Please use a PC Browser to access Register-Tadawul

Disney Collaboration Could Be a Game Changer for Fresh Del Monte Produce (FDP)

Fresh Del Monte Produce Inc. FDP | 38.29 | +0.74% |

- Disney has announced a global collaboration with Fresh Del Monte Produce Inc. to celebrate the release of "Zootopia 2," featuring over 500 million co-branded pineapple and banana tags, interactive digital promotions, and a sweepstakes offering families the chance to win a Dubai vacation.

- This partnership integrates entertainment with retail, amplifying Fresh Del Monte's brand presence and creating new avenues for consumer engagement in the produce aisle.

- We'll explore how this expansive Disney-led campaign could influence Fresh Del Monte's growth outlook and brand value moving forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Fresh Del Monte Produce Investment Narrative Recap

Fresh Del Monte Produce appeals to shareholders who see lasting value in global demand for premium fruit and the ongoing shift toward healthier, convenient options. While the high-profile Disney "Zootopia 2" campaign could elevate Fresh Del Monte's visibility and support near-term brand engagement, this does not materially alter the core catalyst: ongoing supply and pricing dynamics in key fruit categories, particularly pineapples. The biggest risk remains persistent cost inflation, which could squeeze margins if pricing power fades in coming quarters.

Recently, Fresh Del Monte expanded into the UAE with Pinkglow® pineapples, an exclusive launch that demonstrates its product innovation and international reach. This international rollout aligns closely with the short-term catalyst tied to premium fruit varieties and their contribution to margin improvement, showing the company's willingness to extend successful SKUs to new markets.

On the other hand, investors should be alert to mounting operational risks if...

Fresh Del Monte Produce is forecast to reach $4.6 billion in revenue and $127.6 million in earnings by 2028. This projection is based on 2.5% annual revenue growth and a $19.6 million decrease in earnings from current earnings of $147.2 million.

Uncover how Fresh Del Monte Produce's forecasts yield a $46.00 fair value, a 32% upside to its current price.

Exploring Other Perspectives

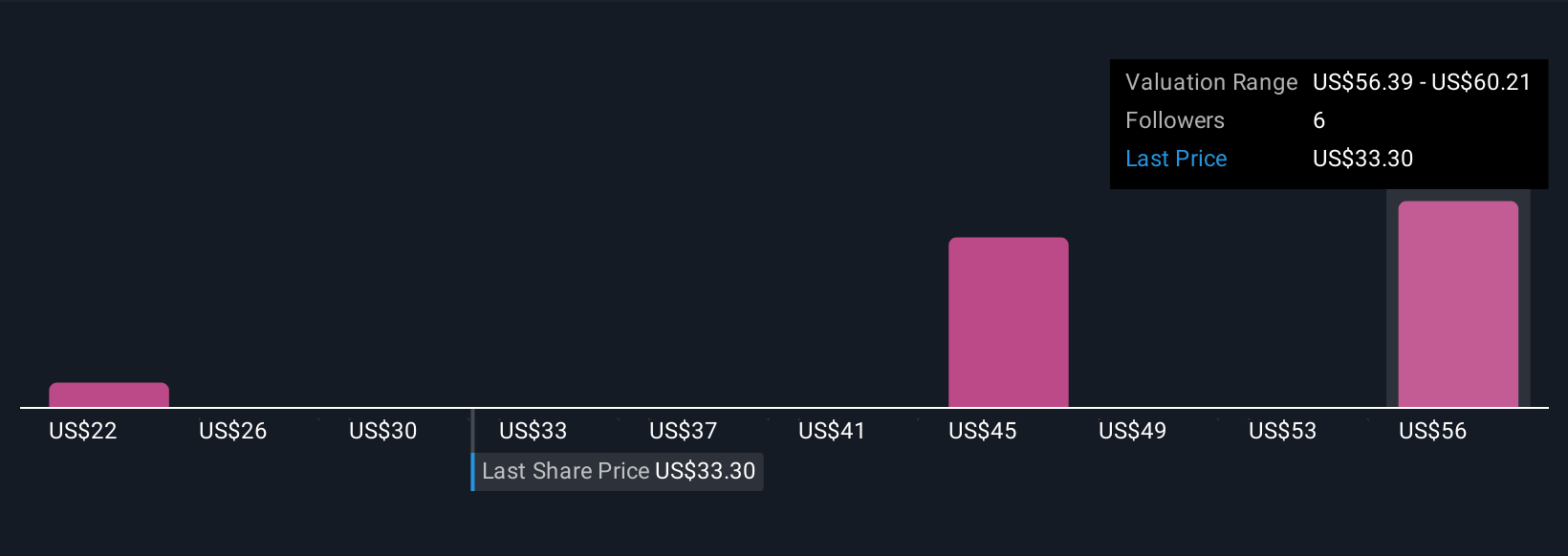

Three fair value estimates from the Simply Wall St Community range widely from US$22 to US$60, indicating significant divergence in individual forecasts. While healthy demand for branded and premium fruit is a key driver, margin headwinds from rising costs remain top of mind for many participants looking at the company's longer-term profit resilience.

Explore 3 other fair value estimates on Fresh Del Monte Produce - why the stock might be worth as much as 73% more than the current price!

Build Your Own Fresh Del Monte Produce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fresh Del Monte Produce research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fresh Del Monte Produce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fresh Del Monte Produce's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.