Please use a PC Browser to access Register-Tadawul

Does DLocal's (DLO) Insider Alignment Offset Margin Pressures Amid Analyst Optimism?

DLocal Limited DLO | 14.13 | -1.40% |

- Wall Street recently anticipated that DLocal would report a year-over-year drop in earnings for Q2 despite higher revenues, ahead of the company’s August 13 results announcement.

- High insider ownership at 49% and a history of annual EPS growth suggest strong management conviction, even as EBIT margins have declined.

- We will now examine how increased analyst optimism amid revenue growth shapes DLocal’s investment narrative going forward.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

DLocal Investment Narrative Recap

To be a shareholder in DLocal, you need confidence in the company’s ability to capture the vast growth opportunity of digitizing payments across emerging markets, all while managing ongoing margin pressures. The recent analyst shift to greater optimism on earnings, despite forecasts for near-term profit declines, reinforces revenue growth as a key catalyst, but does not materially change the immediate risk from take rate compression and competitive pricing, especially in major markets like Brazil and Mexico.

Among DLocal’s recent announcements, the completion of its share buyback program by May 2025 stands out as particularly relevant. While buybacks may signal management’s belief in long-term value, their conclusion puts more focus back on core earnings performance as analysts and investors await the upcoming Q2 report to gauge the company’s operational progress against ambitious growth targets.

However, investors should fully understand that amid revenue gains, mounting pressure from take rate compression and aggressive pricing in key markets remains a...

DLocal's outlook anticipates $1.5 billion in revenue and $296.9 million in earnings by 2028. This implies a 25.8% annual revenue growth and a $147.6 million earnings increase from the current $149.3 million.

Uncover how DLocal's forecasts yield a $12.79 fair value, a 17% upside to its current price.

Exploring Other Perspectives

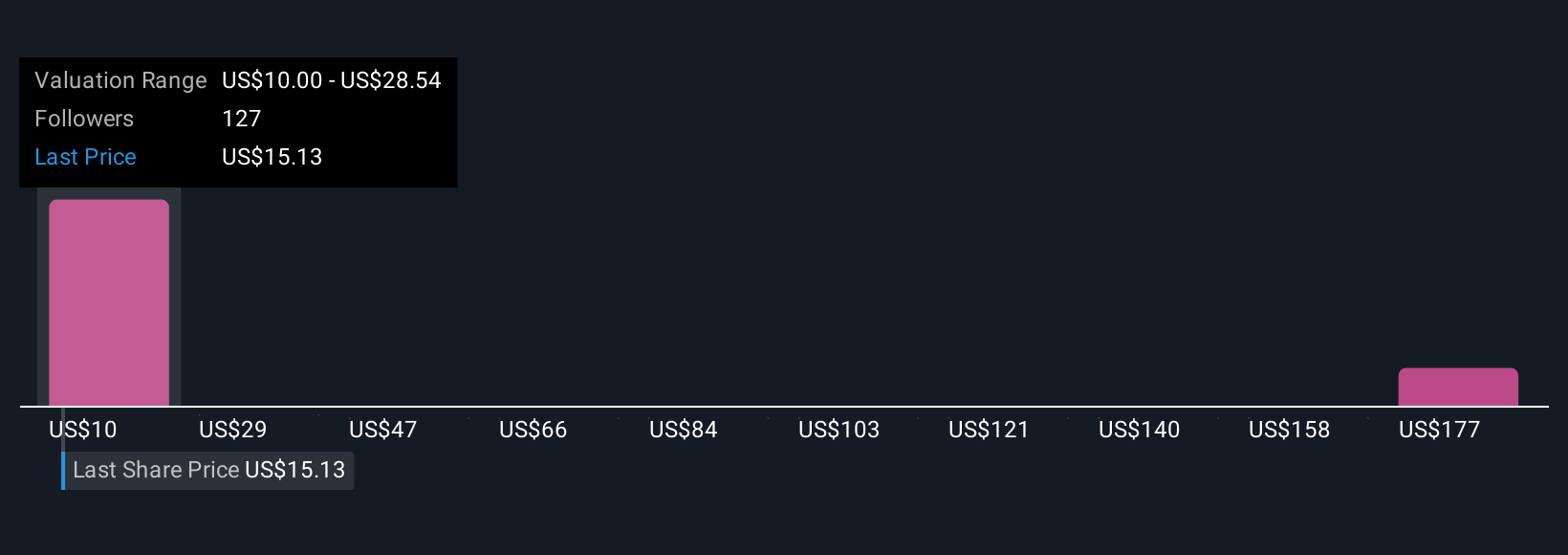

Sixteen fair value estimates from the Simply Wall St Community range from US$9 to a high of US$195.39 per share. These varying outlooks highlight the many ways investors view DLocal’s growth potential, especially as analysts point to take rate compression as a risk with broad consequences for future profitability.

Explore 16 other fair value estimates on DLocal - why the stock might be worth 18% less than the current price!

Build Your Own DLocal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DLocal research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DLocal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DLocal's overall financial health at a glance.

No Opportunity In DLocal?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.