Please use a PC Browser to access Register-Tadawul

Does Blue Owl Capital's (OWL) Latest Liquidity Move Reveal a Shift in Long-Term Investment Strategy?

Blue Owl Capital Inc. Class A Common Stock OWL | 15.77 | +1.12% |

- Earlier this week, Blue Owl Capital was reported to be nearing completion of a US$2.7 billion secondary transaction involving its Dyal Capital Partners IV fund, moving minority stakes in a range of private asset managers into a new vehicle that raised US$1 billion in equity and US$1.7 billion in debt.

- This capital return initiative not only aims to provide liquidity to fund investors but also seeks to bolster Blue Owl's performance metrics by optimizing asset allocation within the Dyal platform.

- We'll examine how this major secondary transaction, designed to return investor cash, may influence Blue Owl Capital’s investment narrative and outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 29 companies in the world exploring or producing it. Find the list for free.

Blue Owl Capital Investment Narrative Recap

To be a shareholder in Blue Owl Capital, you need to believe in the company's ability to drive recurring management fee revenues and earnings growth by expanding through permanent capital vehicles and private credit offerings. The recent US$2.7 billion Dyal secondary transaction was structured to return cash to investors, but its impact on the immediate drivers of asset growth and fundraising momentum appears limited; the primary short term catalyst remains Blue Owl’s success in attracting stable new capital, with heightened execution risks if inflows cool or integration falls short.

Among recent announcements, the July 31, 2025, Q2 results stand out: revenue continued to rise year over year, but net income and margins declined, reflecting both the cost of growth and a more competitive environment for private market managers. These earnings trends offer more context around the firm’s capital return initiative, highlighting the critical importance of margin stabilization for Blue Owl’s investment case given current market pressures.

But even with robust asset raising, investors should not overlook the risk that...

Blue Owl Capital's narrative projects $4.2 billion in revenue and $5.1 billion in earnings by 2028. This requires 17.5% yearly revenue growth and an increase in earnings of about $5.0 billion from the current earnings of $75.4 million.

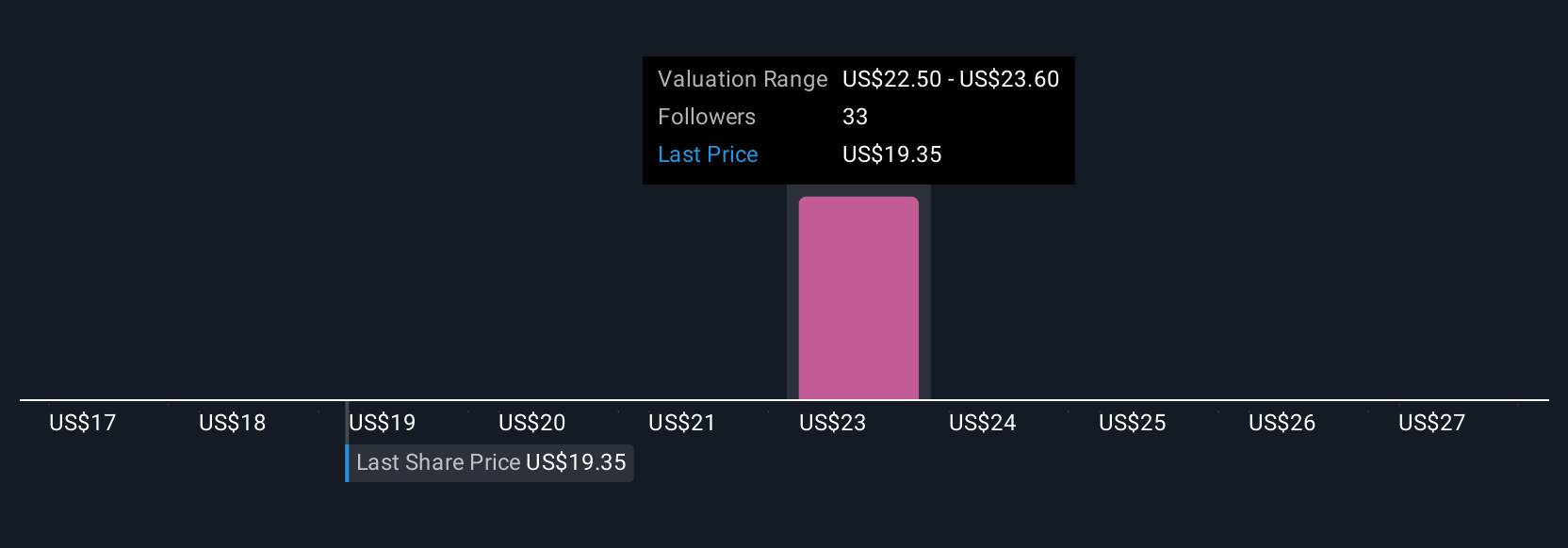

Uncover how Blue Owl Capital's forecasts yield a $23.92 fair value, a 28% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community produced 4 fair value estimates for Blue Owl Capital ranging from US$0.60 to US$28 per share. As you consider these widely diverging views, keep in mind that ongoing fundraising remains the key catalyst influencing Blue Owl’s targets and future potential.

Explore 4 other fair value estimates on Blue Owl Capital - why the stock might be worth as much as 49% more than the current price!

Build Your Own Blue Owl Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Owl Capital research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Blue Owl Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Owl Capital's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.