Please use a PC Browser to access Register-Tadawul

Does ASGN's Governance Update Signal a Shift in Strategic Priorities for ASGN (ASGN)?

On Assignment, Inc. ASGN | 48.07 | +0.94% |

- On September 18, 2025, ASGN Incorporated’s Board of Directors approved amendments to the company’s bylaws that update procedures for stockholder nominations and proposals, clarify advance notice deadlines, and incorporate gender-neutral language.

- These governance enhancements come as ASGN recorded second-quarter earnings and revenue above analyst forecasts, attracting increased attention to its operational direction amid broader industry and market challenges.

- We’ll examine how ASGN’s proactive governance updates may impact its investment narrative during a period of renewed investor focus on company strategy.

Find companies with promising cash flow potential yet trading below their fair value.

ASGN Investment Narrative Recap

To own ASGN stock, an investor needs confidence in the company’s ability to convert technology and consulting investments into profitable growth, despite recent declines in revenue and net income. The September 2025 bylaw amendments, while a positive signal for governance and transparency, are unlikely to materially impact the most immediate catalyst: execution on higher-margin consulting contracts. Persistent softness in traditional staffing and potential further AI adoption remain the most important risks to short-term performance.

Among recent announcements, the ECS Blue Dawn contract stands out as a significant development, reflecting ASGN’s push to secure high-value government business focused on AI and cloud solutions. This aligns with near-term catalysts tied to the company’s pivot toward consulting and technology services, but it doesn’t directly address margin vulnerability from lower traditional staffing demand and segment mix shifts.

Yet, investors should be aware that despite improved board governance, margin pressure from a shifting federal contract mix and broader competition could...

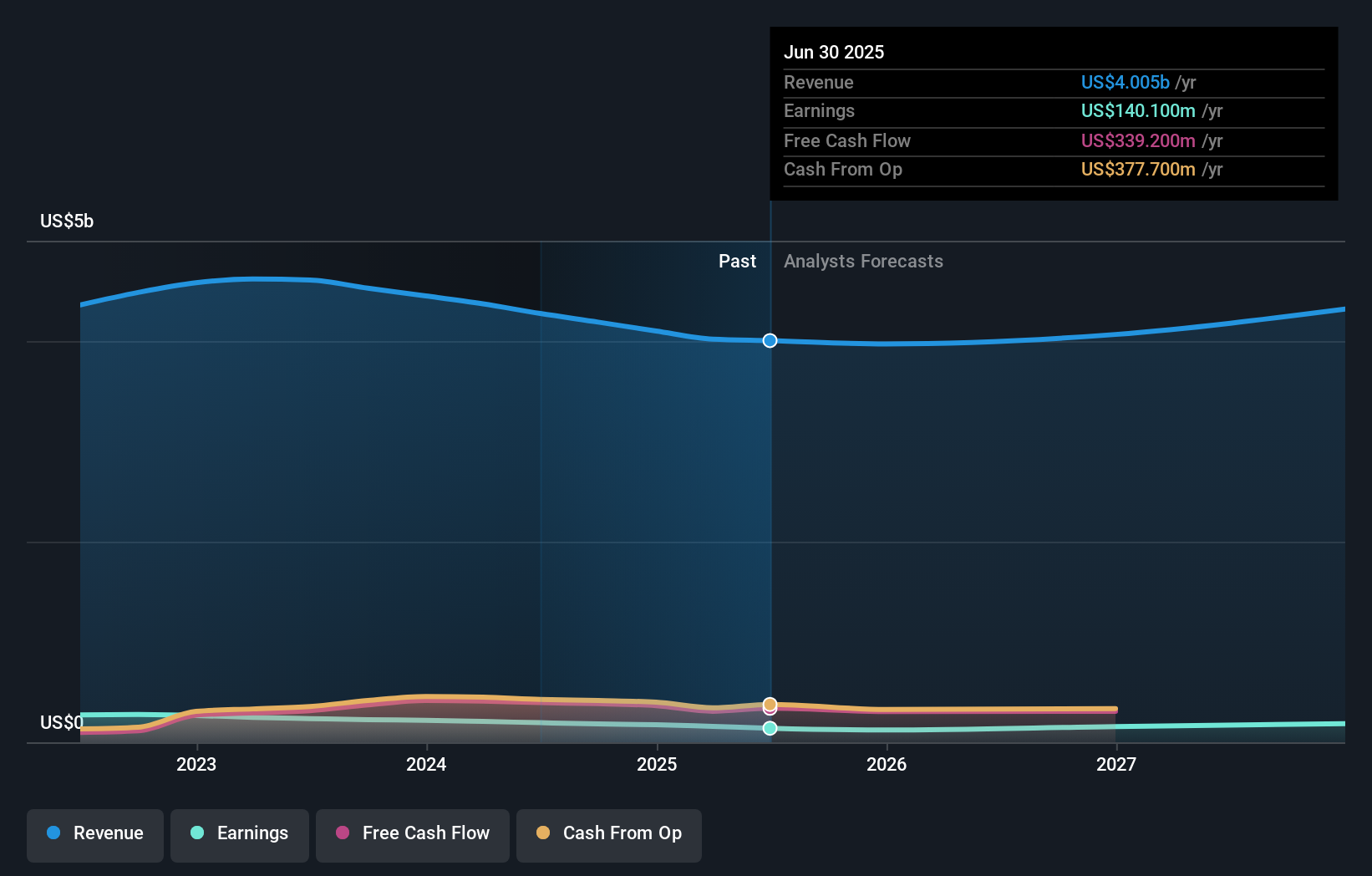

ASGN’s narrative projects $4.3 billion in revenue and $193.8 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $53.7 million increase in earnings from the current $140.1 million.

Uncover how ASGN's forecasts yield a $57.50 fair value, a 20% upside to its current price.

Exploring Other Perspectives

With three fair value estimates from the Simply Wall St Community ranging from US$30.33 to US$77.95, opinions on ASGN’s worth span a considerable gap. Many are watching whether the shift toward federal consulting and cloud contracts can offset drag from declining staffing margins.

Explore 3 other fair value estimates on ASGN - why the stock might be worth 37% less than the current price!

Build Your Own ASGN Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASGN research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ASGN research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASGN's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.