Please use a PC Browser to access Register-Tadawul

Does DuPont’s (DD) Debt Restructuring Signal a New Era of Focused Growth Post-Qnity Spin-Off?

E. I. du Pont de Nemours and Company DD | 46.73 | +2.30% |

- DuPont de Nemours recently announced it has begun offers to exchange all outstanding senior notes for new notes, as part of preparations to separate its electronics business into a new independent company, Qnity Electronics, Inc., with a target completion date of November 1, 2025.

- This move reflects DuPont’s efforts to streamline its capital structure and amend key debt agreements ahead of a major portfolio shift.

- We'll explore how DuPont's restructuring of its senior notes in anticipation of the Qnity separation impacts its future business outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

DuPont de Nemours Investment Narrative Recap

To be a shareholder in DuPont de Nemours today, you need to believe in the company's ongoing transformation as it separates Qnity Electronics and aims for a sharper focus on specialty materials and growth sectors like healthcare and water. The recent exchange offer for senior notes, related to the Qnity separation, is primarily a technical adjustment to debt structure and, by itself, does not materially impact near-term catalysts or the largest risks facing DuPont, such as ongoing legal liabilities and portfolio concentration.

Among DuPont’s recent announcements, the $1.75 billion debt offering by its soon-to-be-spun Qnity subsidiary stands out as it directly supports the electronics business separation. This financing move ties in with the most important near-term catalyst: completing Qnity’s spin-off, which could enable DuPont to allocate more resources to higher-growth segments, but may also concentrate its risks due to a smaller, less diversified portfolio.

In contrast, investors should also keep an eye on...

DuPont de Nemours is forecast to reach $14.0 billion in revenue and $1.7 billion in earnings by 2028. This outlook assumes annual revenue growth of 3.7% and an earnings increase of $1.63 billion from current earnings of $71.0 million.

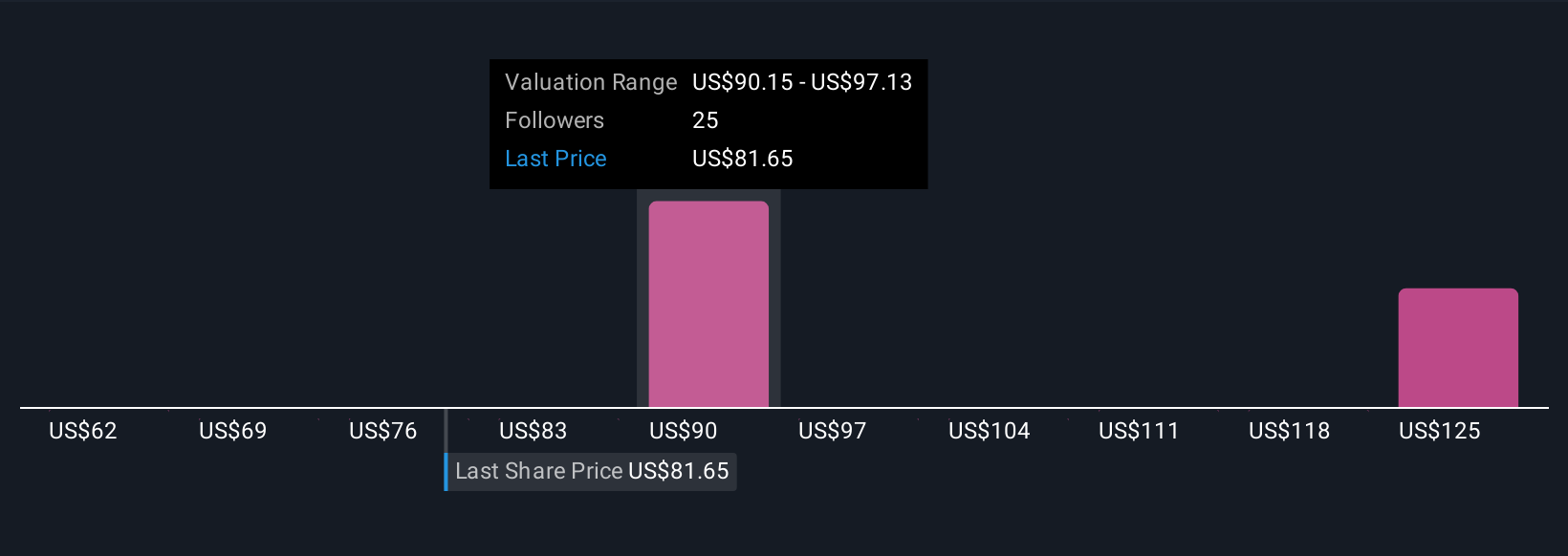

Uncover how DuPont de Nemours' forecasts yield a $89.31 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Fair value estimates from five Simply Wall St Community members range from US$61.37 to US$130.47 per share. While many see substantial upside, some highlight persistent legal and environmental liabilities as a major headwind for future earnings stability.

Explore 5 other fair value estimates on DuPont de Nemours - why the stock might be worth 21% less than the current price!

Build Your Own DuPont de Nemours Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DuPont de Nemours research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DuPont de Nemours research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DuPont de Nemours' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.