Please use a PC Browser to access Register-Tadawul

Does Analyst Enthusiasm for IDEAYA Biosciences (IDYA) Reflect Sustainable Progress in its Oncology Pipeline?

IDEAYA Biosciences IDYA | 33.04 | +2.61% |

- In recent days, Citizens reiterated its Market Outperform rating on IDEAYA Biosciences, expressing optimism about the company’s darovasertib plus crizotinib combination therapy for metastatic uveal melanoma and highlighting IDEAYA’s solid financial position to advance its pipeline.

- This renewed analyst confidence follows IDEAYA’s recent R&D Day, where the spotlight on innovative clinical programs drew continued attention from the research community.

- We'll explore how renewed analyst optimism around clinical progress, particularly in metastatic uveal melanoma, shapes IDEAYA Biosciences’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is IDEAYA Biosciences' Investment Narrative?

To feel confident holding IDEAYA Biosciences through today’s volatility, investors need to believe in the company’s ability to translate its advancing clinical pipeline into meaningful future approvals and partnerships, despite ongoing losses and a lack of near-term profitability. The recent analyst support from Citizens, paired with positive clinical momentum highlighted at IDEAYA’s R&D Day, adds near-term optimism around key catalysts like upcoming darovasertib data readouts and further regulatory milestones. Importantly, the solid financial position strengthened by the recent Servier licensing deal should help shield IDEAYA from dilution risk and sustain its ambitious R&D efforts. Still, the stock’s recent rally suggests much of this optimistic outlook may already be reflected in the price, and ongoing losses or clinical setbacks could weigh on sentiment. The analyst reiteration underscores enthusiasm for IDEAYA’s clinical progress but does not eliminate risks around unproven therapies and a relatively inexperienced management team. Still, beneath the pipeline optimism, there’s the persistent challenge of continued net losses and no near-term path to profitability.

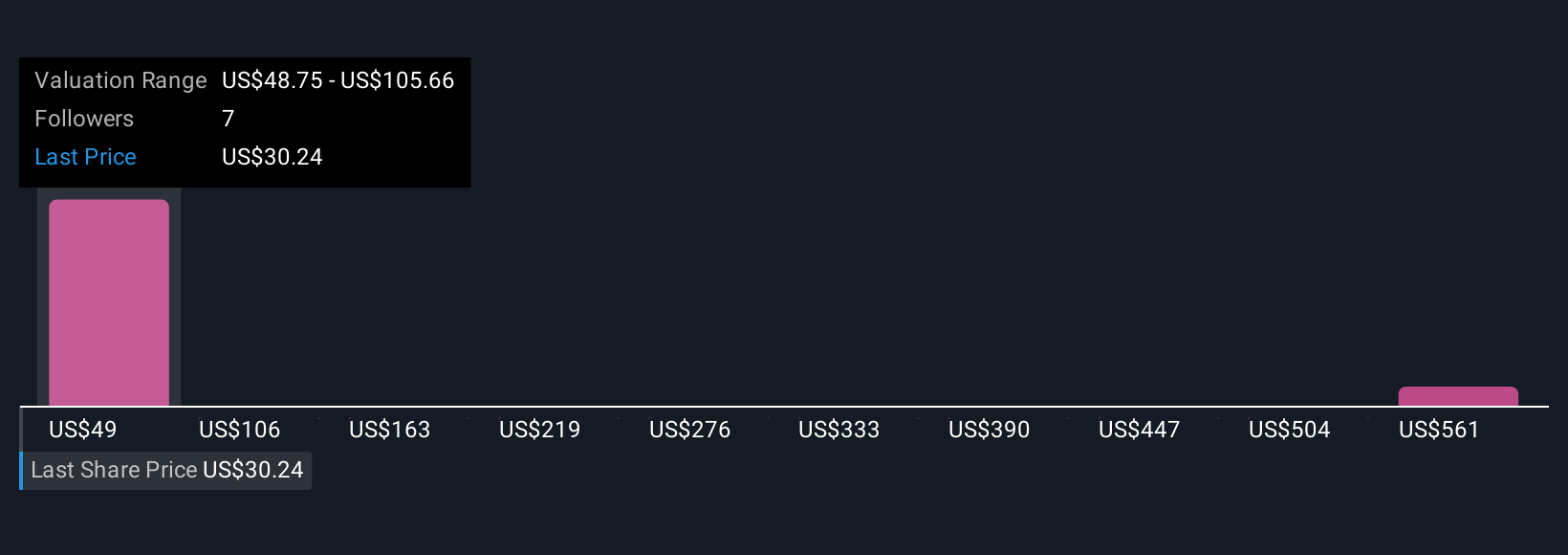

Our comprehensive valuation report raises the possibility that IDEAYA Biosciences is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 3 other fair value estimates on IDEAYA Biosciences - why the stock might be a potential multi-bagger!

Build Your Own IDEAYA Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IDEAYA Biosciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free IDEAYA Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IDEAYA Biosciences' overall financial health at a glance.

No Opportunity In IDEAYA Biosciences?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.