Please use a PC Browser to access Register-Tadawul

Does DHT Holdings’ $308 Million Vessel Financing Deal Shift Its Capital Allocation Strategy? (DHT)

DHT Holdings, Inc. DHT | 14.89 14.89 | +0.13% 0.00% Pre |

- In late July 2025, DHT Holdings announced it had secured a US$308.4 million senior secured credit facility to finance four new vessels under construction in South Korea, arranged with ING Bank and Nordea Bank Abp at an interest rate of SOFR plus a 1.32% margin. This long-term facility, with a 12-year maturity per vessel and a 20-year repayment profile, highlights the company's focus on expanding and modernizing its fleet.

- The structure and scale of this financing arrangement may enhance DHT's financial flexibility and signal to the market its intent to maintain competitive operations amid evolving industry demands.

- We'll examine how access to long-term vessel financing could influence DHT Holdings' future earnings outlook and capital allocation plans.

These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

DHT Holdings Investment Narrative Recap

To own shares in DHT Holdings, investors need to believe in the company's ability to generate stable cash flows from its modern tanker fleet, benefit from supportive freight rates, and sustain shareholder returns through dividends. The recent US$308.4 million credit facility for four new vessels may support fleet renewal goals but does not materially shift the immediate catalyst for the stock, which remains tied to near-term freight rates and the ability to deploy new assets efficiently. At the same time, the greatest risk remains margin pressure if freight rates weaken or planned vessel financing increases costs further, this financing move alone does not resolve or heighten these industry challenges.

The company’s regular dividend announcements underscore its policy to return all ordinary net income to shareholders, with the most recent payout of US$0.15 per share in July 2025 reflecting this ongoing commitment. Investors have seen over 60 consecutive quarterly dividends, giving near-term visibility into capital returns while highlighting the importance of stable earnings, something closely connected to efficient deployment of the newly financed ships and broader market conditions.

However, as vessel financing commitments increase, investors should be aware that if freight rates do not keep pace, net margins and dividend sustainability could come under renewed pressure...

DHT Holdings' narrative projects $456.7 million revenue and $270.8 million earnings by 2028. This requires a 6.7% yearly revenue decline and a $92.2 million earnings increase from $178.6 million currently.

Uncover how DHT Holdings' forecasts yield a $14.15 fair value, a 26% upside to its current price.

Exploring Other Perspectives

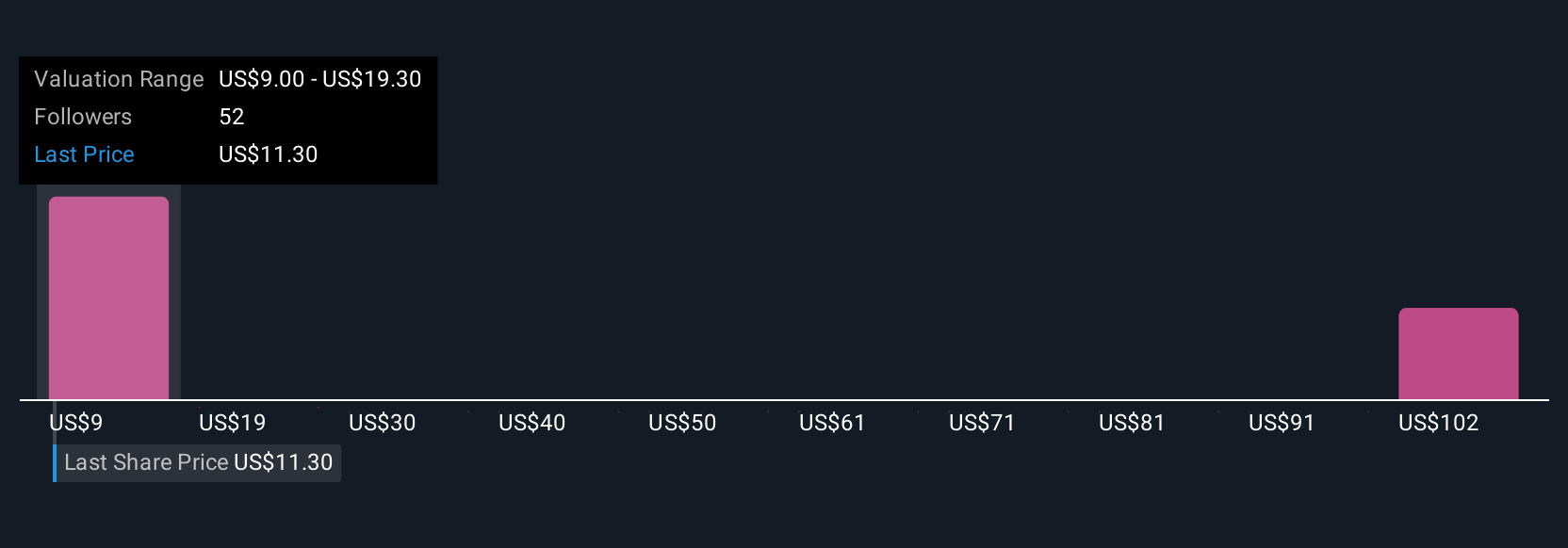

Seven perspectives from the Simply Wall St Community value DHT Holdings anywhere from US$9 to US$113 per share, showing a wide spectrum of opinion. While the new financing supports fleet modernization, participants should consider how margin risks linked to freight volatility could influence company outcomes and explore the range of community insights.

Explore 7 other fair value estimates on DHT Holdings - why the stock might be worth over 10x more than the current price!

Build Your Own DHT Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DHT Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DHT Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DHT Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.