Please use a PC Browser to access Register-Tadawul

Do Governance Changes and Kokai Momentum Signal a New Chapter for Trade Desk (TTD)?

The Trade Desk TTD | 36.19 | -1.26% |

- In late July 2025, The Trade Desk announced proposed amendments to its articles, including an updated conversion date for Class B to Class A common stock and adopting jury trial waivers in line with Nevada law, with a special stockholder meeting set for September 16, 2025.

- An increased focus on institutional ownership highlights how major stakeholders like The Vanguard Group and CEO Jeffrey Green hold significant influence over company decisions.

- We’ll explore how growing adoption of the Kokai platform and improved industry sentiment may shape The Trade Desk’s investment case.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Trade Desk Investment Narrative Recap

To be a Trade Desk shareholder today, you need to believe in the company's ability to drive ongoing growth through technology innovation, particularly with the Kokai platform, and to address the competitive pressures from digital giants like Google and Amazon. The recent amendments to company bylaws, while increasing governance clarity, do not materially affect the main near-term catalyst, which remains strong client adoption of Kokai, nor the current biggest risk: Trade Desk’s need to consistently meet growth targets to sustain investor confidence.

Among recent announcements, the completion of a sizeable share buyback program stands out, especially given current industry sentiment and recent share price movements. While this action speaks to management’s confidence and potentially supports shareholder value, the core catalyst for Trade Desk remains robust uptake and engagement with its AI-driven platform enhancements like Kokai, which are critical to long-term revenue and earnings growth.

By contrast, investors should be aware of the risk that Trade Desk’s track record for meeting its own financial expectations has recently come under scrutiny, especially as...

Trade Desk's narrative projects $4.2 billion in revenue and $811.1 million in earnings by 2028. This requires 17.4% annual revenue growth and a $399 million earnings increase from the current $412.1 million.

Uncover how Trade Desk's forecasts yield a $90.58 fair value, in line with its current price.

Exploring Other Perspectives

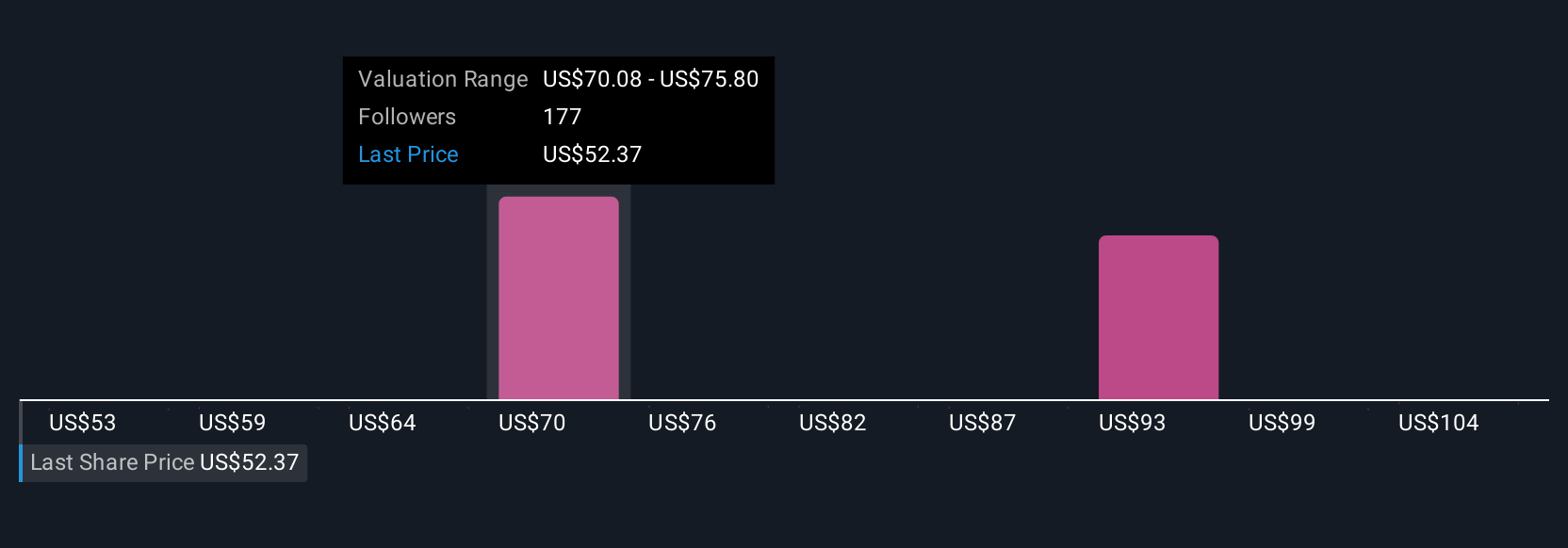

Thirty separate fair value views from the Simply Wall St Community range from US$28.43 to US$122.27 per share. While Kokai adoption is an ongoing catalyst, varied outlooks reflect differing expectations for Trade Desk’s ability to deliver sustainable outperformance.

Explore 30 other fair value estimates on Trade Desk - why the stock might be worth as much as 36% more than the current price!

Build Your Own Trade Desk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trade Desk research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Trade Desk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trade Desk's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.