Please use a PC Browser to access Register-Tadawul

Do Insider Sales at Alignment Healthcare (ALHC) Complicate the Story of Its Rapid Membership Expansion?

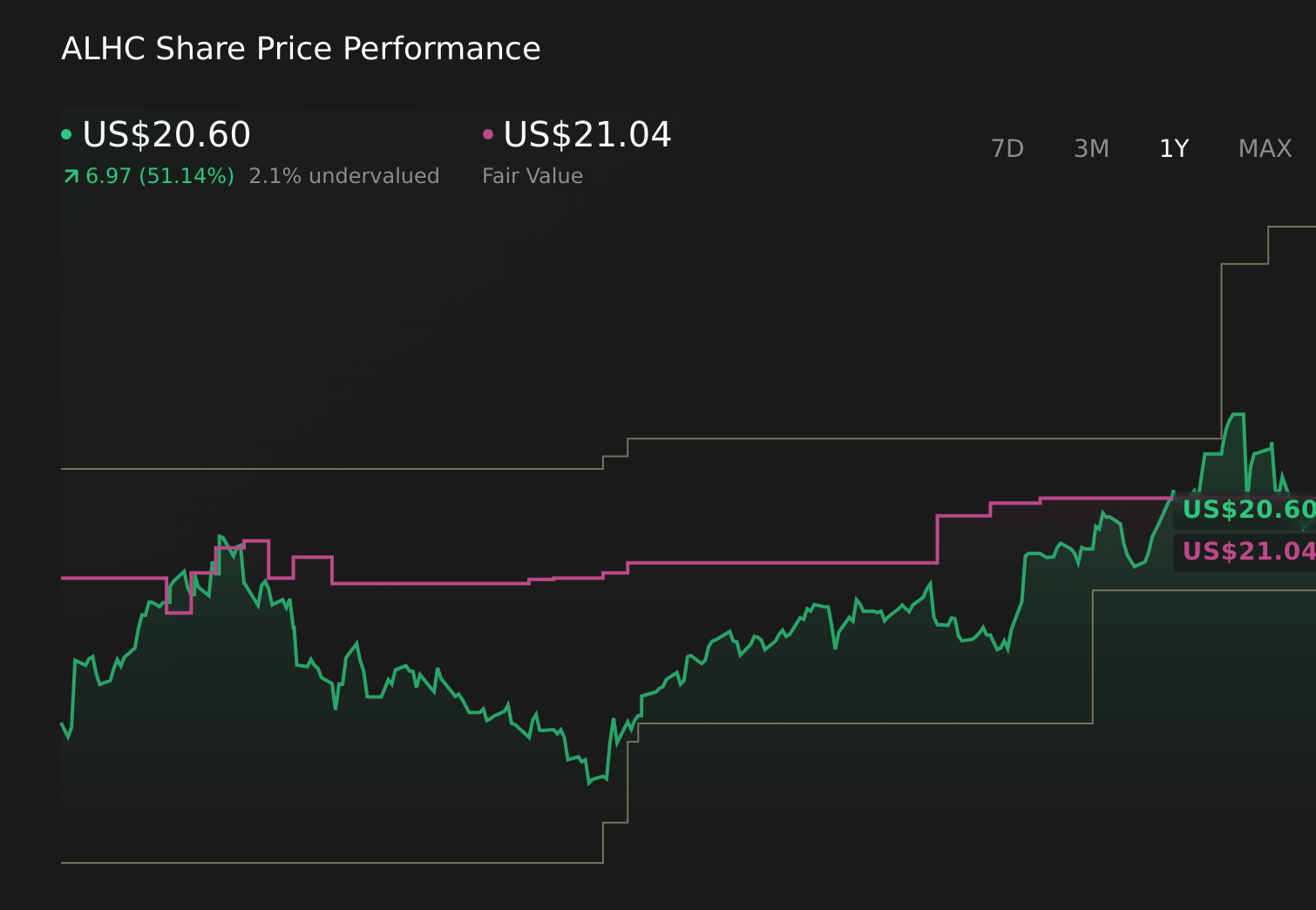

Alignment Healthcare, Inc. ALHC | 20.60 | -1.15% |

- On February 10, 2026, Alignment Healthcare disclosed that CEO John E. Kao and CHRO Andreas Wagner sold shares under a pre-arranged plan and to cover taxes, while the company projected health plan membership growth of 24–27% for 2026 following a 31% year-over-year increase as of January 1.

- This combination of strong membership momentum and analyst upgrades, set against routine insider sales, highlights how operating performance is currently shaping investor expectations for Alignment’s Medicare Advantage platform.

- Building on this strong membership outlook, we’ll now examine how accelerated enrollment growth may influence Alignment Healthcare’s existing investment narrative.

Find 53 companies with promising cash flow potential yet trading below their fair value.

Alignment Healthcare Investment Narrative Recap

To own Alignment Healthcare, you need to believe its Medicare Advantage model can convert strong member growth into sustainable profitability despite regulatory and reimbursement uncertainty. The latest insider sales appear routine and do not materially alter the near term focus on enrollment growth and margin management, while the key risk remains whether rapid membership gains can be maintained without pushing medical costs and compliance risk higher.

Among recent developments, the appointment of Adnan Mansour as Chief Digital Officer stands out, given Alignment’s emphasis on technology driven care and administrative automation. As membership grows more quickly, the success of its AVA platform and broader digital efforts may be critical for holding down SG&A and medical costs, which ties directly into how investors assess the durability of the current growth centric thesis.

Yet despite the strong membership story, investors should be aware of how tighter CMS oversight and potential reimbursement changes could...

Alignment Healthcare's narrative projects $6.8 billion revenue and $118.7 million earnings by 2028.

Uncover how Alignment Healthcare's forecasts yield a $21.04 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Some of the lowest ranked analysts were already cautious, assuming revenue of about US$6.7 billion and only US$66.2 million of earnings by 2028, so you should weigh this more pessimistic margin and cash flow view against the current membership momentum and consider how both stories might shift as fresh data and policy updates arrive.

Explore 2 other fair value estimates on Alignment Healthcare - why the stock might be worth as much as $21.04!

Build Your Own Alignment Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alignment Healthcare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alignment Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alignment Healthcare's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The future of work is here. Discover the 30 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.