Please use a PC Browser to access Register-Tadawul

Does Carpenter Technology's (CRS) Leadership Shakeup Reinforce Its Aerospace Growth Ambitions?

Carpenter Technology Corporation CRS | 323.19 | -0.13% |

- Carpenter Technology recently announced key leadership changes, including appointing Tony R. Thene as Chairman of the Board and promoting Brian J. Malloy to President and COO, following a significant director share sale and its presentation at Morgan Stanley’s 13th Annual Laguna Conference.

- These developments coincide with ongoing robust demand from the global aerospace sector and major multi-year supply agreements, both of which underpin analysts’ views of Carpenter as undervalued with firm long-term prospects.

- Let's examine how this leadership transition could influence Carpenter Technology's investment narrative amid aerospace-driven growth and expansion plans.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Carpenter Technology Investment Narrative Recap

To be a shareholder in Carpenter Technology, you need conviction in sustained aerospace demand, supported by multi-year contracts and the company’s growth plans, while monitoring the risks involving large capital outlays for capacity expansion. The recent leadership changes, including Tony R. Thene’s appointment as Chairman and Brian J. Malloy’s promotion to President and COO, are not expected to materially shift the primary short-term catalyst, strong aerospace demand, nor do they directly reduce the biggest risk of underperforming on expansion execution or market cyclicality.

The leadership appointments stand out, given their timing alongside the Morgan Stanley conference and as Carpenter embarks on ambitious growth projects. With the company preparing to invest US$400 million in new capacity to serve heightened aerospace and electrification demand, experienced leadership takes on added importance in guiding execution and managing operational risk.

On the flip side, investors should be aware of the potential consequences if increased capital expenditures do not...

Carpenter Technology's narrative projects $3.6 billion revenue and $672.3 million earnings by 2028. This requires 7.7% yearly revenue growth and a $296.5 million increase in earnings from $375.8 million today.

Uncover how Carpenter Technology's forecasts yield a $325.72 fair value, a 36% upside to its current price.

Exploring Other Perspectives

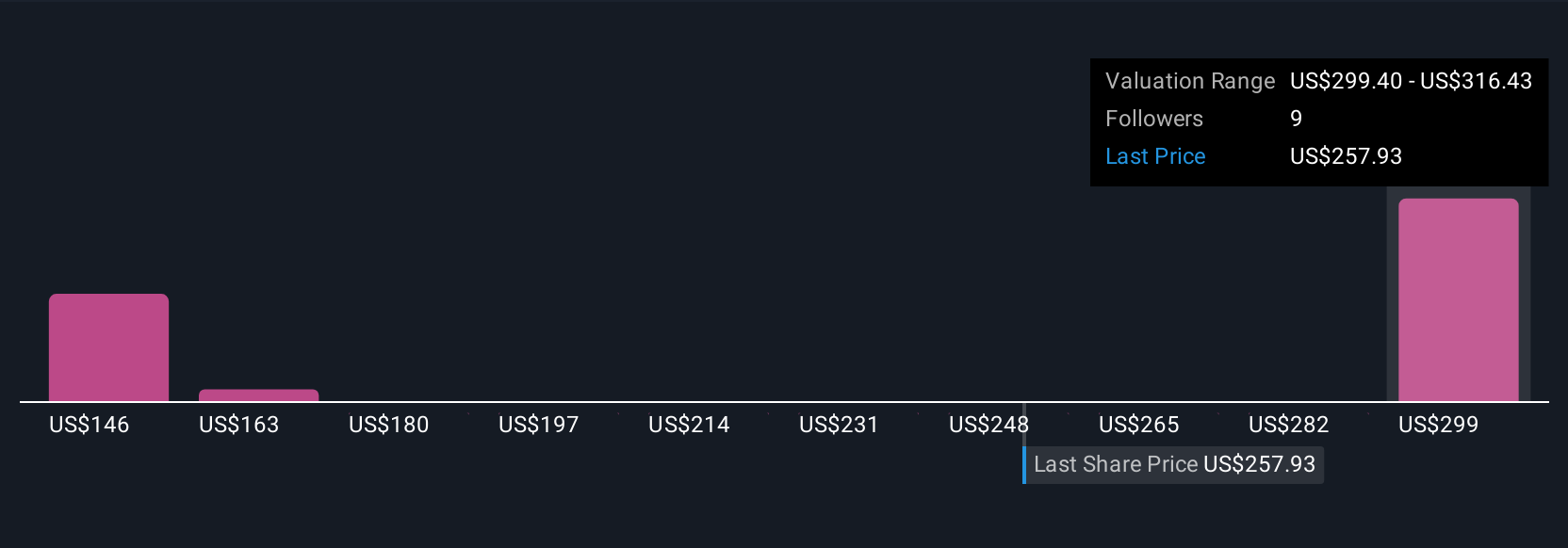

Simply Wall St Community members have offered three fair value estimates for Carpenter Technology ranging from US$141.06 to US$325.72. While investor views differ, the planned US$400 million expansion remains a central factor influencing performance expectations and future returns.

Explore 3 other fair value estimates on Carpenter Technology - why the stock might be worth 41% less than the current price!

Build Your Own Carpenter Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carpenter Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carpenter Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carpenter Technology's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.