Recent proposals to increase authorized shares from 400 million to 700 million may indicate plans for future capital raises. While its debt-to-equity ratio has risen significantly, Taysha maintains more cash than total debt and possesses sufficient short-term assets to cover liabilities. The board is considered experienced with an average tenure of 4.2 years.

Taking Advantage

- Click this link to deep-dive into the 789 companies within our US Penny Stocks screener.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.