Please use a PC Browser to access Register-Tadawul

Do Weaker 2025 Margins Hint At A Strategic Shift In Marten Transport’s (MRTN) Business Model?

Marten Transport, Ltd. MRTN | 13.63 13.63 | +1.19% 0.00% Pre |

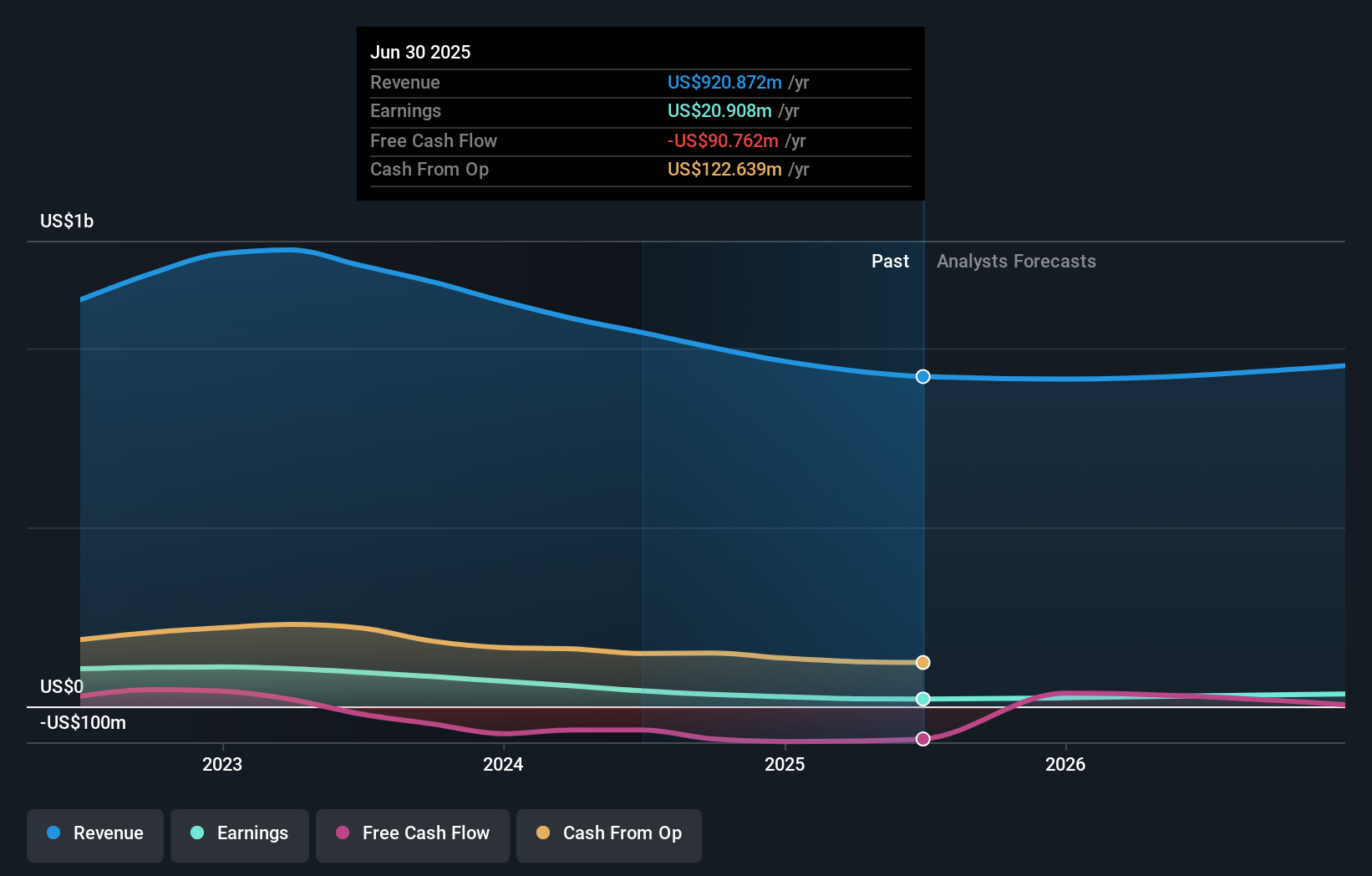

- Marten Transport, Ltd. reported past fourth-quarter 2025 results with sales of US$210.11 million and net income of US$3.7 million, both lower than the prior year, along with diluted EPS of US$0.05 from continuing operations.

- For the full year 2025, the company’s sales fell to US$883.65 million and net income to US$17.44 million, highlighting pressure on both revenue and profitability across the period.

- With earnings per share compressed over both the quarter and full year, we’ll now examine how this weaker profitability shapes Marten Transport’s investment narrative.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Marten Transport's Investment Narrative?

To own Marten Transport today, you need to believe that its niche in temperature-controlled trucking and logistics will still matter even as the business works through weaker profitability. The latest Q4 and full-year 2025 results confirm that pressure on revenue and margins has not yet eased, with net income and EPS down on the prior year despite a long-running dividend and no recent buybacks. That makes near-term catalysts more about operational improvement and better asset utilization than financial engineering. At the same time, a high price-to-earnings multiple, low return on equity and earnings flattered by a sizeable one-off gain leave the stock exposed if progress is slow. The recent share price rebound suggests some optimism, but the earnings miss keeps execution risk front and center.

However, investors should also weigh how thin margins and valuation risk could interact. Marten Transport's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Marten Transport - why the stock might be worth as much as $14.00!

Build Your Own Marten Transport Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marten Transport research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Marten Transport research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marten Transport's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.