Please use a PC Browser to access Register-Tadawul

Does Dover’s (DOV) Tech Integration Offset Questions Raised by Mixed Earnings Results?

Dover Corporation DOV | 199.12 | -1.07% |

- Earlier this month, Dover reported quarterly revenues of US$2.05 billion, reflecting 5.2% year-over-year growth but missing analyst estimates for adjusted operating income and organic revenue.

- The company's announcement of a certified integration between Bulloch POS and Intevacon Fleet Card Solutions highlights steps being taken to open new revenue channels for fuel retailers, even as financial results diverged from expectations.

- We'll explore how Dover's mixed earnings performance and recent technology integration may affect its investment case and outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dover Investment Narrative Recap

To own Dover shares, an investor must believe that the company can deliver consistent growth and margin expansion through its focus on higher-value end markets, even as legacy segments remain subject to cyclicality. The recent earnings miss does little to change the near-term catalyst of ongoing portfolio optimization and margin improvement, but reinforces that execution risks, especially in diverging business lines, remain the most significant challenge today.

The newly completed integration between Bulloch POS and Intevacon Fleet Card Solutions is especially relevant here, as it exemplifies Dover's push to capture incremental value in industrial and retail fueling, sectors that offer both competitive pressures and opportunities for higher aftermarket and service revenues. Such developments are closely watched, given their potential to offset softer performance in legacy or cyclical businesses.

Yet, in contrast to these innovations, investors should be aware of the recurring risk tied to demand volatility in key segments, especially as project delays and...

Dover’s outlook anticipates $9.1 billion in revenue and $1.1 billion in earnings by 2028. Achieving these targets requires 5.2% annual revenue growth, while earnings are expected to remain unchanged from the current level of $1.1 billion.

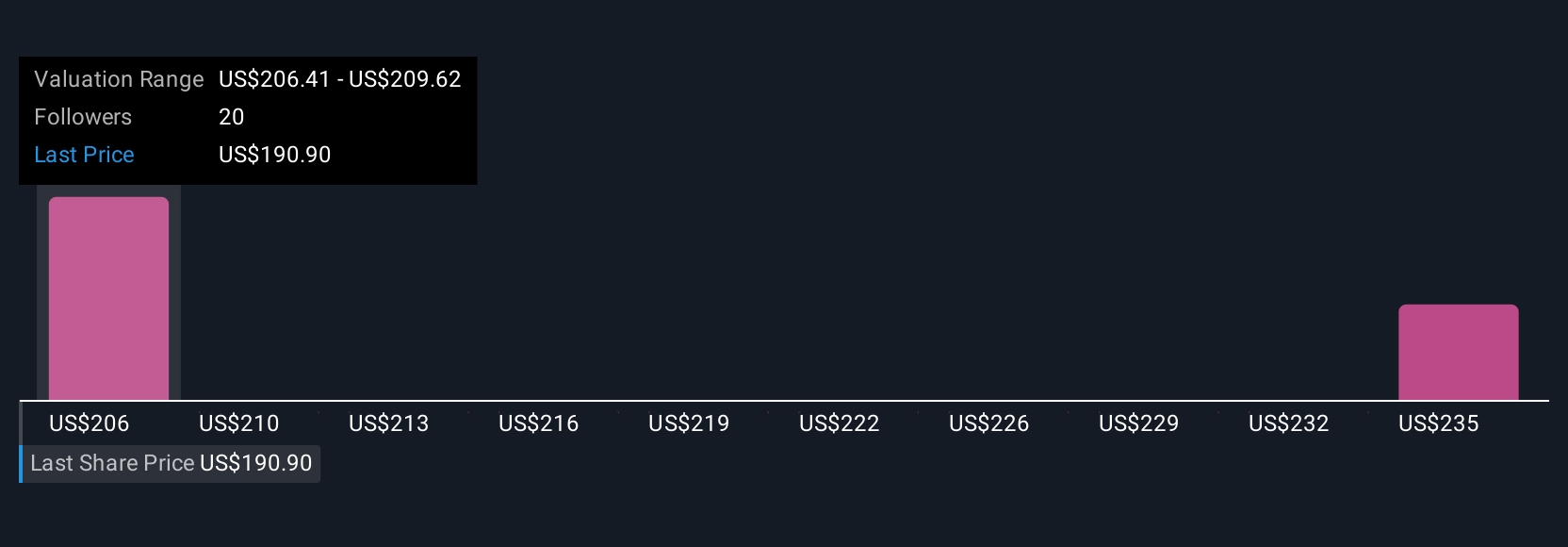

Uncover how Dover's forecasts yield a $213.39 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Dover’s fair value between US$213.39 and US$224.61, based on two independent models. While optimism around margin expansion and portfolio moves persists, opinions vary, so explore how these different views could affect your assessment of Dover’s future performance.

Explore 2 other fair value estimates on Dover - why the stock might be worth just $213.39!

Build Your Own Dover Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dover research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Dover research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dover's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.