Please use a PC Browser to access Register-Tadawul

Do Dover’s (DOV) Latest Tech Launches Reveal a Shift in Its Innovation Strategy?

Dover Corporation DOV | 199.12 | -1.07% |

- Recently, Dover subsidiaries TWG and Malema, part of PSG, announced the global launches of the Guardian Wireless Rated Capacity Indicator System for cranes and the M-3100 Series Clamp-On Ultrasonic Flow Meter for semiconductor applications, respectively, underscoring advances in safety, precision, and high-tech industrial automation.

- These product introductions highlight Dover's expansion into specialized, technology-driven markets and reinforce its commitment to long-term innovation and recurring revenue opportunities.

- We'll examine how Dover's continued investment in advanced industrial solutions, such as the M-3100 Series flow meter, informs its broader investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Dover Investment Narrative Recap

To be a Dover shareholder, one generally has to believe in the company’s ability to continually innovate and shift its portfolio toward higher-growth, technology-driven industrial markets, even as segments remain exposed to cyclical volatility and competition. The recent launches in precision automation and safety, while underscoring Dover's strong push into specialty applications, are not expected to materially alter the main short-term catalyst: the pace at which demand recovers in Dover’s larger, cyclically sensitive segments, amidst ongoing macro and project-related uncertainties.

The October release of the Malema M-3100 Series Clamp-On Ultrasonic Flow Meter is particularly relevant, as it speaks directly to Dover’s push towards precision fluid handling for the semiconductor industry, a sector aligned with automation and digitalization, and tied to positive long-term catalysts around recurring, higher-margin sales.

On the other hand, investors should not overlook how persistent supply chain and demand volatility can abruptly affect near-term revenue...

Dover's narrative projects $9.1 billion revenue and $1.1 billion earnings by 2028. This requires 5.2% yearly revenue growth and no earnings change from the current earnings of $1.1 billion.

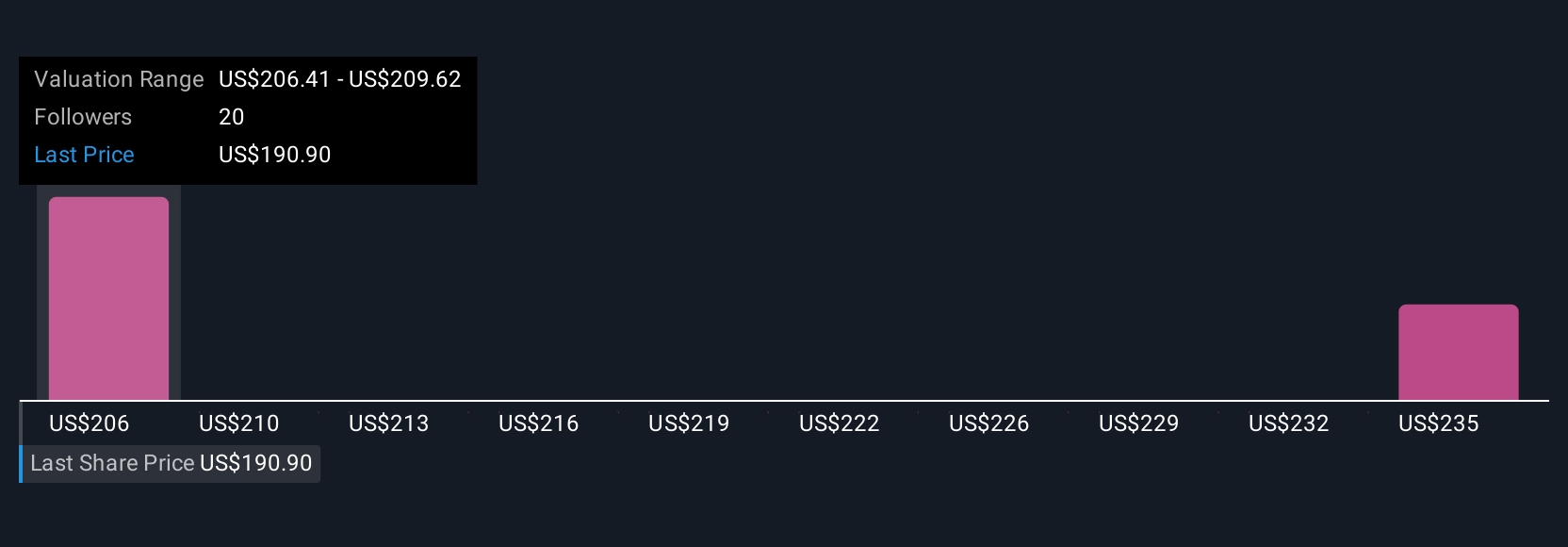

Uncover how Dover's forecasts yield a $213.39 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value estimates for Dover from US$213.39 to US$218.66, reflecting differences across only two viewpoints. While many expect Dover’s growing exposure to automation and semiconductors to support the investment narrative, the biggest risk remains sudden macro shocks that can disrupt revenue and margin progress. Explore how fellow market participants arrive at their assessments and consider the varied outlooks shaping consensus.

Explore 2 other fair value estimates on Dover - why the stock might be worth just $213.39!

Build Your Own Dover Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dover research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Dover research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dover's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.