Please use a PC Browser to access Register-Tadawul

Does Diverging Views On Paycor Deal Reframe Paychex’s Competitive Narrative For PAYX?

Paychex, Inc. PAYX | 91.24 | -1.19% |

- Recently, analysts at William Blair reiterated a Hold rating on Paychex while Cantor Fitzgerald initiated a Sell rating, highlighting concerns about the company’s ability to accelerate organic revenue growth and questioning the long-term benefits of its Paycor acquisition.

- Although management has raised the lower end of its adjusted diluted EPS outlook for 2026 and anticipates interest on client funds at the high end of guidance, the mixed analyst response underscores uncertainty around whether the Paycor deal will truly strengthen Paychex’s competitive position.

- Next, we’ll examine how Cantor Fitzgerald’s concern over Paychex’s organic growth prospects and the Paycor acquisition affects its overall investment narrative.

Uncover the next big thing with 28 elite penny stocks that balance risk and reward.

Paychex Investment Narrative Recap

To own Paychex, you need to believe its human capital management platform can keep driving steady demand from small and mid-sized businesses while it manages integration of Paycor and industry competition. The latest split between Hold and Sell ratings does not materially change the near term catalyst, which remains execution on Paycor-related cross selling, but it does sharpen the biggest current risk around whether that acquisition ultimately supports sustainable organic growth.

Management’s decision to raise the lower end of its adjusted diluted EPS outlook for 2026, helped by interest on client funds tracking toward the top of guidance, sits in clear tension with Cantor Fitzgerald’s worries about organic revenue momentum, making upcoming results a key test of whether Paychex can translate the Paycor deal into the kind of performance that supports its existing catalysts.

Yet while the Paycor integration risk is front of mind, investors should also be aware that...

Paychex's narrative projects $7.5 billion revenue and $2.3 billion earnings by 2028. This requires 10.2% yearly revenue growth and about a $0.6 billion earnings increase from $1.7 billion today.

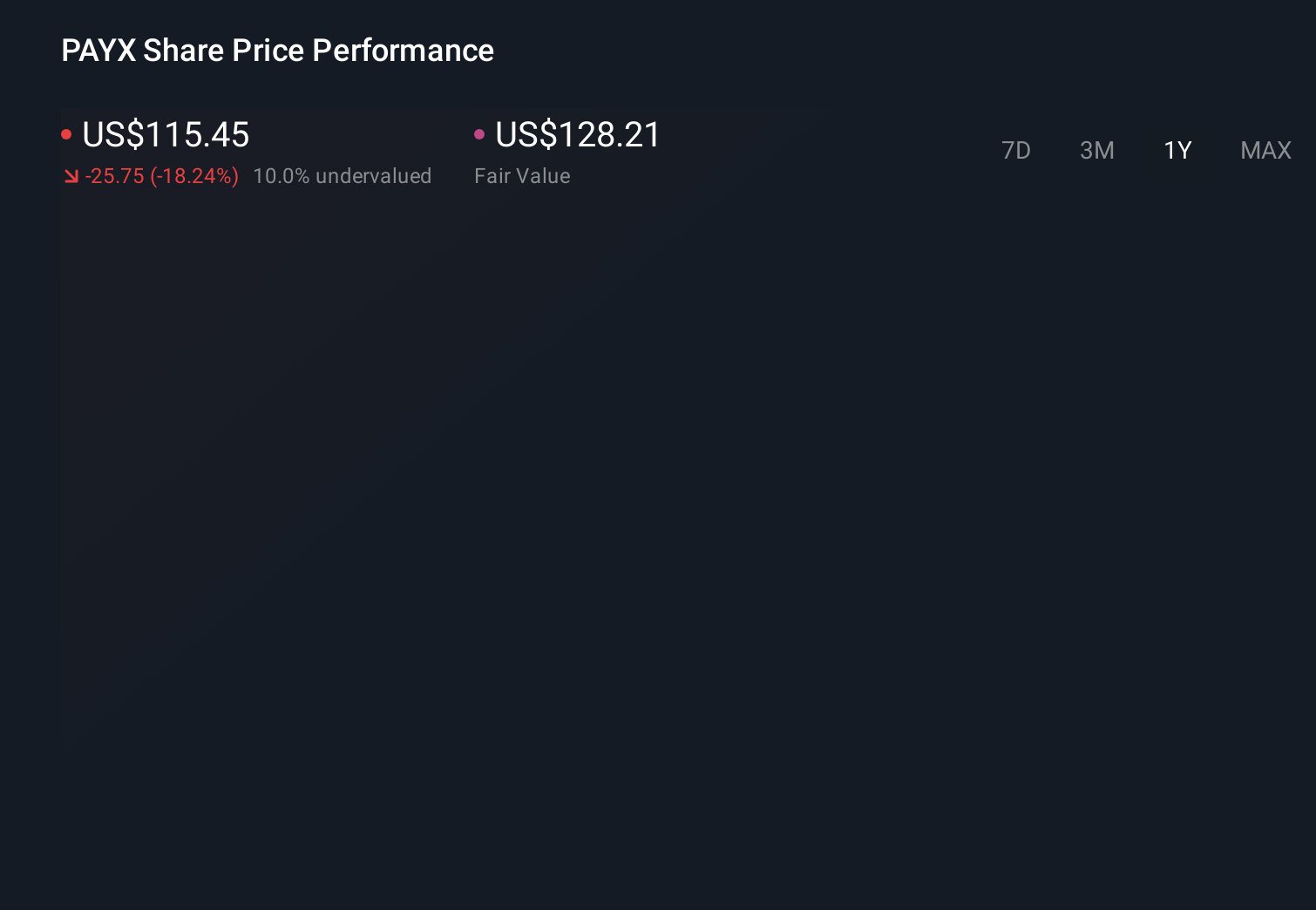

Uncover how Paychex's forecasts yield a $119.53 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$119.53 to US$189.69 per share, showing how far apart individual views can be. Against this spread, concerns about Paychex’s ability to reignite organic growth after the Paycor acquisition take on added importance, and readers may want to compare several viewpoints before forming their own.

Explore 6 other fair value estimates on Paychex - why the stock might be worth over 2x more than the current price!

Build Your Own Paychex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paychex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Paychex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paychex's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The future of work is here. Discover the 30 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.