Please use a PC Browser to access Register-Tadawul

Do Rising Analyst Estimates for BTDR Hint at Shifting Confidence in Bitdeer’s Earnings Power?

Bitdeer Technologies Group Class A BTDR | 7.78 | -2.02% |

- Bitdeer Technologies Group is anticipated to deliver higher earnings and revenue for the quarter ended September 2025, following analysts recently revising their consensus EPS estimate upward by 40% and indicating a strong likelihood of an earnings beat.

- This heightened analyst confidence marks a shift in sentiment, positioning Bitdeer as a focal point ahead of its upcoming earnings announcement.

- With analyst estimates rising, we'll look at how these revised expectations shape Bitdeer's investment narrative and outlook on earnings potential.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bitdeer Technologies Group Investment Narrative Recap

To be a shareholder in Bitdeer Technologies Group, you need to believe in the company’s ability to scale in the energy-intensive Bitcoin mining industry by capitalizing on proprietary technology and optimizing operational efficiency, even as the business faces high fixed costs and periodic swings in revenue. The latest surge in analyst expectations, with consensus EPS estimates up 40%, significantly increases anticipation for the upcoming earnings report, intensifying the focus on Bitdeer’s near-term profitability; however, the risk of margin pressure from high R&D and operating costs remains material and unchanged.

Among Bitdeer’s many recent announcements, the September launch of the SEALMINER A3 series stands out as most relevant. These new, more efficient ASIC mining units not only reinforce the earnings growth narrative but also serve as a visible catalyst supporting analyst optimism for both higher revenue and margin improvement in the near term. But while optimism around these innovations builds, investors should remain alert to the ongoing risk that...

Bitdeer Technologies Group's forecast anticipates $1.8 billion in revenue and $343.9 million in earnings by 2028. This outlook assumes annual revenue growth of 71.6% and an earnings increase of $664.2 million from the current -$320.3 million.

Uncover how Bitdeer Technologies Group's forecasts yield a $32.68 fair value, a 43% upside to its current price.

Exploring Other Perspectives

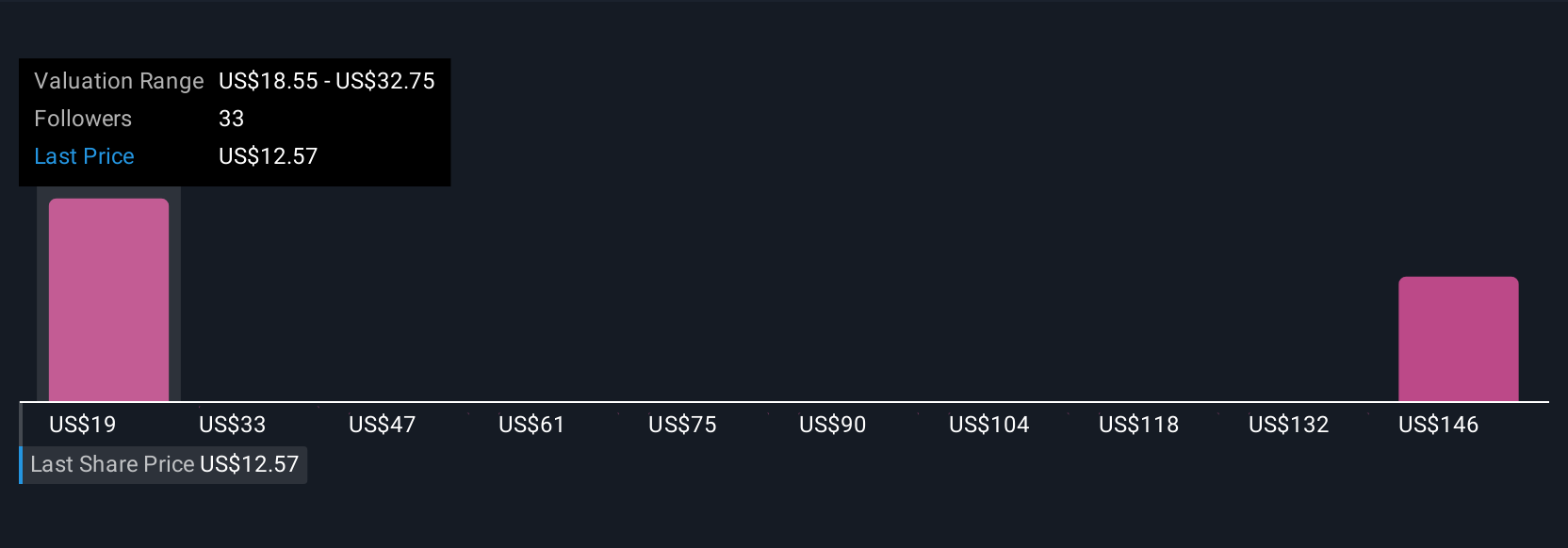

Seven members of the Simply Wall St Community have produced fair value estimates for Bitdeer ranging from US$18.55 to US$388.00 per share. Some see major upside on the back of proprietary ASIC technology launches, but opinions vary widely and it’s important to consider a range of views before forming your own perspective.

Explore 7 other fair value estimates on Bitdeer Technologies Group - why the stock might be a potential multi-bagger!

Build Your Own Bitdeer Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bitdeer Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitdeer Technologies Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.