Please use a PC Browser to access Register-Tadawul

Does Analyst Optimism and Strong Momentum Signal a Turning Point for Dorman Products (DORM)?

Dorman Products, Inc. DORM | 128.01 | -0.36% |

- In recent weeks, Dorman Products received a Momentum Style Score of A and a Zacks Rank of #2, accompanied by upward earnings estimate revisions and no downward adjustments.

- This positive momentum and analyst optimism provide additional support to Dorman Products' outlook, which has recently surpassed both its industry peers and the S&P 500.

- Now, we'll explore how these upward earnings estimate revisions and robust analyst sentiment may influence Dorman Products' overall investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dorman Products Investment Narrative Recap

To be a Dorman Products shareholder today, you have to believe that the company's core strength relies on steady demand for replacement automotive parts, fueled by the rising age of vehicles on roads in North America. The recent upgrade to a Momentum Style Score of A, strong Zacks Rank, and upward earnings revisions have helped power its short-term outlook, but the most important catalyst, ongoing innovation in new, high-margin products, remains balanced against persistent margin risks from potential input cost volatility caused by tariffs and global uncertainty, which have not changed materially in the wake of recent news. Among recent company developments, Dorman’s announcement of hundreds of new aftermarket parts, including proprietary and "new to the aftermarket" repair solutions, directly supports its earnings guidance upgrade. These continuous product launches are designed to increase recurring sales and enhance profitability, reinforcing the key catalyst investors are watching most closely in Dorman’s story. However, investors should also be mindful that despite current momentum, unpredictability in global tariff and input costs could...

Dorman Products' narrative projects $2.5 billion revenue and $237.0 million earnings by 2028. This requires 6.0% yearly revenue growth and a $11.0 million earnings increase from $226.0 million.

Uncover how Dorman Products' forecasts yield a $164.17 fair value, in line with its current price.

Exploring Other Perspectives

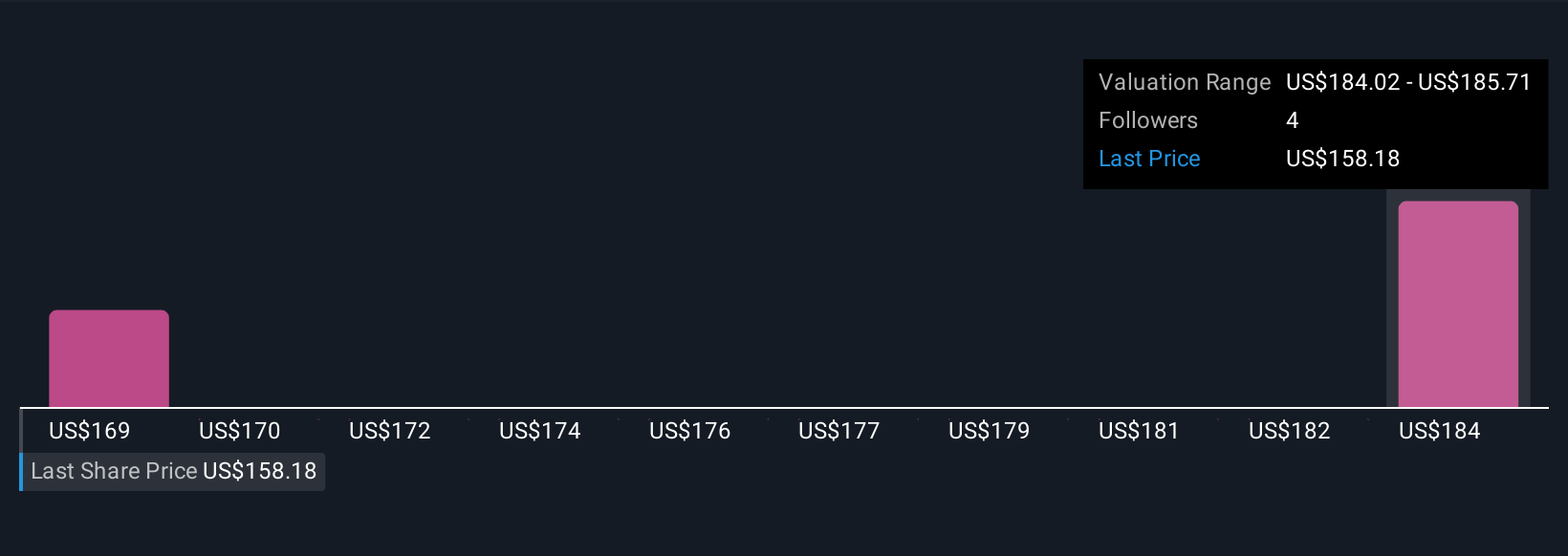

Simply Wall St Community members have produced two fair value estimates for Dorman Products, ranging from US$164.17 to US$193.88. As upgraded analyst expectations meet diverse community opinions, consider how input cost risk might shape the company’s next move.

Explore 2 other fair value estimates on Dorman Products - why the stock might be worth as much as 20% more than the current price!

Build Your Own Dorman Products Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dorman Products research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Dorman Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dorman Products' overall financial health at a glance.

No Opportunity In Dorman Products?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.