Please use a PC Browser to access Register-Tadawul

Does Citi’s Coverage Signal a Turning Point for MSG Sports’ (MSGS) Long-Term Value Story?

MADISON SQUARE GARDEN SPORTS CORP MSGS | 237.44 | +0.90% |

- Citi recently initiated coverage of Madison Square Garden Sports, parent company of the New York Knicks and Rangers, highlighting the stock as undervalued and encouraging investor interest based on its potential value.

- This endorsement from a major financial institution points to renewed optimism around MSG Sports’ long-term prospects, despite previous market skepticism.

- With Citi’s positive analyst coverage spotlighting valuation, we’ll explore how strengthened investor confidence influences MSG Sports’ current investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Madison Square Garden Sports Investment Narrative Recap

An investor in Madison Square Garden Sports needs confidence in the enduring power and market value of its flagship assets, the New York Knicks and Rangers, and a belief that long-term drivers like national media rights and fan demand can outpace structural declines in local media revenue. Citi’s recent coverage acknowledges market skepticism but highlights potential undervaluation; however, this endorsement does not materially alter the biggest near-term catalyst, which remains the shift toward higher-value national media rights starting in fiscal 2026, nor does it address the persistent risk from renegotiated local media deals reducing predictable revenue. Looking beyond analyst coverage, the August 2025 earnings report stands out for its relevance; despite full-year revenue growth, the company posted a net loss, highlighting the margin pressure that can result from higher expenses and lower media rights income. The absence of share buybacks in recent quarters also underscores a cautious capital allocation stance that may impact perceptions of shareholder value, especially in the context of rising costs and evolving revenue streams. Yet, while new endorsements shine a light on upside, investors should remain mindful of the risk that local media contraction…

Madison Square Garden Sports' narrative projects $1.1 billion in revenue and $102.9 million in earnings by 2028. This requires 1.6% yearly revenue growth and a $125.4 million earnings increase from the current $-22.5 million.

Uncover how Madison Square Garden Sports' forecasts yield a $261.50 fair value, a 23% upside to its current price.

Exploring Other Perspectives

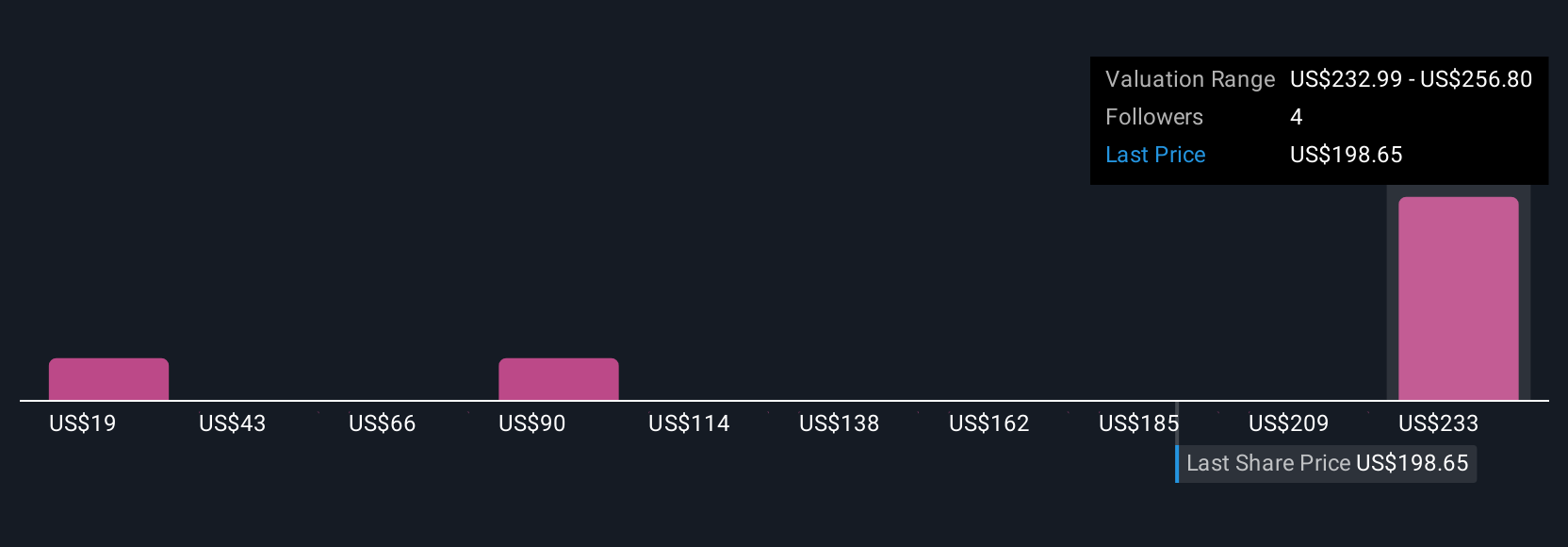

Three members of the Simply Wall St Community set fair value estimates between US$19 and US$262 per share, capturing dramatic variance in outlook. Amid this, shifting media rights agreements continue to test visibility into MSGS’s long-term revenue trajectory, inviting you to weigh multiple viewpoints before making up your mind.

Explore 3 other fair value estimates on Madison Square Garden Sports - why the stock might be worth less than half the current price!

Build Your Own Madison Square Garden Sports Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Madison Square Garden Sports research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Madison Square Garden Sports research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Madison Square Garden Sports' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.