Please use a PC Browser to access Register-Tadawul

Does CRISPR Therapeutics' (CRSP) SyNTase Spotlight Signal Durable Leadership in Genetic Medicine Innovation?

CRISPR Therapeutics AG CRSP | 48.32 | -1.04% |

- CRISPR Therapeutics recently announced that its novel SyNTase gene editing technology will be featured in an oral presentation at the ESGCT 2025 Congress, showcasing preclinical results targeting Alpha-1 Antitrypsin Deficiency with high efficiency and precision.

- This unveiling highlights the company’s ability to deliver innovative in vivo gene correction solutions that could expand the reach of genetic therapies beyond currently approved treatments.

- We'll explore how the introduction of SyNTase and the initiation of a new Phase 2 clinical trial reinforce CRISPR Therapeutics' investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is CRISPR Therapeutics' Investment Narrative?

An investor considering CRISPR Therapeutics has to weigh a compelling innovation story against persistent unprofitability and execution risk. The recent SyNTase unveiling brings meaningful attention to the company’s science, and the strong preclinical results for Alpha-1 Antitrypsin Deficiency showcase potential for impactful new therapies, broadening the pipeline’s reach beyond previously approved indications. Short-term, this new technology could act as a positive catalyst, heightening interest ahead of further data releases and possibly influencing market sentiment, as seen in recent price movements. However, with CRISPR remaining unprofitable and not projected to reach profitability in the near future, capital needs and commercial execution remain critical concerns. While the market has responded with momentum following recent announcements, the core risk profile around clinical success rates and the long timeline to sustainable earnings remains largely unchanged, though the technology news does have the potential to nudge expectations if upcoming updates are also positive.

On the other hand, execution remains a risk that investors should watch closely.

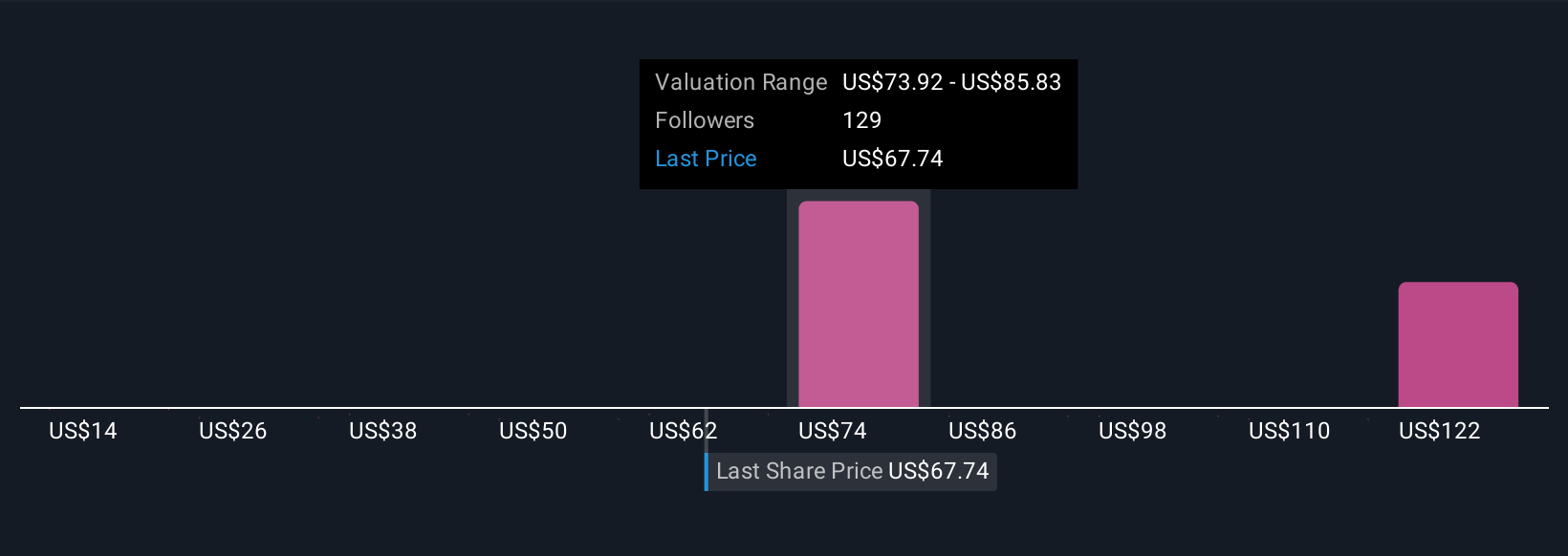

CRISPR Therapeutics' shares have been on the rise but are still potentially undervalued by 49%. Find out what it's worth.Exploring Other Perspectives

Explore 19 other fair value estimates on CRISPR Therapeutics - why the stock might be worth less than half the current price!

Build Your Own CRISPR Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CRISPR Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CRISPR Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CRISPR Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.