Please use a PC Browser to access Register-Tadawul

Discovering Opportunities: 3 Penny Stocks With Market Caps Over $500M

VTEX VTEX | 3.83 | -1.29% |

As the U.S. market navigates a landscape of tariff exemptions and fluctuating tech stock performance, investors are keenly observing opportunities that may arise from these developments. For those interested in smaller or newer companies, penny stocks — despite their somewhat outdated moniker — remain a relevant investment area. When supported by solid financial health, these stocks can offer a blend of value and growth potential that might not be as prominent in larger firms.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.48 | $364.86M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.02 | $1.2B | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (NYSE:CINT) | $4.87 | $651.45M | ✅ 5 ⚠️ 0 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.796 | $14.15M | ✅ 4 ⚠️ 4 View Analysis > |

| Global Self Storage (NasdaqCM:SELF) | $4.93 | $55.56M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.83 | $48.44M | ✅ 4 ⚠️ 3 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.33 | $70.67M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.7755 | $5.63M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $226.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.99 | $88.43M | ✅ 3 ⚠️ 2 View Analysis > |

We'll examine a selection from our screener results.

Organogenesis Holdings (NasdaqCM:ORGO)

Simply Wall St Financial Health Rating: ★★★★★★

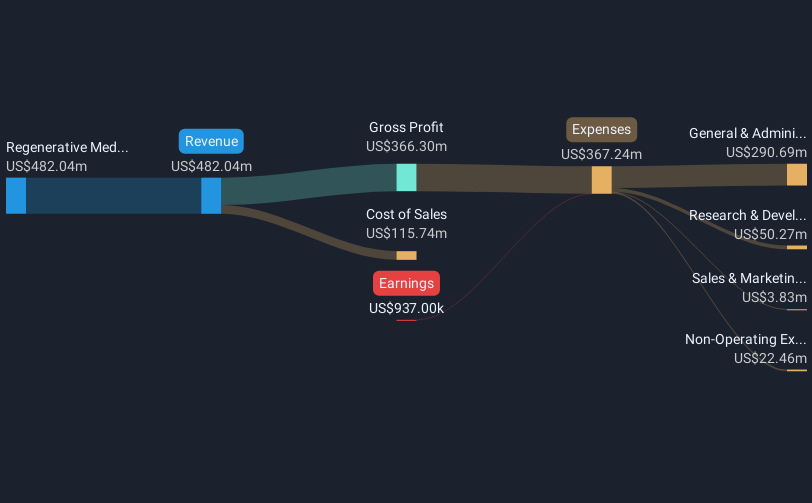

Overview: Organogenesis Holdings Inc. is a regenerative medicine company that develops, manufactures, and commercializes products for advanced wound care and surgical and sports medicine markets in the United States, with a market cap of $540.29 million.

Operations: The company generates revenue primarily from its Regenerative Medicine segment, amounting to $482.04 million.

Market Cap: $540.29M

Organogenesis Holdings Inc., with a market cap of US$540.29 million, recently joined the S&P Biotechnology Select Industry Index, highlighting its presence in the sector. Despite being unprofitable and experiencing high share price volatility, it reported a net income of US$7.67 million for Q4 2024, a turnaround from the previous year's loss. The company is debt-free and has strong short-term assets exceeding liabilities by over US$200 million, providing financial stability. However, significant insider selling raises concerns about internal confidence despite forecasts of substantial earnings growth and trading at good value compared to peers.

Alight (NYSE:ALIT)

Simply Wall St Financial Health Rating: ★★★★★☆

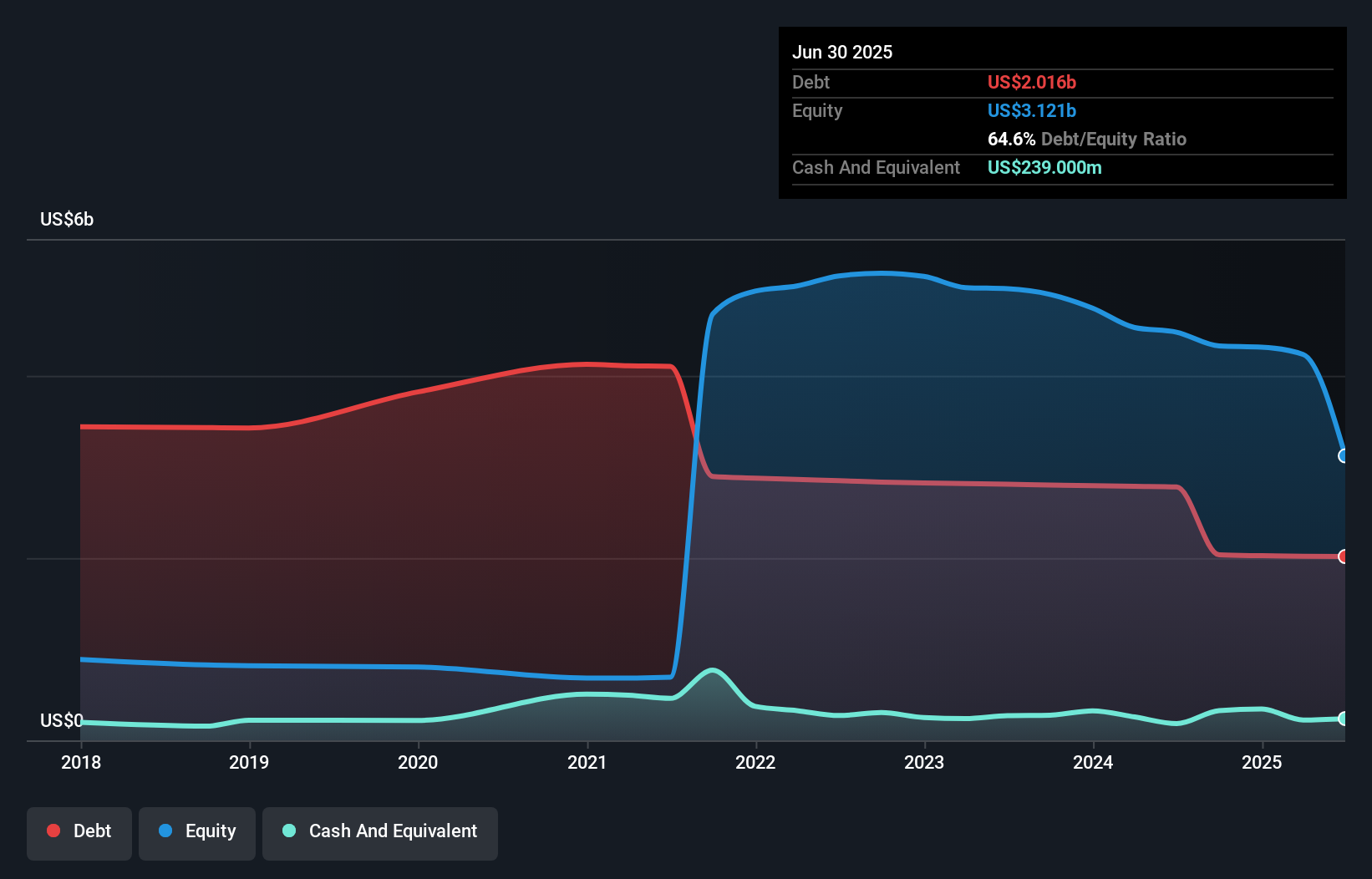

Overview: Alight, Inc. is a technology-enabled services company operating globally with a market cap of approximately $2.64 billion.

Operations: The company's revenue is primarily derived from its Employer Solutions segment, which generated $2.33 billion.

Market Cap: $2.64B

Alight, Inc., with a market cap of approximately US$2.64 billion, remains unprofitable but has shown progress by reducing its net loss to US$157 million in 2024 from US$345 million the previous year. The company has improved its debt-to-equity ratio significantly over five years and maintains a positive cash runway for over three years due to growing free cash flow. Alight's short-term assets exceed short-term liabilities; however, long-term liabilities remain uncovered. Recent board changes and enhancements in their Alight Worklife® platform aim to strengthen their service offerings and operational efficiency amidst ongoing volatility and undervaluation concerns.

VTEX (NYSE:VTEX)

Simply Wall St Financial Health Rating: ★★★★★★

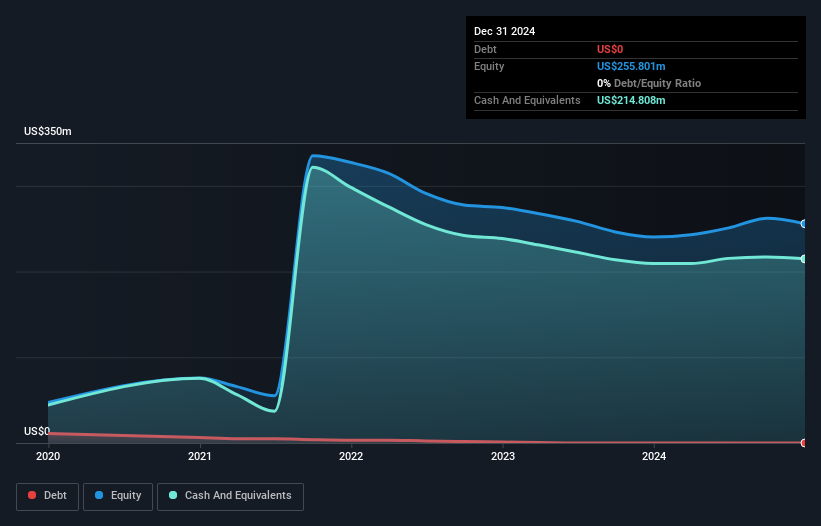

Overview: VTEX, along with its subsidiaries, offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of approximately $897.84 million.

Operations: The company's revenue is primarily generated from its Internet Software & Services segment, totaling $226.71 million.

Market Cap: $897.84M

VTEX, with a market cap of approximately US$897.84 million, has transitioned to profitability over the past year, reporting a net income of US$12 million for 2024 compared to a net loss the previous year. The company is debt-free and maintains strong liquidity, with short-term assets of US$284.6 million exceeding both short-term and long-term liabilities. Despite experiencing large one-off losses impacting recent financial results, VTEX's earnings are forecasted to grow significantly at 41.22% annually. Recent developments include share buybacks totaling US$20.23 million and revenue guidance projecting growth between 14% and 17% for 2025.

Taking Advantage

- Get an in-depth perspective on all 795 US Penny Stocks by using our screener here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 21 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.